7 Reasons Why Tax Planning Is So Important

Key Points – 7 Reasons Why Tax Planning Is So Important

- Tax Planning Is an Important Part of An Overall Financial Plan

- It’s All About Paying the Least Amount in Taxes Over Your Lifetime, Not Just in a Given Year

- How Tax Planning Relates to RMDs, QCDs, and So Much More

- The Impact of Tax Planning with Medicare and Social Security

- 9 Minutes to Read

“Tax Time” Shouldn’t Be Limited to April

With Tax Day in 2023 set for April 17, some people might not want to think much about taxes for the next seven months until right before the deadline. Well, those people who wait until the last minute to file their taxes might not be aware of some tax planning opportunities that can make tax filing a more pleasant experience year in and year out. Tax planning is so important, and that can’t be understated enough.

The overall concept of tax planning is to pay the least amount in taxes over your lifetime rather than any given year. We’re going to share seven reasons why tax planning is so important that will hopefully help you grasp that concept. Each of these each reasons illustrate how tax planning is an important part of a comprehensive financial plan.

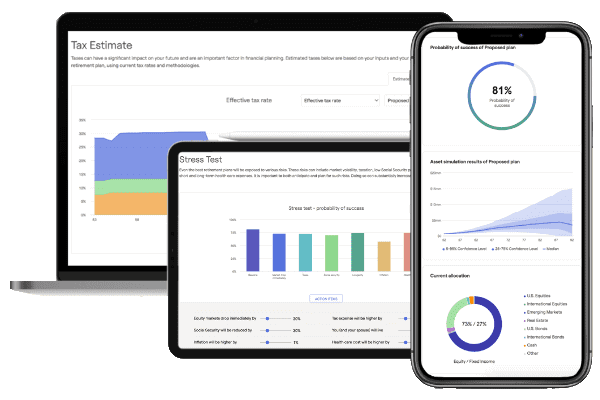

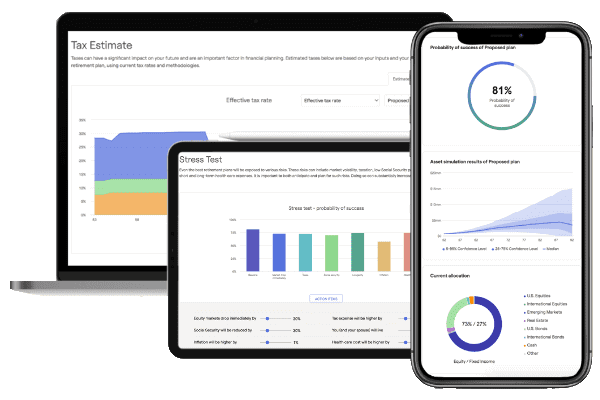

By using our industry-leading financial planning tool, you can incorporate various tax planning strategies while building your financial plan to see the difference they can make over your lifetime. This is the same financial planning tool that our CFP® professionals use with our clients, and you can use it from the comfort of your own home! Just click the “Start Planning” button below to start building your plan today.

A Quick Overview of the Seven Reasons Tax Planning Is So Important

- Don’t Tip the IRS … It’s Your Money!

- Tax Rates Are Sunsetting in 2026

- RMDs

- And QCDs!

- Taking Care of Your Children and Grandchildren

- Tax Planning Can Make a Big Difference with Medicare and Social Security

- Your Asset Location Matters

1. Don’t Tip the IRS … It’s Your Money!

Tax planning has, is, and always will be important to us at Modern Wealth Management. We’re passionate about finding what tax planning strategies work best for certain individuals so that they can live their one best financial life.

We’re passionate about helping people pay as little as possible in taxes leading up to and through retirement. Your money should be your money, not the IRS’s money. You tip your server, not the IRS.

We hope that you’ll review and download our Tax Reduction Strategies Guide. It is one of our most valuable resources that helps explain why tax planning is so important.

Download: Tax Reduction Strategies Guide

2. Tax Rates Are Sunsetting in 2026

When our CPAs and CFP® professionals review a financial plan, one of the main things they assess is a person’s current tax rate compared to what their tax rate will be in the future. Well, when the clock strikes midnight on December 31, 2025, tax rates will be going up. Why is that? Because the tax laws in the Tax Cuts and Jobs Act will be sunsetting.

With tax rates rising, your net income will likely be falling. Some of the tax planning strategies that we’re about to review can help combat that issue. We’re always looking ahead with these tax planning strategies because that’s how you win the game with the IRS.

The historic inflation that we’re battling right now could also be impacting tax rates in the near term. The IRS is exploring the idea of implementing higher-than-usual inflation adjustments for 2023 tax brackets and 401(k) contribution limits.

Furthermore, Shane Barber pointed out in his latest article that the passing of the Inflation Reduction Act could actually add another layer of taxation on these already high prices. Since there unfortunately isn’t a clear end in sight with this inflation, doing some tax planning to put you in the best position long term is extremely important.

3. Thinking About RMDs Well Before Your Initial RMD Date

Along with looking ahead with your future tax brackets vs. your current tax bracket, another reason tax planning is important is to start thinking early about Required Minimum Distributions. Your first RMD from a traditional IRA must be taken prior to April 1 of the year after you turn 72. You don’t want to be greeted with an unpleasant surprise of how much those RMDs can be shortly before you need to start taking them.

Our financial planning tool will show you what those RMDs will look like once they start to come out. Dean shares that it’s not a bad idea to start reviewing what those RMDs will like as early as a decade before you need to start taking them.

“When using our tool, you can start looking at your effective tax rate and your marginal rate when you turn 72. That can illustrate some pretty large scenarios,” Dean said. “You’ll probably see that it will be higher—around 24% or 32%. Even though you don’t have to take an RMD yet in your early 60s, you can take them out then and likely be in the 12% bracket or 22% bracket.”

A Good Time for Roth Conversions

A couple of months ago, we published an article titled, 6 Reasons Why Roth Conversions Could Work for You. By doing a Roth conversion, you’re required to pay income tax on the amount you convert, but won’t need to make RMDs on it since they aren’t required during the lifetime of the original Roth IRA owner’s account.

Oftentimes, RMDs can be a trigger point for people that have been living their one best financial life in retirement and have their retirement expenses covered. Having to take RMDs and bumping up into the next tax bracket for money that they don’t need can be infuriating for them.

“It’s always interesting how surprised people are when they figure out how much the Required Minimum Distributions actually are,” Dean said. “And that the percentage that has to come out every year goes up.”

4. And QCDs!

As we move on to No. 4 on our list of why tax planning is so important, we shift our attentions from Required Minimum Distributions to

Qualified Charitable Distributions. QCDs allow you to send a maximum of $100,000 directly to charity from your IRA without that income ever appearing on your tax return. What’s more is that QCDs also satisfy RMDs. However, you can start taking QCDs at 70.5. As we mentioned earlier, you don’t have to start taking RMDs from traditional IRAs until April 1 of the year after you turn 72.

People can often forget that QCDs and charitable donations via bunching, donor-advised funds, and charitable trusts are a tax planning strategy. Especially with the high standard deductions right now, the timing of charitable donations can make quite a difference for some people. You can contribute up to $100,000 a year in QCDs.

Understanding the Ins and Outs of QCDs

A couple of weeks ago, Matt Kasper met with a client who did all their RMDs as QCDs last year. Because they were so charitably inclined, they still didn’t fulfill their standard deduction and personal exemption. There was money that could have gotten out at 0% because they had just completed everything as a QCD. Fortunately, Matt had a discussion with them to help explain what all they needed to have in mind when making that decision.

“If they wanted to complete everything as a QCD again this year, that’s great and more power to them. But they still have money that we could get out federally tax-free. It would be a mistake not to do that,” Matt said. “That could be a conversion or for spending. Sometimes people don’t see that they’re spending, distributing, or converting out of their IRAs to the level that they should be. That’s something that people need to be quick with.”

5. Taking Care of Your Children and Grandchildren

When we meet with people to begin creating their financial plan, one of the first things we want to know are the things that are most important to them. Oftentimes, people will quickly mention their family.

Along with wanting to spend quality time with family in retirement, it’s important to a lot of people that their loved ones are well off financially after they pass on. This is another situation where tax planning is very important.

The SECURE Act Has Made It Tougher to Transition Wealth to the Next Generation(s)

When you’re transitioning wealth to the next generation(s), you need to make sure you’re up to date on the SECURE Act. The SECURE Act eliminated stretch IRAs, which made it possible to extend the tax-deferred status of an inherited IRA once it’s passed to a non-spouse beneficiary. Because of the elimination of the stretch IRA, non-spouse beneficiaries are required to empty that full account within 10 years after your death. That, in turn, bunches all the taxes on the account into a 10-year window, which means a lot of your planned savings are going to go to Uncle Sam.

“If your plan is to leave your IRA to children or grandchildren, that plan is off the table. The SECURE Act was the beginning of the end with that but now IRS has added new regulations that just came out this year that most people don’t even know about it yet. IRAs and 401(k)s— retirement accounts are lousy assets,” Ed Slott, who is considered to be America’s IRA expert, said on The Guided Retirement Show. “They’re no good anymore to pass to the next generation. So, you need to look to alternative solutions. The Roth IRA, even life insurance, anything tax-free is a better solution.”

The main goal here is to minimize taxation for your loved ones. If you were to die before your spouse, you don’t want them to experience the financial burden that can come with going from married filing jointly to single-filing status. Tax planning can significantly reduce that burden, so the peace of mind that comes with that is very important.

6. Tax Planning Can Make a Big Difference with Medicare and Social Security

Next up on our list of seven reasons why tax planning is so important are two reasons that are morphed into one. Tax planning is vitally important to prevent issues related to Medicare and Social Security that can derail your retirement. Ed mentioned Roth IRAs in our last reason why tax planning is important, and they certainly apply here as well.

“There are two other big benefits to the Roth IRA that a lot of advisors don’t consider. One of those is that income from the Roth IRA while you’re in retirement doesn’t affect the Medicare IRMAA tax,” Dean said. “So, the higher Medicare premiums. It also doesn’t affect how much of your Social Security is being taxed. So, distributions from a Roth IRA, besides being tax-free, can play very favorable into somebody’s distribution strategy in retirement by keeping those things.”

Let’s dive a little bit deeper into tax planning as it relates to Social Security. Many people don’t realize that up to 85% of your Social Security can be taxable. Another one of Dean’s good friends, Marty James, helps us explain how to determine if you’ll need to pay taxes on your Social Security benefits.

“We have this concept called provisional income,” Marty said. “Determine how much of your Social Security benefits are going to be taxable. Take all your income, plus even your tax-exempt interest and such, and come up with this thing called modified adjusted gross income. You’re going to use that, one half of your Social Security benefits, and if that number hits a certain level, depending on whether you’re single or married, then that determines whether you’re going to pay taxes on your Social Security benefits.”

7. Your Asset Location Matters

We’ve finally reached our last reason for why tax planning is so important, and it’s something that you need to be thinking about when you turn 50. Can you think of what this reason might be? We’re talking about catch-up contributions. At 50, you can increase the amount in contributions going into your traditional IRA, Roth IRA, and 401(k).

Our team gets plenty of questions regarding catch-up contributions. Should you contribute to Roth or traditional? If that’s something that’s on your mind, just know that you’re far from being alone with having questions about that. Knowing where to save is a big reason why tax planning is so important. We went into further detail about things to think about in terms of asset location at certain ages in our 401(k) Survival Guide.

One of the examples of that in our 401(k) Survival Guide discusses something that can happen a few years later once you turn 55. If you’re over 55 and you separate service from your company, you can get away from the 10% early withdrawal rule by leaving some money in the company plan. That applies whether you’re retiring or if you’re going to work for another company. You can see more examples of why your asset location matters (and why tax planning is important) by downloading our 401(k) Survival Guide below.

Download: 401(k) Survival Guide

Do You See Why Tax Planning Is So Important Now?

We could probably keep going with more reasons why tax planning is so important, but hopefully this list has helped get that point across to you. To truly understand why tax planning is important, start building your plan with our financial planning tool. Your financial plan won’t be complete without the tax planning strategies we’ve touched on. Begin building your plan today by clicking the “Start Planning” button below.

If you have any questions about tax planning and why it’s important with your financial plan, we’re happy to answer them. We can also help you with navigating our financial planning tool. By scheduling a 20-minute “ask anything” session or complimentary consultation with one of our CFP® professionals, you can begin getting the clarity and confidence that comes with comprehensive financial planning. We can meet with you in person, virtually, or by phone—whatever is easiest for you.

Schedule a Complimentary Consultation

Click below to get started. We can meet in-person, by virtual meeting, or by phone. Then it’s just two simple steps to schedule a time for your Complimentary Consultation.

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.