What Is Financial Wellness?

Key Points – What Is Financial Wellness?

- The U.S. Consumer Financial Protection Bureau’s Definitions of Financial Well-Being

- Comparing Retirement Planning to Training for a 5K

- Our Retirement Plan Checklist and Guided Retirement System Can Serve as Training Plans for Your Retirement

- Your Goals Are a Critical with Achieving Financial Wellness

- 8 Minutes to Read

Your Retirement Is the Ultimate Goal of Financial Wellness

When someone says the word “wellness,” what’s the first thing that comes to your mind? Wellness tends to be on a lot of people’s minds in late December/early January when making or trying to stick to New Year’s resolutions related to exercising. If you’re one of those people, we certainly hope that you’re still making strides with your exercise goals. Whether you are or not, we want to take a deeper dive into the meaning of wellness and how it can relate to your finances (financial wellness).

Before we do that, though, we want to take a moment to recognize that January is Financial Wellness Month. You probably already knew that if you’ve looked at and/or downloaded our Retirement Planning Calendar. It highlights dates and events that you need to be aware of and prepare for while planning your retirement. You can download your copy below.

As we answer the question, “What is financial wellness?” we first want to define what wellness means. Merriam Webster defines wellness as the quality or state of being in good health, especially as an actively sought goal. So, what do you think that the ultimate actively sought goal could be with financial wellness? If you said, “retirement,” you’re partially correct. You’re not only seeking to get to retirement, though. You’re seeking to get to and through retirement. More on that momentarily.

Defining Financial Wellness

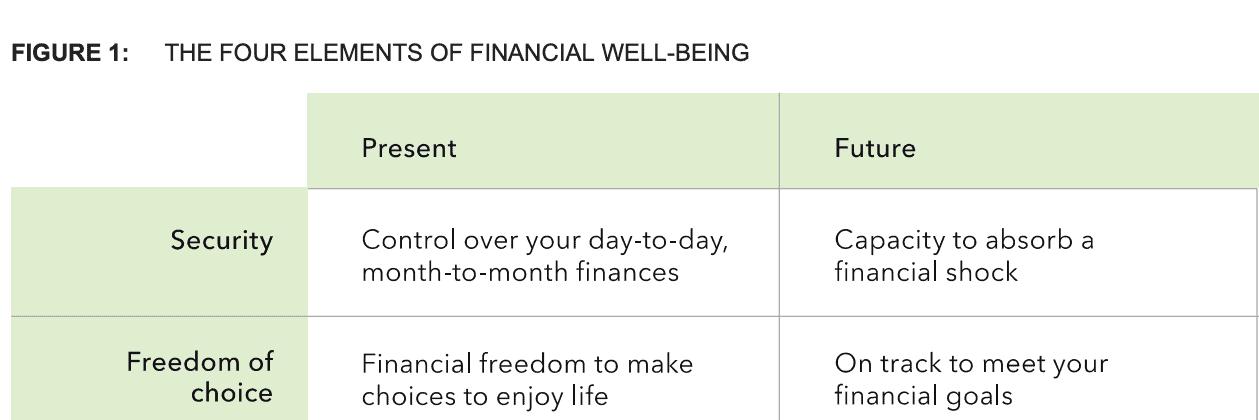

Now, let’s define financial wellness. The U.S. Consumer Financial Protection Bureau gave two definitions of financial well-being (essentially another way to say financial wellness) in its 2017 Financial Well-Being Scale Development Technical Report. Their first definition of financial well-being is a state of being wherein a person can fully meet current and ongoing financial obligations, can feel secure in their financial future, and is able to make choices that allow them to enjoy life. Their second definition is fairly similar—the feeling of having financial security and financial freedom of choice, in the present and when considering the future. Figure 1 outlines the CFPB’s four elements of financial well-being.

FIGURE 1 – The Four Elements of Financial Well-Being – U.S. Consumer Financial Protection Bureau

Modern Wealth Management Managing Director Dean Barber has his own way of defining financial wellness/well-being as well. He describes it as financial independence. Dean believes that financial independence is the ability to do the things you want to do because you want to do them and not because you think you need to have a paycheck. If you choose to continue to work, it’s because you want to.

The Parallels Between Training for a 5K and Planning for Retirement

As we continue to answer the question, “What is financial wellness?” we’re going to use a fitness reference. Let’s say that you set out a goal of completing a 5K walk/run for a New Year’s resolution but haven’t exercised in months. If you immediately tried to do that 5K on January 2, odds are that you probably weren’t feeling your best if you were able to complete it. You would likely be very sore (lack wellness) for the next few days as well.

Remember that the ultimate goal we’re seeking with financial wellness is to get to and through retirement. Just like with trying to complete the 5K on January 2 without doing any prior training, deciding to retire early but not planning for it won’t likely end well. Before you do the 5K, you should establish a training plan. Before you retire, you need a financial plan that helps you determine how much you might need to get to and through retirement.

Retirement planning shouldn’t be done on a whim. We encourage people to beginning planning for retirement about 10-15 years before their desired retirement date. That might feel like more of a marathon than a 5K, but either way, the earlier you get your financial plan put together, the more clarity and confidence you’ll have leading up to and going through retirement.

As you begin planning for retirement and pursuing financial wellness, there are a lot of questions you need to ask yourself and things to keep in mind. In our Retirement Plan Checklist, we’ve compiled 30 questions and age-based and date-based timelines to help gauge your retirement readiness. You can download your copy below.

Keeping Financial Wellness Top of Mind

Whether you’re planning for retirement or training for a 5K, having a clear-cut goal in mind is important. It’s also important to have sub-goals that you want to achieve along the way. When you’re trying to figure out how much you need to retire, it’s not all about your finances. You need to ask yourself what things are most important to you in retirement and then determine how much those things cost.

Before we start building your financial plan, we need to know what’s important to you and how you think and feel about money. With training for a 5K, are you just trying to finish it? Do you have a goal time in mind? Are you thinking about doing a longer race in the future like a 10K, half marathon, or marathon and using this 5K as a fitness baseline? Whether you’re training for a race or planning for your retirement, your goals matter. They’re a key factor to your financial wellness.

Part of Financial Wellness Involves Everchanging Goals

Your goals are also likely to change as your training for a 5K or planning for retirement. When you’re training for the 5K, following your training plan to a T can be near impossible no matter your fitness level. Injuries, illnesses, and other life commitments can change your training plan and force you to readjust your goals. Or maybe your workouts feel super easy and you want to challenge yourself. That also could require you to change your goals.

With retirement planning, there are even more things to consider that could impact your goals. Did you decide that you want to help fund your grandchildren’s educations? Maybe you want to travel more in retirement or buy a second home? Those are some exciting subgoals that apply to your overall goal of getting to and through retirement. On the flip side, what if you or your spouse have an unexpected long-term care stay? Unfortunately, injuries/health issues can force you to change your goals for retirement and with training for a 5K. Reviewing your financial plan and your goals is a crucial component of financial wellness.

There’s More to Your Financial Plan Than Investments … and There’s More to Training for a 5K Than Running/Walking

When people meet with our CFP® Professionals for the first time to discuss retirement planning, one of the first things they usually want to talk about is investments. What many of them don’t completely understand, though, is that an investment plan and financial plan aren’t one in the same.

Tax Planning and Social Security Claiming Strategies

Yes, your investments serve as an engine to your financial plan. But your financial plan can’t function on investment alone. You need a forward-looking tax plan that helps you pay as little tax as possible over your lifetime. Understanding how to maximize your Social Security benefits and when and how to claim Social Security can make a huge difference in the success of your retirement.

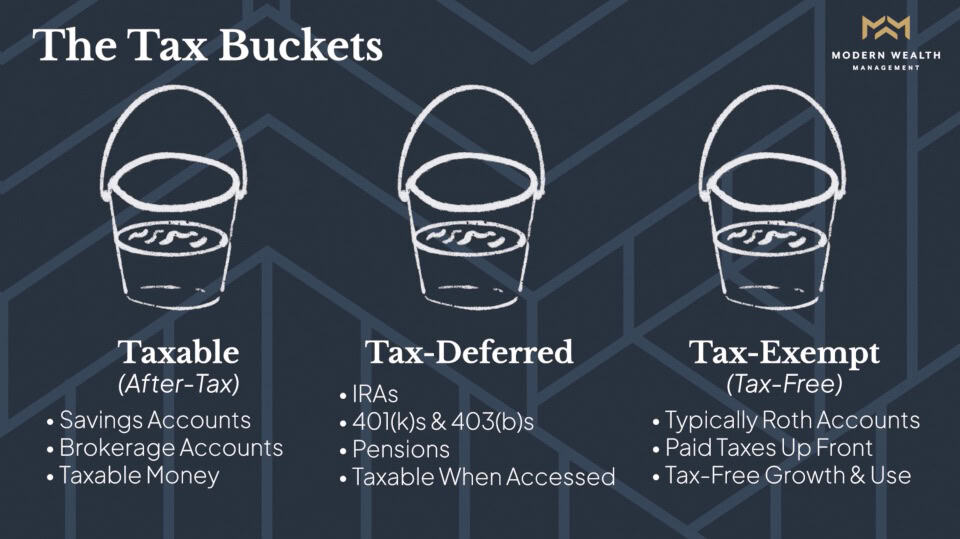

If you’ve focused on saving for retirement 10-15 year before you plan to retire, that’s great. But keep in mind that if you’ve saved, let’s say $1 million, for retirement, you don’t actually have $1 million. Uncle Sam hasn’t had his piece of the pie yet. That’s why we stress the importance of tax diversification.

We break down your retirement savings into three buckets—taxable, tax-deferred, and tax-free. You can see what retirement funds fall within each bucket below in Figure 2. A big part of financial wellness involves knowing when and how much to take from each bucket. It can be quite a balancing act, so we encourage you to consult a tax professional if you’re even the least bit unsure of potential tax implications on your retirement savings.

FIGURE 2 – Three Tax Buckets

Setting Up a Spending Plan

Once you stop working, your money starts working for you rather than you working for your money. Unfortunately, we’ve seen way too many instances of people do a great job of saving only to pass away early on or even prior to retirement. Retirement planning would be a lot easier if we knew when everyone was going to die, but that’s the great unknown.

As we touched on earlier, your goals should be a vital part of the retirement planning process. When we start assigning monetary values to your retirement goals, we’re creating a spending plan for your retirement. We break down your retirement into three different sections—your go-go, slow-go, and no-go years. The idea is to front-load your spending in retirement to an extent because you never know what day might be your last.

We say to a certain extent for a few reasons. Your health is truly your wealth in retirement. Good physical, mental, and financial wellness all can play big roles in you living a long and healthy life. Even if you feel as strong as an ox to begin retirement, everyone needs health insurance. For most retirees, that will be Medicare once they turn 65. If you plan to retire before turning 65, make sure to be aware of your health insurance options since you will no longer be covered by your employer.

Leaving Your Legacy

So, we’ve highlighted how taxes, Social Security, and insurance factor into your retirement along with your investments. If you think about it, there’s a lot more that goes into training for a 5K than running/walking as well. Biking and swimming are two popular cross-training activities that can enhance your fitness while also taking the toll off your knees. A good sleeping schedule and proper nutrition are also critical in helping you reach your 5K goals (and fitness goals in general).

However, there’s still one more retirement planning component that we haven’t answered during our quest to define financial wellness. Honestly, a relay race might have been a better fitness example to illustrate the importance of financial wellness rather than a 5K.

Like we said at the beginning of the article, your retirement date isn’t the finish line of your retirement planning. The end of your life likely isn’t the finish line either. How is that possible, you ask? Most people want to leave a legacy after they pass on. Oftentimes, people will pass the baton (their wealth) down to the next generation(s) and/or some charities they’re passionate about. This is why having an estate plan with up-to-date beneficiaries is pivotal as you’re practicing financial wellness.

And you don’t have to wait until you pass away to start gifting. One of the greatest rewards for our advisors is to hear stories from people who get to witness their loved ones have success because of their financial support. That can’t happen without good financial wellness.

Do You Have Questions About How to Achieve Financial Wellness?

Training for a 5K isn’t easy, and neither is planning for retirement. Both are a lot easier with teammates and coaches helping you along the way. While that’s probably the extent of how much we can help you train for a 5K, we welcome the opportunity to assist you with enhancing your financial wellness.

Along with utilizing our Retirement Plan Checklist, we encourage you to start building your financial plan with our financial planning tool. You can access it at no cost or obligation and from the comfort of your own home. Click the “Start Planning” button below to begin your path to financial wellness.

While there aren’t any hurdles in a 5K walk/run, there can be some figurative hurdles that come up when planning for retirement. Let us help you clear them. You can schedule a 20-minute “ask anything” session or complimentary consultation with one of our CFP® Professionals by clicking here. We can meet with you in person, virtually, or by phone. We’re ready to help you achieve financial wellness and live your one best financial life.

Schedule a Complimentary Consultation

Click below to get started. We can meet in-person, by virtual meeting, or by phone. Then it’s just two simple steps to schedule a time for your Complimentary Consultation.

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.