Bond Yields Keep Rising

Key Points – Bond Yields Keep Rising

- Relentless Rising Bond Yields

- Higher for Longer, but Less Inverted Yield Curve

- Understanding What Happens When Bond Yields Keep Rising

- Stubborn Inflation as Energy Prices Spike

- Equity Market Pullback

- 3 Minutes to Read | 3 Minutes to Watch

The data in today’s article is as of September 28, 2023.

Will Bond Yields Keep Rising?

Our Director of Investments Stephen Tuckwood, CFA is stepping in for Dean Barber for our September Monthly Economic Update. See what Tuck has to share about the relentless rising bond yields, key takeaways from the yield curve, a spike in energy prices, and the pullback in the equity market.

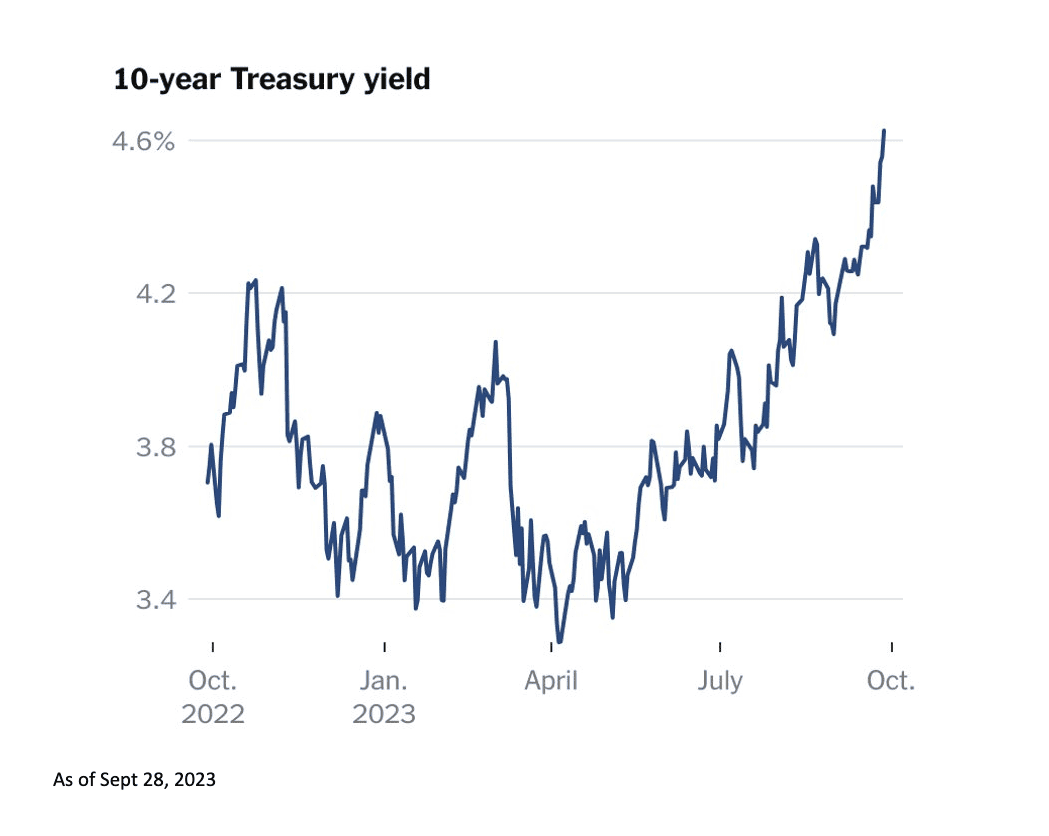

A Milestone for the 10-Year Treasury

September was a very eventful month in the markets, but Tuck is going to really focus on what’s going on in the fixed income market. The U.S. 10-year treasury surged above 4.6% for the first time since October 2007. Ten-year yields are up 50 basis points month to date, which would be the largest monthly move in the past 12 months.

FIGURE 1 – 10-Year Treasury Yield – U.S. Treasuries Yield Curve

One reason that longer-term bond yields keep rising is due to the most recent FOMC meeting. Federal Reserve Chairman Jerome Powell essentially promised to keep rates higher for longer and produced forecasts to back it up. That changed the markets’ expectations for interest rates, which reflect what Powell said about rates being higher for longer.

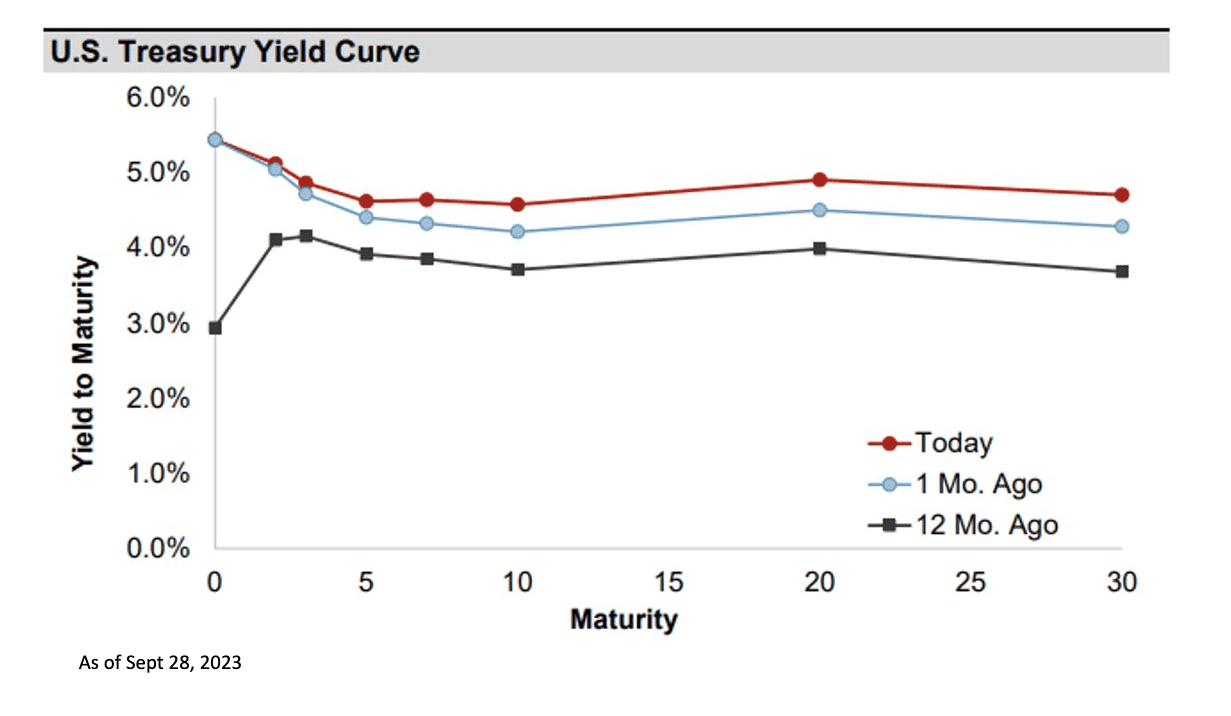

Some Good News Regarding the Yield Curve

While bond yields keep rising, it’s not all bad news when looking at the yield curve. The yield curve has become less inverted.

FIGURE 2 – Yield to Maturity – U.S. Treasuries Yield Curve

Generally, the more inverted it is, the more likely it is to have a recession. At the beginning of the year, many market prognosticators were forecasting a recession for the second half of the year. That clearly hasn’t materialized.

The U.S. economy has proven to be very resilient and has even pleasantly surprised to the upside. Calls for a recession have now shifted to next year.

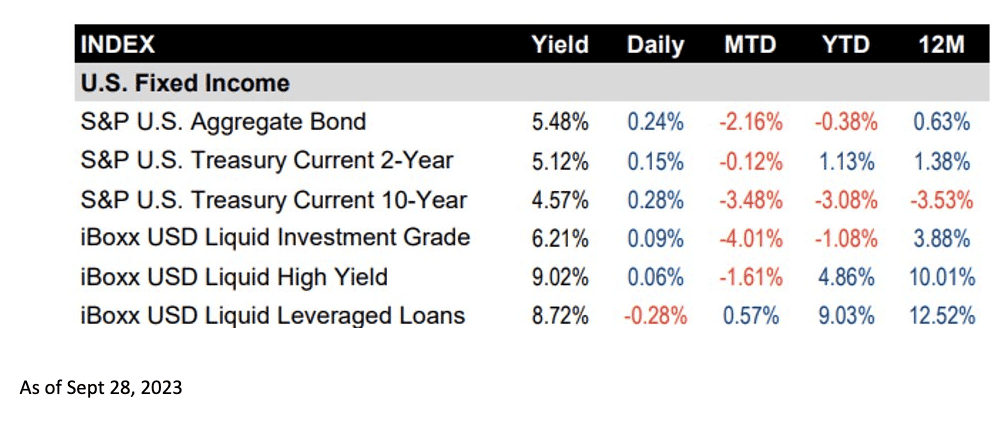

Bond Indices in Negative Territory

Rising interest rates have rarely been the headwind for fixed income markets. This recent upward move on the longer end of the curve has pushed many bond indices into negative territory for the year. That makes it very difficult for active managers in the fixed income market to outperform indices across the board.

FIGURE 3 – U.S. Fixed Income – S&P Dow Jones Indices

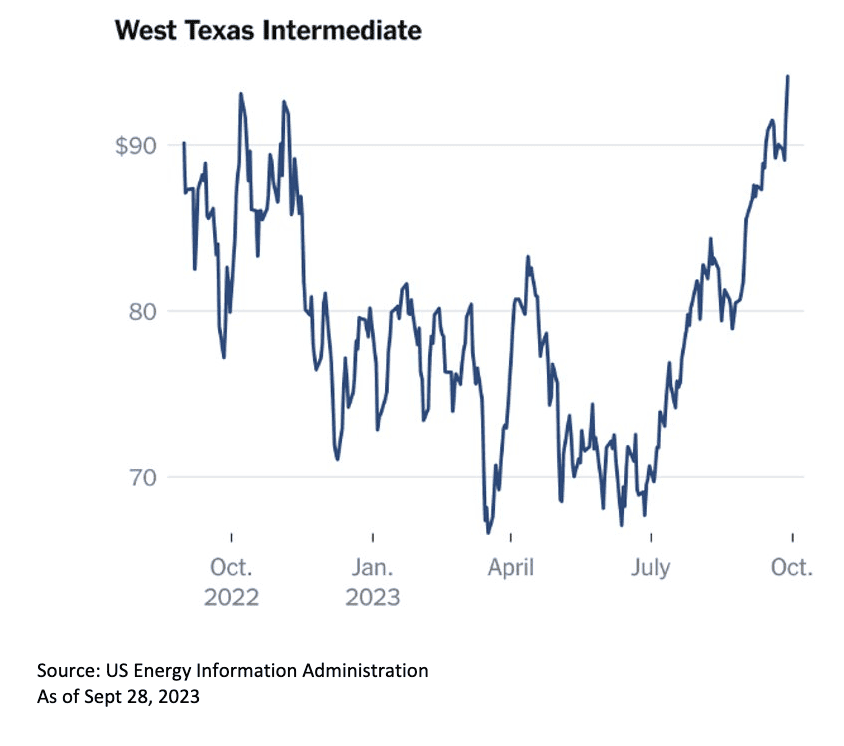

Inflation Remains High

As economic growth has surprised to the upside, inflation remains stubbornly high. Cracks are starting to appear in the housing market, which may provide some relief to inflation. But counter to that, oil prices have recently climbed to a 13-month high. West Texas Intermediate, which is the U.S. broad oil benchmark, briefly topped at $95 a barrel for the first time since August 2022.

FIGURE 4 – West Texas Intermediate – U.S. Energy Information Administration/The New York Times

Concerns about tight supplies are fueling the rise in oil prices, which is reigniting worries about inflation and the need for interest rates to stay higher for longer. Again, inflation has remained stubbornly high compared to historical levels.

What About the Stock Markets?

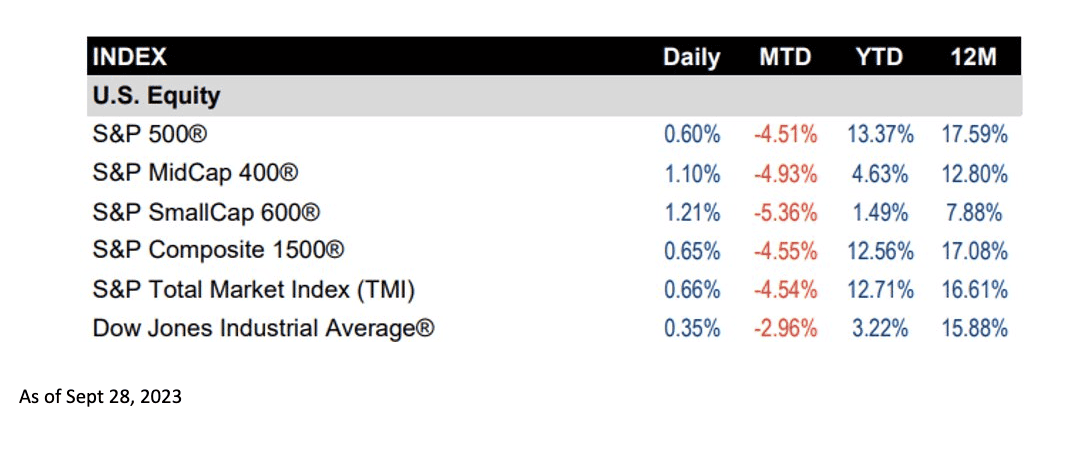

We’ve addressed why bonds yields keep rising, but what about the stock markets? It has generally been a strong year for U.S. equities so far. The broad index has posted double digit returns, although that’s been driven by a very narrow group of stocks.

FIGURE 5 – U.S. Equity – S&P Dow Jones Indices

We began to see some cracks in August, and September’s pullback looks to be the largest monthly decline so far this year. With only three months left in 2024, July’s peak might prove to be the market high for the year. Only time will tell on that, though.

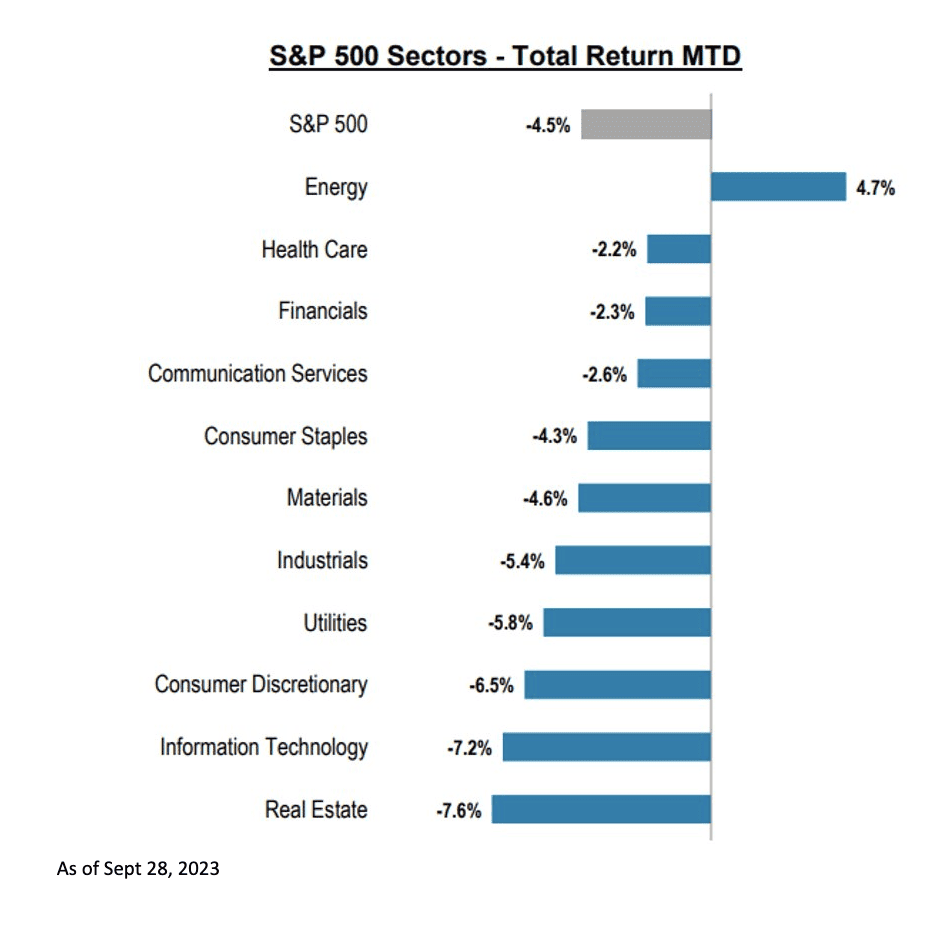

Energy Leads the Way in September

Peeling back the onion one layer and looking at sector performance, interest rate-sensitive real estate has fared the worst this month given the move in longer-term rates. Technology has also led the index lower after powering the market higher during the beginning of the year.

FIGURE 6 – S&P 500 Sectors – Total Return MTD – S&P Dow Jones Indices

Energy is likely to be the only positive sector this month, as oil and gas firms have benefitted from higher energy prices.

Have Any Questions About the Rising Bond Yields or Other Data That We’ve Covered?

That does it for our September Monthly Economic Update. If you have any questions about the relentless rising bond yields, inflation, or anything else that Tuck covered, let us know. You can schedule a 20-minute “ask anything” session or complimentary consultation with one of our CFP® Professionals by clicking here. Depending on what setting works best for you, we can meet with you in person, virtually, or by phone.

Thanks again for tuning into our September Monthly Economic Update. We’ll continue to closely monitor the markets and share what we see in our October Monthly Economic Update.

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management, LLC, an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management, LLC does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.