10 Ways to Fight Inflation in Retirement

Key Points – 10 Ways to Fight Inflation in Retirement

- What Can Gallup’s 2024 Economy and Personal Finance Poll Tell Us About Inflation?

- Stress Testing for Inflation

- What Do You Consider to Be a Safe Withdrawal Rate?

- Some Wise Words from the One and Only Warren Buffett

- 10 Minutes to Read

How to Fight Inflation in Retirement

The fear of running out of money in retirement can be a huge financial stressor. One of the primary factors that has fueled that fear in recent years has been inflation. While inflation is a risk factor that is out of our control, it’s something that everyone can and should plan for. We’re going to review 10 ways you can fight inflation in retirement.

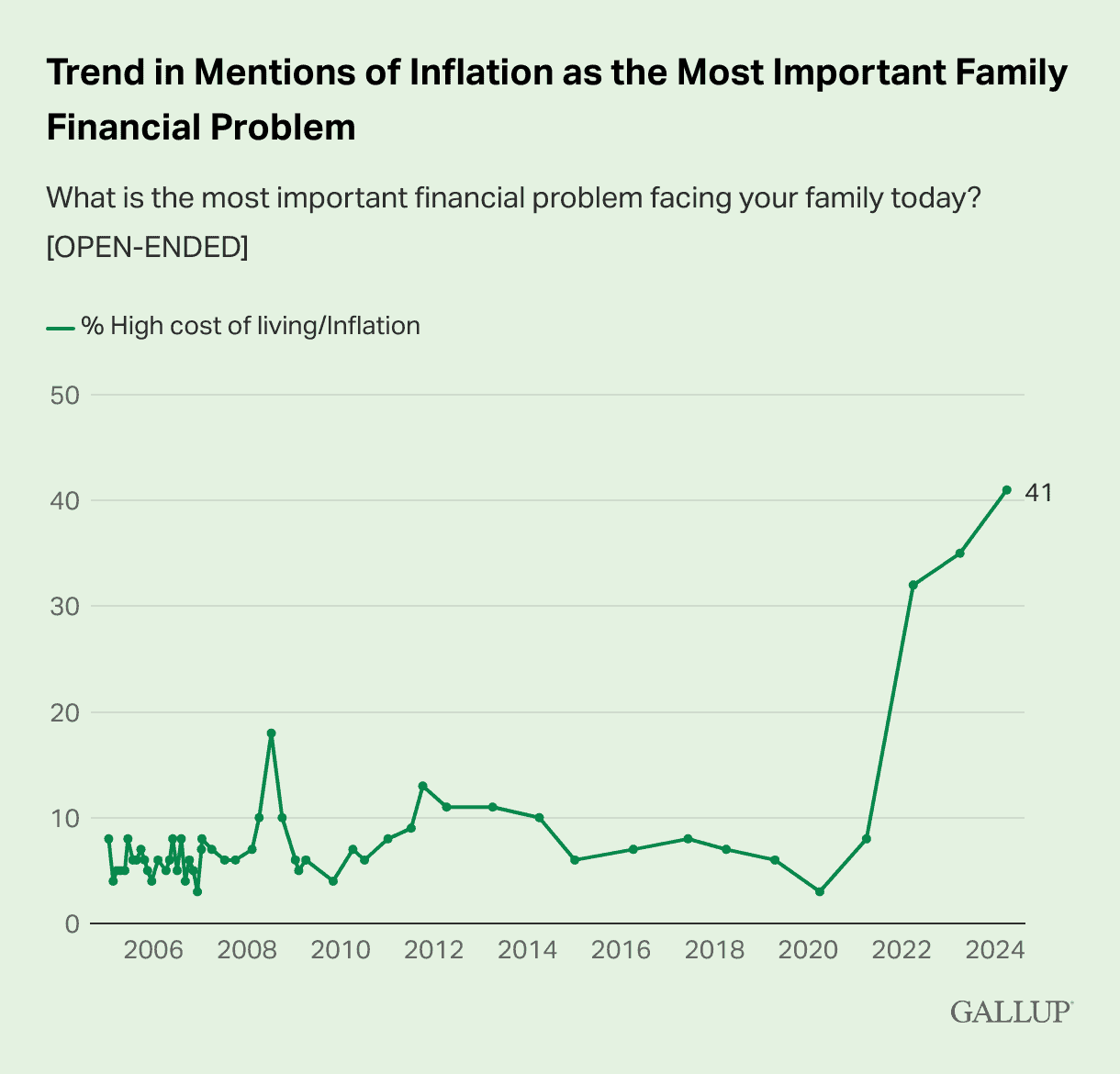

Before we review those 10 ways to fight inflation in retirement, we want to share some compelling data about inflation from Gallup’s 2024 Economy and Personal Financial poll.1 Gallup surveyed Americans from April 1-22 to determine to primary financial issue that their family was dealing with, and has conducted this poll every year since 2005. Figures 1 and 2, show how inflation has become a growing concern for U.S. families, even though the rate of inflation has slowed since it’s high point of 9.1% in June 2022.2

Gallup also noted that 46% of Americans 50 and older said that inflation was their top financial concern compared to 36% of Americans younger than 50. So, without further ado, let’s dive into our 10 ways to fight inflation in retirement.

1. Grow Your Money Faster Than the Inflation Rate

This may seem kind of tongue in cheek, but it’s true, is it not? Inflation can obviously be a hurdle in the path of people’s financial goals, but having a dynamic, forward-looking financial plan can help you clear it. One of our managing directors, Dean Barber, always says that inflation won’t cause you to go broke, but it can make you live like you’re broke.

So, oftentimes doing that little something to adjust your financial plan to counter inflation is all that’s needed. It’s our goal to not only help you grow your money faster than the inflation rate but give you more confidence that you’re doing the right things with your money, freedom from financial stress, and time to spend doing the things you love.

We constantly stress test for inflation when we build retirement plans by looking historical periods when inflation was high and see what asset classes did well. We can also look at how long the inflationary periods lasted and what the new withdrawal rates needed to look like. You can determine an asset allocation that gives you the highest probability from a historical perspective to successfully fight inflation in retirement.

Stress testing for inflation is also prominently featured item on our Retirement Plan Checklist. It consists of 30 yes-or-no questions and age-and date-based timelines that gauge your retirement readiness. Download your copy below!

2. Bonds (Most of the Time)

Given how bonds have performed since 2022, it may be a surprise to see them at No. 2 on our list of ways to fight inflation in retirement. Typically, they would undoubtably be a top option. You might not want to be reminded that the bond aggregate was down by as much as 16.6% on October 24, 2022. The bond markets didn’t exactly get off to a hot start in 2024 either.

But if you tuned into Episode 109 of The Guided Retirement Show with Dean and AllianceBernstein’s David Mitchell in April, hopefully you’re realizing that there could be opportunities in the bond market on the horizon. David also made a guest appearance on America’s Wealth Management Show to discuss opportunities in the municipal bond market. It’s important to remember that when interest rates fall, bond prices go up (and vice versa).

There has been a great deal of anticipation of when the Federal Reserve could begin cutting rates and has projected for three cuts in 2024.3 But since inflation has run hotter than expected in 2024,4 it’s put FOMC Chairman Jerome Powell in a difficult spot. He acknowledged on April 16 that it’s taking longer than expected to get inflation back to the Fed’s 2% target rate and to begin cutting rates.5

At some point, though, the Fed will begin cutting rates. And when that happens, bond prices will likely go up due to the interest rate/bond price inverse relationship. That’s why this could be a good time—depending on your situation—to consider bonds.

3. Income

It all comes back to income when figuring out how to fight inflation. Dividend-paying stocks, utilities, and energy are oftentimes sectors that can be dependable. Technology stocks (specifically the Magnificent Seven: Microsoft, Apple, Nvidia, Amazon, Tesla, Meta, and Google) drove a substantial amount of the S&P 500’s return for much of 2023. That’s why Dean has consistently pointed out the difference between the S&P 500 cap-weighted and S&P 500 equal-weighted indexes in his Monthly Economic Updates.

However, Dean didn’t advise to go all in on a few (or all seven) of those Magnificent Seven stocks. He stressed to have diversification, be patience, and to look for opportunities to rebalance your portfolio.

It’s easy for investors to be greedy when they’re getting strong returns and fearful when they’re not. But remember that Warren Buffett recommends doing the opposite—be fearful when others are greedy and greedy when others are fearful.6 The thought of selling winners and buying losers can be hard to grasp, but it’s critical to not be overcome by emotions when investing.

Make sure you’re covering future distributions and sustaining the appropriate risk level as you’re fighting inflation in retirement. Market volatility can be uncomfortable, but it’s normal, so don’t lose sight of what you’re trying to accomplish with your investment goals in retirement.

4. Real Estate

Direct ownership of real estate or investing in real estate ETFs is our next suggestion for how to fight inflation. As the value of property increases, the loan-to-value of mortgage debt decreases, thus acting as a discount and a great option for how to fight inflation.

Do you understand how real estate investment trusts (REITs) operate? They’re companies that own and manage income-producing real estate. REITs are comprised of a pool of real estate that distributes dividends to those who invest in them. But REITs can have their flaws as well, such as needing to pay property taxes. To learn more about the different dynamics of REITs, check out Dean’s interview with LODAS Markets CEO Brian King on The Guided Retirement Show.

5. Adjust Your Withdrawal Rate

We’ve talked a lot about withdrawal rates lately. In December, Dean and Bud Kasper, CFP®, AIF® posed the question on America’s Wealth Management Show if the 4% rule once again served as a safe withdrawal rate. They asked this question as they reviewed a 2023 Morningstar study which determined that new retirees could spend more from their portfolios.7

Morningstar conducted the same study in 2021 and 2022 as well. For each year, they assumed a 30-year time horizon for retirement. At the end of that 30-year retirement, they wanted to determine what spending rate could be used to still have a 90% probability of not running out of money. In 2021, Morningstar determined that “safe” withdrawal was 3.3%. And in 2022, it bumped up to 3.8%. In 2023, it reached 4%, which has been considered as a rule of thumb when it comes to safe withdrawal rates.

But as Bud and Dean explained on America’s Wealth Management Show, a 4% “safe” withdrawal rate won’t be safe for everyone. For example, a “safe” withdrawal rate for someone who is just beginning their career will be different than a “safe” withdrawal rate for someone who is in the middle of their career or about to retire. Adjusting your withdrawal rate based on how much you’re making and market performances is critical when it comes to how to fight inflation and achieving financially stability in retirement.

6. Harvesting of Gains

This leads us to harvesting gains, which is the last of the five things on our list of how to fight inflation that you can likely do on your own. Harvesting gains can be a very impactful strategy, especially if you’re asking your money to produce income.

In retirement, you need for your money to go to work for you. It’s easy to be greedy and ask why you would want to take money out that you’ve made in equities and put it into something safe. When everything is going great, you just want to let it roll. If you’re younger, you can take that approach, but that could be a recipe for disaster if you’re approaching retirement or already retired.

Your money in the stock market should be viewed as money you’ll be spending seven to 10 years from now. During rough patches, it’s so important to harvest gains to have multiple years of income. Utilizing this bucket approach and having two to three years of income in a very safe place is essentially How to Fight Inflation 101.

7. Maximizing Social Security Benefits

A lot of people probably don’t think of maximizing Social Security benefits as a means for how to fight inflation. However, we’ve illustrated many times to clients the difference that proper Social Security claiming strategies might be able to make over their lifetime.

Social Security is taxed different than any other asset. That’s why maximizing Social Security benefits and reducing taxes (guess what the next item on our list of ways to fight inflation is) go together. The difference between the best and the worst Social Security claiming strategy may result in a substantial amount of retirement income.

Remember that the longer you delay claiming, the larger your benefit will be. So while claiming Social Security when first eligible at 62 can be tempting, keep that in mind. The differences between claiming early and delaying Social Security can be staggering, especially after the cost-of-living adjustment factors in.

8. Reducing Taxes

Could you be overpaying your taxes and not even realize it? We’re not talking about potential issues with how your taxes are being prepared. We’re talking about potentially missing opportunities that you don’t know about if you don’t have a CFP® Professional and CPA working in a coordinated effort on your behalf.

- Have you considered Roth conversions?

- Are you planning for Required Minimum Distributions?

- Do you know your current tax rate and your future tax rate? (FYI: tax rates are set to revert to the higher rates of 2017 after 2025, as parts of the Tax Cuts and Jobs Act are scheduled to sunset)8

It’s critical to work with a team of professionals that includes a CPA who can help you address those questions so that you’re paying the least amount of tax possible over your lifetime rather than on a year-by-year basis. By mitigating taxes and maximizing Social Security, you also aren’t solely relying on asset allocation and investments.

9. Reviewing the Five Financial Planning Techniques Outlined in Alpha, Beta, and Now … Gamma

No, we aren’t talking about a fraternity or sorority house when we say Alpha, Beta, and Now … Gamma. The Alpha, Beta, and Now … Gamma white paper from Morningstar is a study we’ve referenced a lot since it was published in 2013.9

Alpha talks about growth, Beta talks about volatility, and then Gamma sources income in the least taxing way possible. If we do that, we can fight inflation because we’re streamlining how to attack income by sourcing it out. By sourcing out, I’m talking about accounts you have that you’ve paid tax on. They’re not going to tax you twice in America, even though they’ll try.

That study outlines five financial planning techniques which are core to our firm’s principles and key for how to fight inflation. Those five techniques are:

- Asset Location and Withdrawal Sourcing

- Total Wealth Asset Allocation

- Annuity Allocation

- Dynamic Withdrawal Strategy

- Liability-Relative Optimization

Total wealth asset allocation and dynamic withdrawal strategy are two points that we frequently talk about. For example, if you have a 60/40 asset allocation at the beginning of the year, you likely won’t stay there for the balance of the year unless you rebalance. Inflation no doubt contributes to that.

10. What About Gold and Crypto?

Can you believe that May 22 will mark 14 years since bitcoin was first used for a commercial transaction?10 That marked the beginning of what has been a very volatile journey for bitcoin and cryptocurrency in general. At times, it’s served as a very popular hedge against inflation. But it’s also served as a reminder to abide by Warren Buffett’s wise words on investing that we shared earlier.

There are some financial horror stories of people who went all in on crypto and lost everything.11 Some FTX creditors can attest to that after its monumental collapse in November 2022. The former crypto giant is just now claiming that it will be able to pay back its creditors.12 So, while crypto can serve as a hedge against inflation, just make sure not to put all your eggs in one basket and to have good diversification within your investments.

The same goes for commodities. For example, gold prices have been at all-time highs in 2024.13 But there have still been 18 calendar years since 1988 that gold has had a negative annual return—including in 2021 and 2022 when inflation was on the rise.14 So, if you’re thinking about rushing to gold or other hot commodities to add to your portfolio, remember to be cautious and to look for opportunities to rebalance.

The Bottom Line for How to Fight Inflation

We hope that these 10 tips can help you in your quest of how to fight inflation. The main takeaway to remember here is that inflation is a normal economic situation. Everyone needs to plan for it accordingly.

If you have questions about how you should be fighting inflation, whether you’re retired or preparing for retirement, schedule a conversation with our team below.

Let’s see how a personalized, forward-looking financial plan can help you fight inflation as you approach and go through retirement. We want to make sure that you have more confidence to do the right things with your money, freedom from financial stress, and time to spend doing the things you love.

Resources Mentioned in This Article

- Longevity Risk in Retirement and How to Plan for It

- Financial Stress: How Do You Deal with It?

- Reasons People Runs Out of Retirement Money

- 4 Retirement Risks That Are Out of Your Control

- Stress Testing Your Financial Plan

- Skills to Expect of a Financial Advisor

- Components of a Complete Financial Plan with Logan DeGraeve, CFP®, AIF®

- Is Inflation Slowing?

- 5 Long-Term Strategies for a Better Retirement

- Safe Withdrawal Rates

- Understanding Retirement Asset Allocation

- What Is a Monte Carlo Simulation?

- Inverted Yield Curve Signals Recession

- When Will Bond Funds Recover?

- Market Sentiment and the Inflation’s Impact with David Mitchell

- Interest Rates and Bond Prices

- Magnificent Seven Stocks Continue to Drive the Market

- What Is Driving the Stock Market?

- The S&P 500 Cap-Weighted vs. Equal-Weighted Index

- Reviewing Rebalancing Strategies

- Retirement Rules of Thumb: Let’s Bust Them

- Inflation Rates and the Fed

- Understanding Sequence of Returns Risk with Bud Kasper, CFP®, AIF®

- Maximizing Social Security Benefits

- Retiring Before 62: What You Need to Consider

- Taxes on Retirement Income

- Avoiding Costly Mistakes When Claiming Social Security with Ken Sokol

- Social Security Administration Announces 3.2% COLA Increase for 2024

- The CFP® Professional and CPA Relationship with Logan DeGraeve, CFP®, AIF® and Corey Hulstein, CPA

- What Is Tax Planning?

- Roth Conversion Rules

- RMD Strategies for Before and After Retirement

- What If We Go Back to Old Tax Rates?

- Tax Rates Sunset in 2026 and Why That Matters

- Why You Need a Financial Planning Team with Jason Gordo

- Accessing Liquidity in REITs and Private Real Estate Markets with Brian King

Downloads

Other Sources

[1] https://news.gallup.com/poll/644690/americans-continue-name-inflation-top-financial-problem.aspx

[2] https://www.usinflationcalculator.com/inflation/current-inflation-rates/

[7] https://www.morningstar.com/retirement/good-news-safe-withdrawal-rates

[8] https://taxfoundation.org/blog/tcja-expiring-means-for-you/

[10] https://finance.yahoo.com/news/celebrating-bitcoin-pizza-day-time-163536216.html

[11] https://abcnews.go.com/US/year-crypto-broke-customers-investors-lost-millions/story?id=96662010

[12] https://www.cnn.com/2024/05/08/business/ftx-bankruptcy-plan-repay-creditors/index.html

[13] https://www.cnn.com/2024/04/09/economy/gold-prices-record-highs/index.html

[14] https://www.cnbc.com/2024/04/01/gold-prices-hit-all-time-high-what-to-know-before-investing.html

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.