4 Retirement Risks That Are Out of Your Control

Key Points – 4 Retirement Risks That Are Out of Your Control

- Controlling What You Can Control

- Stress Testing Your Financial Plan

- The Importance of a Forward-Looking Financial Plan

- 10 Minutes to Read | 23 Minutes to Watch

Controlling What You Can Control

A huge factor of financial planning is controlling what you can control. It’s pivotal to understand that as you’re determining if you have enough money to get to and through retirement. The fear of outliving your money is a retirement risk that’s a big concern for a lot of people. However, with a financial plan, it’s a controllable retirement risk. In this episode of America’s Wealth Management Show, Logan DeGraeve, CFP®, AIF® and Chris Rett, CFP®, AIF® discuss four retirement risks that you can plan for but are out of your control.

Schedule a Meeting Get the Retirement Plan Checklist

Your Investments Are Just One Component of Your Financial Plan

It’s important to understand the role of your investments as you’re trying to get to and through retirement. There are so many people who think that their investment plan is a financial plan, but that isn’t the case. As a firm, we strongly believe that your financial plan isn’t complete if you don’t also have a forward-looking tax plan, up-to-date estate plan, and a good understanding of risk management. That doesn’t mean your investments aren’t important, though. Think of them as the engine that makes your financial plan run.

Your investments are something that you have control over. However, there are also retirement risks that are out of your control. Your investments coincide with market volatility, which is one of those uncontrollable retirement risks. Here are the four retirement risks that are out of your control (but that you can plan for) that we’re going to review.

As we review those four retirement risks that are out of your control, we’re going to touch on some retirement risks that are in your control. The bottom line is that is critical to have a goals-based financial plan in place that takes those retirement risks into consideration as you’re planning for and going through retirement. Now, let’s discuss how to go about planning for market volatility, interest rates, inflation, and tax rate hikes.

1. Retirement Risks That Are Out of Your Control – Market Volatility

It’s hard for Logan, Chris, and the rest of our financial advisors to talk about market volatility without thinking back to the wild market volatility we saw late in 2021 and throughout 2022.

For example, let’s flash back to December 2021 and say that it was a couple’s goal to retire in 2022. However, 90% of this couple’s savings was in 401(k) plans and 100% of the money saved in their 401(k)s was in the S&P 500. That asset allocation wouldn’t have been in their best interest.

One of the things that our financial planning tool can do is to show the probability of success with that asset allocation compared to other asset allocations. In that instance, we would advise the couple to take 30% of the money they had in the S&P 500 and keep it there. Then, we would have them put the balance of it in the fixed income portion of their 401(k) since it was unknown what was going to happen with interest rates at that time. Again, interest rates are one of those uncontrollable retirement risks that we’ll discuss more momentarily.

Taking the Least Amount of Risk to Accomplish Your Long-Term Objectives

While you can’t control market volatility, you can control taking the least amount of risk in your investments and still accomplish all your long-term objectives. That’s a unique way to think about it as opposed to, “What’s my risk tolerance?”

In the case of that couple, 30% equity exposure would have given them a better probability of success than 100% equity exposure because it could help prevent massive drawdowns. When you’re retired, you need to start asking your money to work for you. You need to take systematic withdrawals to get your income into your checking account to go spend.

Another Reason Why Fear Can Be One of Your Biggest Emotions When It Comes to Your Investments

Oftentimes, people are very fearful of future unknowns. People can be fearful of the fact that their ability to earn a paycheck is gone and they’re relying on the investments that they need to support their lifestyle. They don’t have the clarity that they need to know what a safe amount to spend might be, so they end up passing away with a lot of money that they could have enjoyed.

It’s critical to have the confidence that you’re doing the right things with your money, freedom from financial stress, and time to do the things you love. As you’re preparing for and going through retirement, make sure you keep a copy of our Retirement Plan Checklist handy. It consists of 30 yes-or-no questions and age-and date-based timelines that gauge your retirement readiness and reviews several key retirement considerations, including planning for these retirement risks that are out of your control. Download your copy below.

2. Retirement Risks That Are Out of Your Control – Inflation

Moving on to another retirement risk that’s out of your control and is also very pertinent, let’s talk about inflation. When that couple came in again in July 2022, the annual inflation rate was at 9.1%.1 The rate of inflation has cooled considerably since then—falling to 3.4% as of May 15.2

But as you’ve probably noticed, prices at places like the grocery store haven’t been falling in many cases. That’s because we’ve been experiencing disinflation, which is a decrease in the rate of inflation. It occurs when prices increase, but at a slower rate than they were previously.

In addition to that, inflation has run hotter than expected so far in 2024 to further increase financial stress for many Americans.3 and 4 Federal Reserve Chairman Jerome Powell’s top priority has been to kill inflation—getting it down to a 2% target rate before lowering interest rates. But both those things have been incredibly difficult for him to try to control.5

Stress Testing for Inflation

So, if it’s been difficult for the Fed to control inflation, how are you supposed to plan for it? Immediately cutting back on doing the things you love isn’t the answer. Inflation is something that you need to stress test for within your financial plan. The average annual inflation rate was at or just above that 2% target rate for about a decade until 2021.6 But doesn’t mean that planning for 2% inflation within your plan was advisable during that timeframe.

When you’re planning for retirement, you’re not planning for a 10-year retirement. You’re likely planning for your retirement to last 30 years, if not longer. If you go back 30 years, you have the persistent inflation we’ve been mired in since 2021, the Great Recession, and the Dot-Com Bubble that have occurred in that timeframe. While it’s impossible to predict when those type of events will happen, you can and should plan for them.

Inflation eclipsed 14% in 1980.7 Could your current financial plan survive that if that happened during your retirement? That’s why we stress test financial plans against previous economic cycles and events to see if you could have enough money to get to and through retirement. You need to stress test your plan against all four of these retirement risks that are out of your control.

Expenses Inflate at Different Rates

As you’re building your financial plan, you also shouldn’t apply one inflation rate for all the expenses within your plan. Think about this. Your mortgage is at a fixed rate, so it won’t be inflating at all. And on the other hand, you have your health care costs.

According to the Peterson-KFF Health System Tracker,8 the price of medical care has gone up 114.3% since 2000, while prices for all consumer goods/services has increased by 80.8%. That’s why we generally consider a general inflation rate for general expenses and then a separate inflation rate for health care costs within a client’s financial plan. So, while inflation isn’t a retirement risk that’s in your control, you can plan for it.

3. Retirement Risks That Are Out of Your Control – Interest Rates

Interest rates and what the Fed decides to do with them is No. 3 on our list of retirement risks that are out of your control. You can probably also start to see that these retirement risks that are out of your control are intertwined.

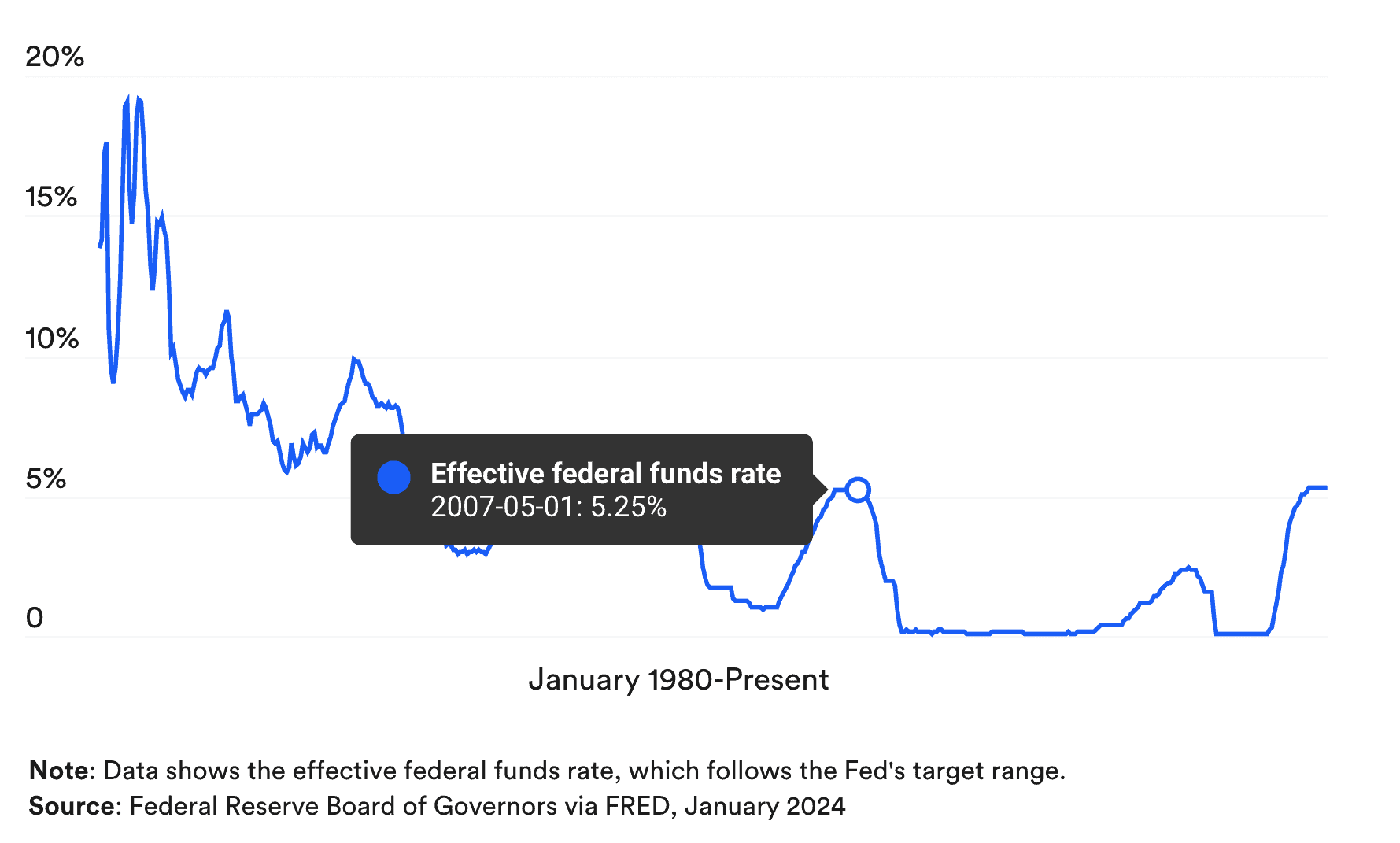

It was just over two years ago (March 2022) that the Fed began raising rates. The Fed’s series of rate hikes took the Fed funds rate range from 0% – 0.25% to 5.25% – 5.5%.9 Do you know when the last time was that the Fed Funds rate was that high? It was in 2007 during the Great Recession.

FIGURE 1 – Fed Funds Rate 1980-2004 – Bankrate/Federal Reserve Board of Governors

Yes, Figure 1 shows that the Fed Funds rate was at or near 0% for long stretches following the Great Depression and the onset of COVID-19. But now Powell and the Fed has been saying that they don’t feel comfortable cutting rates until inflation is under control.10 How long can we expect rates to be higher for longer? Unfortunately, we don’t have a crystal ball to answer that. No one does. Hence why interest rates are a retirement risk that is out of your control.

Bucketing Strategies

But do you know what you can do? We can stress test your financial plan against periods in which we’ve experienced high interest rate environments. It’s also important to have somewhere between 18 and 24 months of needed income that’s set aside for when there are market downturns, high inflation, high interest rates, etc. Some people might want to go as far as 30 to 36 months of needed income or needed distribution from their underlying investments.

You have other parts of your portfolio where you’re still trying to do more of a moderate or longer-term growth investment strategy. In years where you get some outperformance in bucket two and bucket three, you can scrape those winnings off and put it back into bucket one until you get to a point where you’re comfortable.

Remember that the rules change when you get near retirement or in retirement. You don’t want to allow market volatility, which can be a result of high interest rates and high inflation, to cause you to have to sell things at discounted prices to fund your retirement.

4. Retirement Risks That Are Out of Your Control – Tax Rate Hikes

As we wrap up discussing retirement risks that are out of your control, let’s talk about tax rate hikes. After 2025, parts of the Tax Cuts and Jobs Act—including today’s tax rates—are scheduled to sunset.11 The tax rates would revert to the higher rates from 2017.

If you’re doing proper financial planning, taxes are at the heart of a financial plan. There’s almost no financial decision that an individual or a couple makes that won’t at some point come back to the tax return. If you don’t understand that different types of income during retirement are taxed at different rates and they don’t play well together, you can pull money out of the wrong account and it can cause unwanted tax consequences.

Looking at Your Current and Future Tax Rates

With the 2023 tax season now behind us, that doesn’t mean that you shouldn’t think about your taxes until next year. That’s especially true for the balance of 2024 due to the possibility of the current tax rates sunsetting after 2025. The goal is to pay the least amount of taxes over your lifetime, not just in one year.

Let’s say that you have most or all your retirement savings in a traditional 401(k) and traditional IRAs. The funds within those accounts are tax-deferred, meaning that they won’t be taxed until you take the money out of those accounts. For now, that might seem like an ideal situation. But if you plan to access that money after 2025, keep in mind that it will be taxed at higher rates than today’s rates.

Tax Planning Strategies

That’s why we’ve been doing a lot of Roth conversions for people in recent years. With Roth conversions, you’re converting funds from your traditional IRA into a Roth IRA. You’re required to pay the taxes on that conversion, but from that point on those funds will grow tax-free and the distributions will be tax-free.

Roth conversions aren’t for everyone, though. There can be unintended consequences of doing Roth conversions, such as making more of your Social Security taxable or paying higher Medicare premiums. Make sure that you’re working with a CPA that works alongside your CFP® Professional as you’re considering Roth conversions and other tax planning strategies.

Your CFP® Professional and CPA should be working side by side to consistently review your financial plan for tax planning opportunities. To learn more about Roth conversions and other tax planning strategies that can potentially help you determine how to minimize your tax burden over your lifetime, download our Roth Conversion Case Studies and Tax Reduction Strategies guide below.

Forward-Looking Planning Is Pivotal as You’re Dealing with Retirement Risks That Are Out of Your Control

Again, we have no control over whether tax rates will go up in 2026. But having a forward-looking tax plan can help prepare you for this big potential change in the tax code. Tax rates, interest rates, inflation, and market volatility are all big retirement risks that need to be planned for. If you have any questions about these retirement risks and how to plan for them, start a conversation with our team below.

Don’t let your emotions drive your decision-making when it comes to various retirement risks. Our team of professionals is ready to help you develop a personalized financial plan that considers all these retirement risks so that you have more confidence that you’re making the right decisions with your money, freedom from financial stress, and time to do the things you love.

4 Retirement Risks That Are Out of Your Control : Watch Guide

00:00 – Introduction

01:04 – 1. Market Volatility

07:05 – 2. Inflation

10:03 – 3. Interest Rates

16:20 – Tax Rate Hikes

21:30 – What We Learned Today

Resources Mentioned in This Article

Articles

- Have I Saved Enough to Retire?

- Components of a Complete Financial Plan with Logan DeGraeve, CFP®, AIF®

- Don’t Miss Out on Your Money: Redefining Risk Management

- What If We Go Back to Old Tax Rates?

- 401(k) Planning for 2024 and Beyond

- The S&P 500 Cap-Weighted vs. Equal-Weighted Index

- How Our Financial Planning Tool Works

- What Is a Monte Carlo Simulation?

- The Great Recession’s History Remains Relevant

- The Dot-Com Bubble’s History Remains Relevant

- Mortgage Tips for Different Phases in Life with Tim Kay

- What If We Go Back to Old Tax Rates?

- Tax Rates Sunset in 2026 and Why That Matters

- Revisiting Roth vs. Traditional with Bud Kasper, CFP®, AIF® and Corey Hulstein, CPA

- The CFP® Professional and CPA Relationship with Logan DeGraeve, CFP®, AIF® and Corey Hulstein, CPA

- Tax Planning Strategies with Marty James, CPA, PFS

- Why You Need a Financial Planning Team with Jason Gordo

Past Shows

- What Is Financial Planning?

- Longevity Risk in Retirement and How to Plan for It

- What Is Tax Planning?

- 5 Estate Planning Documents That Everyone Needs

- Market Volatility: Short-Term or Here to Stay?

- The Effect of Rising Interest Rates on the Economy

- Understanding Retirement Asset Allocation

- 5 Long-Term Strategies for a Better Retirement

- Retirement Withdrawal Strategy: You Need a Plan

- Your Retirement Lifestyle: What Do You Want Your Retirement to Look Like?

- Managing Risk in the Markets

- Safe Withdrawal Rates

- Is Inflation Still Cooling?

- Disinflation vs. Deflation: How Are They Different?

- Stress Testing Your Financial Plan

- Health Care Costs During Retirement

- The Impact of Rising Interest Rates

- Taxes on Retirement Income

- The IRA Early Withdrawal Penalty: How to Avoid the 10% Penalty

- How Do I Pay Less Taxes?

- What Is Tax Planning?

- Roth Conversion Rules

- Converting to a Roth IRA: What Are the Pros and Cons?

- How Does a Roth IRA Grow?

Downloads

Other Sources

[1 and 6] https://www.usinflationcalculator.com/inflation/current-inflation-rates/

[2] https://www.cnbc.com/2024/05/15/heres-the-inflation-breakdown-for-april-2024-in-one-chart.html

[4] https://news.gallup.com/poll/644690/americans-continue-name-inflation-top-financial-problem.aspx

[7] https://www.federalreservehistory.org/essays/great-inflation

[9] https://www.bankrate.com/banking/federal-reserve/history-of-federal-funds-rate/

[11] https://taxfoundation.org/blog/tcja-expiring-means-for-you/

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.