2022 Was Unusual for Bonds, Tough on Stocks

Key Points – 2022 Was Unusual for Bonds, Tough on Stocks

- 2022 Stock Market Performance Year-to-Date

- What an Unusual Year for Bonds 2022 Was

- Continued Volatility and Rate Hikes

- 5 Minutes to Read | 8 Minutes to Watch

The data in today’s article is as of December 30, 2022.

2022 In Review

2022 is in the rearview mirror, and thank goodness, because it was a rough year. Watch Dean review the tough year on stocks, the unusual year for bonds, interest rates and the Federal Reserve, and our outlook for 2023 as it stands today.

2022 is in the rearview mirror, and thank goodness, because it was a rough year. Let’s review what we saw in the stock market, the bond market, with interest rates and the Federal Reserve, and our outlook for 2023 as it stands today.

If you’ve been staying up-to-date with our Monthly Economic Updates, you know that we’ve been talking about the inverted yield curve and the possibility of a recession in 2023.

2022 Market Performance

2022 Stock Market Performance Year-to-Date

So, let’s just step back for a minute and do a quick review of what happened in 2022.

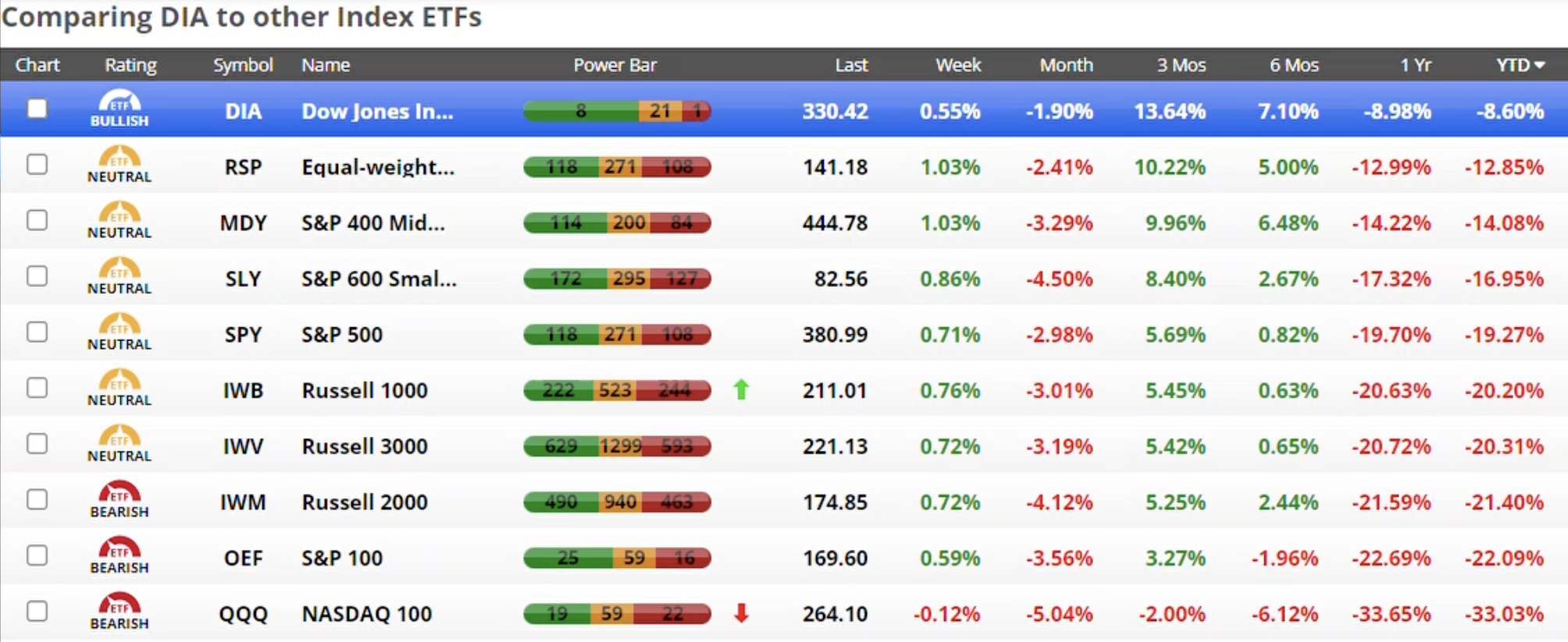

FIGURE 1 – 2022 Stock Market Performance – Chaikin Analytics

In Figure 1 we can see from the Dow Jones Industrial Average to the NASDAQ, on a year to date basis, the best performing sector was the Dow Jones Industrial Average -8.6%.

As you look down the list, you see the S&P 500 is -19.27%, the NASDAQ Composite is -33.03%, and then everything else in-between.

2022 Stock Market Performance December

FIGURE 1 – 2022 Stock Market Performance – Chaikin Analytics

Looking at Figure 1 once again, you can confirm the month of December was not a very nice month to us. In last month’s update, we posed the question about whether or not we would see a Santa Claus Rally. The Santa Claus Rally did not ensue, and 2023 looks to bring some more difficulties. However, it also looks to bring some opportunities.

US Money Flows Out of Equity Mutual Funds

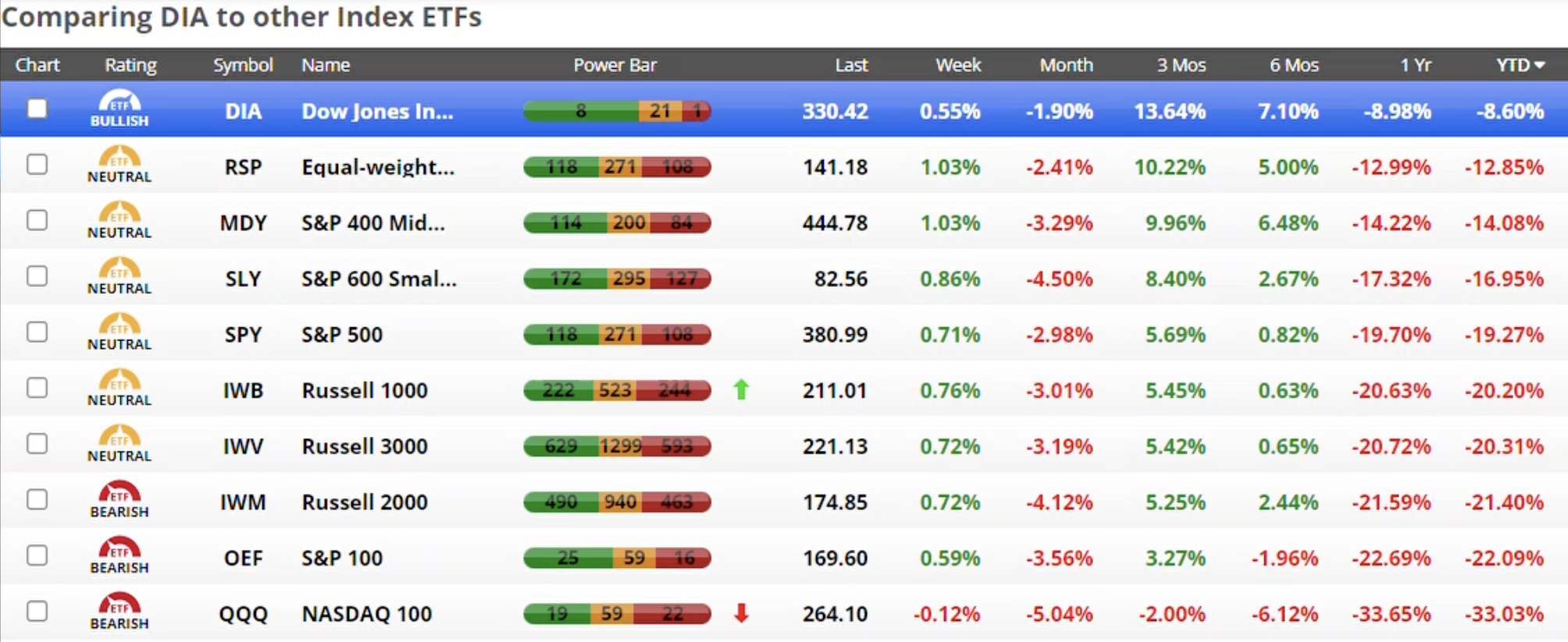

FIGURE 2 – Equity Mutual-Fund Flows – Stansberry Research

Figure 2 shows money flows out of equity mutual funds. You can see that in December 2022 there have been more outflows of equity mutual funds than there has been since October 2020. December 2018 is the biggest outflow that we can see on this chart. Next, you see October 2008, as Lehman Brothers collapsed, and the financial crisis really began to become a reality.

And so here we are, with money flows going out of equity mutual funds: at the same rate that they did in October of 2020 and October of 2008. The question is: How does the market typically react after we’ve had that much money flowing out?

S&P 500 Index Returns

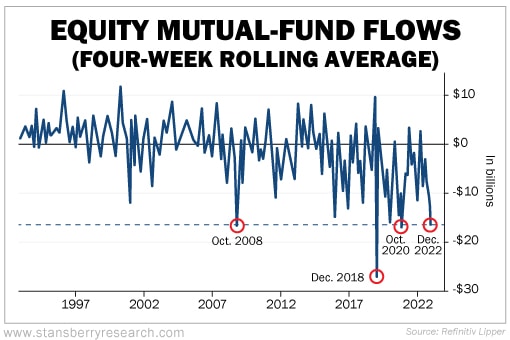

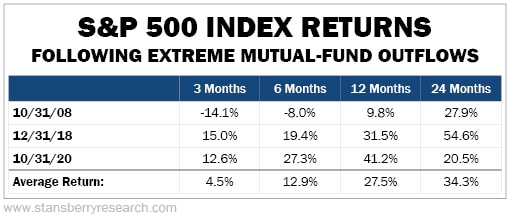

FIGURE 3 – S&P 500 Index Returns– Stansberry Research

Figure 3 shows the three-month, six-month, 12-month, and 24-month returns following October 31, 2008. In the three months after October 31, 2008, there was still another -14% drawdown, six months later an -8% loss. However, within 12 months it was +9.8% higher and within 24 months +27.9% higher.

Three months after December 31, 2018, the S&P 500 was +15%, six months later +19%, 12 months it was +31%, and 24 months +54%. After the 2020 money flow going out, it was +12.6% higher three months later, +27% six months later, +41% after 12 months later, and only +20% after 24 months. That 24-month change is lower with the losses we experienced in 2022.

Look at the average return in Figure 3 with these massive outflows within three months the markets are +4.5%, +12.9% over six months, +27.9% over 12 months, and +34.3% over 24 months.

Bear Markets Are Followed By Bull Markets

What we know is that every bear market is followed by a bull market. Markets tend to overreact. They will overcorrect to the downside and then they’ll get out overpriced on the upside. Right now, we don’t know whether things have overcorrected to the downside.

When the Federal Reserve feels that they have inflation under control, we believe we’ll see the beginning of the next market rally. As that market rally comes on, we would anticipate some very positive returns in the 12- and 24-month period following if that comment does occur.

2022 Bond Market Performance

What an Unusual Year for Bonds 2022 Was

FIGURE 4 – Bonds Year-to-Date – Kwanti

Lately, we have seen a little bit of reprieve in our bond sector. Figure 4 shows AGG, which is the bond aggregate, at worst case scenario on October 24. This year, the bond aggregate was -16.6%. As we end 2022, it’s -12.6%. These are the biggest losses that we’ve seen in bonds in recent memory.

One thing we know about bonds is that losses are temporary unless you bought the bonds at a premium. If you bought the bonds at par, they’re going to mature at par and you’re going to get the interest rate in between now and then.

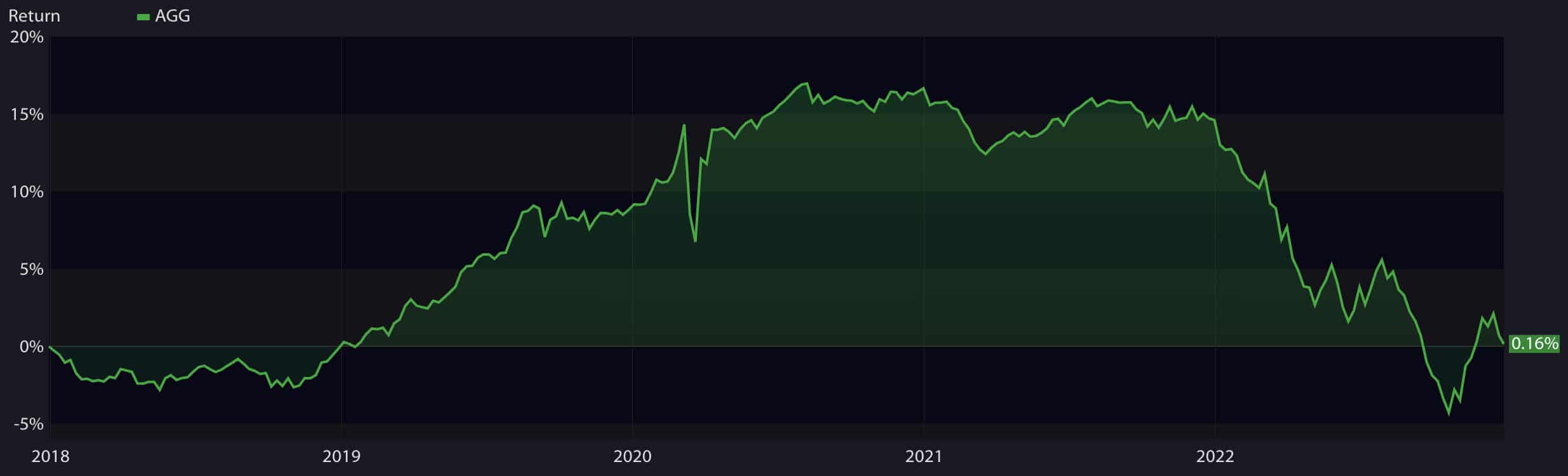

Bonds Over 3 Years

FIGURE 5 – Bonds Year-to-Date – Kwanti

And something even more frightening is when you look at the three-year chart on bonds as seen in Figure 5.

Bonds Over 5 Years

FIGURE 6 – Bonds Year-to-Date – Kwanti

Figure 6 is showing the five-year chart on bonds, it’s basically flat over a five-year period.

Typically, bonds will increase in value if the stock market is doing poorly. Except with inflation, and with the Fed being forced to raise interest rates, it has put pressure on bonds. But, also stereotypically, when we see a bad year in bonds, we will see some good years follow.

Continued Volatility and Rate Hikes

We think 2023 is going to begin with more volatility and the Fed will have to continue to raise rates a bit. However, we think that by the end of the second quarter, the Fed should be finished with its rate hiking cycle. We also think that could be the point when the economy might head into a recession.

The Stock Market is a Leading Indicator

But remember, the stock market’s a leading indicator. If the economy is slowing enough, that will signal that the Fed should need to raise rates anymore. In fact, we may see rates start to come down toward the end of the year. That would be a solid catalyst for a long-term run in the equity markets and recovery in the bond market.

We hope everybody has a happy and safe New Year and a prosperous 2023.

Get the 2023 Retirement Planning Calendar

Stay on course with your retirement plans! Our 2023 Retirement Planning Calendar is here to help you through 2023 as you venture to and through retirement. This calendar will be updated regularly to include new dates, links, and more. Get your copy today.

Schedule a Complimentary Consultation

Click below to get started. We can meet in-person, by virtual meeting, or by phone. Then it’s just two simple steps to schedule a time for your Complimentary Consultation.

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.