Family Financial Planning with Matt Kasper

START PLANNING Subscribe on YouTube

Sign up for our Weekly Newsletter Share this Episode

Family Financial Planning with Matt Kasper Show Notes

When we’re trying to find out what’s most important to people in their retirement, one of the most common answers is spending time with family. Many of those people are also passionate about gifting money to the next generation(s) so that their loved ones are in good hands financially after they pass on. The ins and outs of estate planning are very important, but also quite complex. That’s why we’re having Matt Kasper, CFP® join Dean Barber to discuss Family Financial Planning.

In this podcast interview, you’ll learn:

- The four main components of a financial are all connected, and they impact not only yourself, but the next generation.

- Communication is critical with family financial planning.

- The differences between a will and a trust.

- Investments aren’t the main focus with family financial planning.

What All Goes into Family Financial Planning?

Through the decades of experience that Dean and Matt have in the financial services industry, they know that a financial plan is created to give you clarity, confidence, and control about your financial life. But there is so much of your financial plan that’s designed for not just you, but your whole family. We’re going to review several of the main aspects of family financial planning.

“There’s so much that goes into this big wealth transfer. We’re always thinking about how to best serve our clients and making sure that they have a plan in place so they can have a lasting retirement. The next conversation is about how this transfer takes place. How does this all pass on first to your survivorship? If you’re married, you want your spouse to be taken care of. And, of course, the next big transfer is going to be to the next generation or possibly to charity.” – Matt Kasper

Everyone is going to have family financial planning that’s unique to them. Our team needs to have conversations with you about your thoughts on family financial planning to understand what’s going to be best for you and your family.

The Four Components of a Financial Plan

Every financial plan should have four main components—investments, risk management, taxes, and estate planning. All four of those are very unique. The investment part of the plan doesn’t have as much to do with your family members as the other three components. But all four of them are connected. Let’s review how each component impacts you as well as the next generation as we look at family financial planning.

Estate Planning

Since we’re talking about legacy, it seems appropriate that we review estate planning first. What can you do proactively to keep your family so they’re not surprised by any aspects of the plan? Everyone’s wishes need to be known so you’re getting rid of as much of the clutter as possible.

Matt and Dean have had an opportunity to work with a lot of people whose parents have passed. Dean met with one of his clients recently who is in their early 70s whose parents lived long lives and passed away within two weeks of each other in their own homes. While we’re sorry for that client to have two big losses in such a short amount of time, it can be much more difficult for the surviving spouse and family when there’s an expected death, long-term care stay, or other complex scenario.

Knowing What’s in a Trust or Will

There was one thing that did surprise that client, though. He couldn’t believe the wealth that his parents had. He watched them live well below their means for many years and asked them if they needed help. While he was named the successor trustee on their trust, but he didn’t really know what was in the trust and the terms of it. So, he spent the better part of 2022 settling the estate. It ended up being about $1.5 million, and that didn’t include the home they lived in.

“He wished he would’ve known what his parents had so he could’ve encouraged them to live a better life as opposed to living like they were dirt poor. I think that generation sometimes would rather live like they were poor and make sure that if something like the Great Depression ever came around again that they would be OK. I’ve witnessed many other instances of that generation being tight-lipped about their finances. That goes back to Matt’s point and the importance of sharing what that plan is during a family meeting.” – Dean Barber

Whoever is going to be your successor trustee or named in the trust need to be in the know. They don’t necessarily need to know the dollar amounts within it, but they need to understand what your wants/wishes are and why you’ve set the trust up in the way that you have.

The Problems with a Protective Mindset

Unfortunately, it’s become very common for people to have a protective mindset with their finances and wants/wishes. That protective mindset can lead to a couple of issues. One, it can keep you from living out your retirement goals. Two, it can keep you from engaging with your family and keeping them from being aware of what’s to come in the future.

It’s a blessing to receive an inheritance, but there are a lot of people who are ill-prepared to receive it in terms of potential probate or knowing what exactly you’re inheriting—whether it’s investments, real estate, etc. It’s all about communication with family financial planning.

The Three Types of Estate Plans

There are three types of estate plans that someone can have—no plan, a will-based plan, or a trust-based plan. No plan obviously means that you’ve done nothing and the courts decide where your money goes when you pass on.

The will-based plan outlines what you want to happen and who gets what. Every will is probated. Depending on the state you live in, you’ll lose 3% to 6% of the value of the estate. It’s very public and drags out over a minimum of nine months before the estate is settled. The probate courts will read the will, determine if it was accurate, and then say where all the money is going to go.

At Minimum, You Should Have a Will-Based Plan

Basically, you’re paying 3% to 6% of the value of the estate for an attorney and a judge to read the will and say where everything should go. If you want any privacy and you have assets, you should have a trust. Minimally, we know we need to get a will-based plan in place.

“While that will is a letter of instruction to the judge about how you want your property distributed to your loved ones, that’s still just a safety net. We need to do things prior to that, such as having other documents in place. We need the proper power of attorneys in place—both for health care and financial. Also, health care proxies need to be in place. That’s going to be conclusive inside of a will-based plan. It’s not just going to be having that letter of instruction to the judge, which you’re hoping to never utilize in the first place. But you need to minimally have a will in place.” – Matt Kasper

With something like a financial power of attorney, it’s not always someone getting into an accident and needing someone else to make decisions for them. It could be something like getting dementia and no longer being able to manage your finances properly. Who’s going to take care of your finances if that happens? Unfortunately, dementia is a fairly common thing for people to go through. You need to prepare for the possibility of that by getting all your documents in place.

What’s in a Trust?

If you have a trust, your trust will include the trust document, the financial and health care powers of attorney, health care directives, and a will. The trust encompasses the whole thing.

“If you have any money at all, you should have a trust because it acts in two capacities. One, it acts if you’re incapable of making decisions. Two, it acts during a smooth transfer to the next generation and avoiding probate courts.” – Dean Barber

Mistakes That Can Be Made with Trusts

While Dean and Matt recommend having a trust, they’ve also seen people make some common mistakes with them. One of them tends to happen when someone goes to their attorney, their attorney drafts the trust, gives it to them, and shares the funding instructions, but tells them that it’s OK if they don’t get it funded because they’ve included a pour-over will. For anything that doesn’t get into the trust, the pour-over will force everything into it upon your death.

Well, that’s a dirty trick. The attorney just ensured that anything that goes untitled in your trust goes through probate. Like we said earlier, all wills go through probate. It’s a way that the attorney can get paid a second time at your death just to make sure that all the assets that you didn’t put in your trust get put into the trust by going through probate.

When you think about property, it’s not just your investments and making sure that the beneficiaries are reflecting the trust. It’s things like the deed of your home and making sure that’s titled properly inside the trust. It’s also things like the beneficiaries on your life insurance or whether you want your IRA to go through the trust. If your trust happens to have a partial beneficiary of a charity and the IRA goes into the trust, the trust is then disqualified under the new SECURE Act from being able to pass that through to the ultimate beneficiary without taxation.

You Need a Team of Professionals That Work Together

A good CFP® Professional will work alongside you and the estate planning attorney to make sure that everything is squared away. There’s nobody that knows your finances better than your CFP® Professional. That’s why it’s critical for the CFP® Professional to have a great relationship with the estate planning attorney.

The Good, the Bad, and the Ugly

We also want to highlight the expectations of a trust. We already highlighted the expectation of the documents that need to be a part of it. There’s also the proper titling and the funding to avoid probate. But there’s also some of the uniqueness that comes from designing a trust. It demonstrates the true meaning of family financial planning.

“We can all relate to the example of the good, the bad, and the ugly. It’s easy for me to do that because I have two older brothers. I have an ugly brother, bad brother, and clearly I’m the good brother. This is where you might not want an outright distribution to specific loved ones. It’s not that you don’t love them. It’s because you want to protect them—potentially against themselves. How many people are going to be ill-prepared to manage wealth that’s being transferred after the passing of a loved one?” – Matt Kasper

Age Laddering

Did you know that one-third of the population depletes a wealth transfer within a two-year timeframe? There’s a responsibility that can be managed through a trust to where you may put in some parameters.

Age-laddering is a common parameter. Maybe you have a grandchild who is a teenager. They’re likely not going to be equipped to manage wealth. But maybe you still want to help them with college? You can design your trust so your grandchildren get something for having good grades. Oftentimes, people will just want their grandchildren to attain an age where they’re more developed and design the trust accordingly. Maybe you design it so that your grandchildren will get a certain amount at age 25, then at 30, and then at 35. Family financial planning is about getting them to a point to where they can manage wealth at certain stages.

“The trust is a complex tool, but it can be designed to do what you want it to do. It’s designed to carry out your wishes if you’re incapable of making decisions while you’re alive and then once you’ve passed on. You want to make sure that your money is going to the people and charities that you care about the most.” – Dean Barber

Giving with Cold and Warm Hands

Good estate planning not only involves giving from cold hands but giving from warm hands. This is where the collaboration between the CFP® Professional and estate planning attorney can really pay off. One of the greatest things that Dean has seen in his career was a couple that designed their financial plan and estate plan and gift millions of dollars to their daughters and grandchildren. That was only a part of what made it great, though.

“I asked them if it would be of any interest to them to start giving some money to their daughters and grandchildren while they were still alive so they could watch them enjoy it. The husband looked at me and asked if they could do that without destroying their ability to do the things they wanted to do. I said, ‘Absolutely!’ We came up with an annual $250,000 gifting strategy for their daughters. They’ve been able to watch how this has impacted their daughters’ and grandchildren’s lives and be a part of it.” – Dean Barber

The gifting of that couple also taught their daughters a lot about financial planning. That money wasn’t given to them just to spend it. It was going to be used to help pay for their children’s educations and saving for retirement. That couple brought in their daughters, who were in their 30s, and we started doing financial planning for them. We created an estate plan for them as well. There’s a lot of fun that can be had with family financial planning if it’s done right.

Gift Exclusions and Unified Credit

When you think about gift exclusions, $17,000 is what you can gift without having to report it on your taxes (that’s up from $16,000 in 2022). And it’s a per person exemption. That could be a partial design to what you’re trying to do. However, there are a lot of people who don’t understand how gift exclusions work.

Every U.S. citizen has a unified credit. It’s the amount of money that you can pass from one generation to another while you’re alive or after you’ve passed without having to incur an estate tax. In 2023, it’s just under $13 million per person ($26 million for a married couple). If you were to give your children, grandchildren, etc. anything in excess of $17,000 per person, the excess just comes off the $13 million unified credit. It doesn’t create a tax scenario for you or whoever you’re passing the money on to. So, if you and your spouse have an estate that’s less than $26 million, you can give away as much as you want to while you’re alive. There is no gift or estate tax if that’s the case.

We have seen that unified credit increase significantly over the years. And it might seem improbable that we’ll need exceed that $13 million/$26 million limit. But one thing to be aware of is that it’s going to be cut in half in 2026. That’s when the Tax Cuts and Jobs Act sunsets. That’s why your estate plan as part of your financial plan needs to be flexible.

Risk Management

We covered a lot of ground with what family financial planning is in relation to estate planning. Now, let’s shift gears to family financial planning when it comes to risk management. When you’re talking about risk management, you’re talking about insurance.

You need to have the proper insurances to protect yourself and your loved ones if you’re no longer around. This includes health insurance, disability insurance, long-term care insurance, and life insurance. Those insurance plans have an important role in the overall financial plan. They’re designed to protect you from unexpected losses.

“From a family financial planning level, life insurance is key with protecting your loved one. It’s always important to think of your spouse. How are you protecting them and making sure that they’re sustaining the lifestyle that you want them to have?” – Matt Kasper

Two Phases of Life Insurance

There are two phases of life insurance if you really think about it. You’ve got your life insurance while you’re working that’s there to replace your income so that your family can continue to live the lifestyle that they want. And sometimes, there’s another use of life insurance when you head into retirement. Dean has another story from a couple that he began working with 30 years ago to help highlight the importance of life insurance as it relates to family financial planning. The wife of that couple asked Dean if he could talk to her dad about some questions relating to his estate. He was more than happy to.

“Her dad knew he was going to reach a point where he wouldn’t be able to handle it on his own. He wanted to have a plan to take care of his wife and then the money would go to his children. I said that I would love to. He lived in Arizona, so I never got to meet him in person. But one of the things he wanted to do was leave a sizeable estate to his kids and grandkids. As we went through the financial planning process, we realized that there was going to be more money than he was going to spend. I said that if he wanted to maximize his estate that he should use some of the excess money to buy a life insurance policy.” – Dean Barber

Life Insurance Proves the Power of Family Financial Planning

That life insurance policy allowed him to send additional tax-free dollars to his children once he passed on. Once he and his wife passed, his children received that money.

Well, the couple Dean was working with decided a few years ago decided that they wanted to do the same thing with the life insurance policy to gift money to their children. They have additional wealth that’s far beyond the value of their estate that they can transfer because they weren’t spending all the money. They leveraged that through life insurance to create an additional tax-free legacy for their daughters.

Matt has seen many instances of the power of family financial planning through life insurance as well. One family in particular that he works with comes to mind when he thinks of family financial planning. That family had a set amount that they knew they wanted to give to their children.

“Insurance solved for that. They ultimately did a paid-up type of plan to where they had a death benefit that met the expectation that they wanted for their loved ones to receive as their inheritance. Because they have accomplished that already, that’s complete. They can spend everything else and enjoy their retirement as much as they can.” – Matt Kasper

The Tax Code Surrounding Life Insurance

When Dean thinks about life insurance, it doesn’t take him long to think about his good friend, Ed Slott. Ed is considered to be America’s IRA expert, and Dean has studied with him for nearly 20 years. Ed told Dean that the tax code that is written around life insurance is the best tax code out there. If you want to pass money to the next generation, the best money is life insurance. So, get the amount that you want, buy a life insurance policy that will fund that, and then spend every dime that you have.

“You can see where these things are playing together with the estate plan and life insurance. If you want to spend more money in retirement, have a life insurance policy that’s going to have the legacy that you want so that you don’t need to worry about whether you’re going to leave a legacy.” – Dean Barber

Dean has one more point to make about insurance before we move on to discussing family financial planning as it relates to taxes. He believes that the type of life insurance people should purchase, especially for a legacy plan, is a policy that’s permanent. It doesn’t need to accumulate a lot of cash value, but it should have a guaranteed premium for the rest of your life.

It should also include a critical care rider, which basically allows the individual to access part of the death benefit tax-free to fund long-term care if they need to go into a nursing home. Also, it can also protect the surviving spouse. Health care expenses are right up there with taxes in being the biggest wealth-eroding factors in retirement. Therefore, having that protection is critical.

Taxes

One thing a lot of people don’t realize is that you have more control over your taxes in retirement than any other point of your life. A good tax plan starts well before retirement because you need to have tax diversification. If you’ve done a good job at creating tax diversification, you’ll be able to control your taxes in retirement.

“When it comes to the family financial planning part of taxes, it’s thinking about how different assets will pass to the next generation. What will be the tax impact? Once you understand all that, you need to have the conversation with the next generation about the tax implications or lack thereof because of the planning that you’ve done.” – Dean Barber

Tax Planning Is Critical

Oftentimes, the biggest account that pre-retirees will accumulate wealth in is an employer plan like a 401(k). If someone didn’t have access to a Roth 401(k) or was unaware of the value to contributing to one, that could mean a few things. They might be doing a great job of saving and accumulating wealth, but the IRS is going to get a big component of it. That’s not only a challenge for the person that’s retiring with that tax-deferred account, but it’s going to be a bigger challenge passed on to the next generation.

Because of the SECURE Act, we now have a 10-year timeframe to completely withdraw the funds. That can happen all in year one or spread out evenly over 10 years, but no matter how you go about it, tax planning is key.

“That’s something that we’ve had to guide our clients through with our CPAs. We’d be lost without the CPAs giving that guidance to ensure that our clients retain as much of that inheritance as possible.” – Matt Kasper

Required Minimum Distributions

The SECURE Act changed everything with how people inherit IRAs. There are so many super complex rules under the SECURE Act that can throw off the beneficiary. There’s a different rule if someone passes away before their Required Beginning Date. That’s the date that you must start taking money out of your IRA or 401(k) in the form of a Required Minimum Distribution.

If someone dies before that, the 10-year rule applies to the next generation, but they don’t need to take any RMDs through that 10-year period. They just need to make sure that all the money is out by the end of 10 years.

If someone dies after the Required Beginning Date, the beneficiary must take RMDs every year and all the money needs to be out by the end of 10 years. So, if the beneficiary doesn’t understand the complexity of this, it’s easy for them to fall into a scenario where they could be subject to a 50% penalty by not doing it correctly. And not only do you have the penalty, but you have the taxes on top of that.

“Most of the people who inherit money are in their 50s or 60s and probably in their peak-earning years. If all the money needs to come out of that IRA and the beneficiary is in their peak-earning years, there’s a good chance that the money coming out of that IRA will be taxed at a much higher rate than you paid on that when you put it in.” – Dean Barber

Roth Conversions

This is the financial plan comes in. This scenario is part of the tax plan, but it’s also part of the estate plan. At this point, should you consider starting to move some of the money from a traditional IRA to a Roth IRA? When you’re making that decision, you can’t make it based only on your personal financial plan. You need to make the decision based on a generational plan. That really outlines the importance of family financial planning.

We know that at some point, that money is going to come out. If we can move it into a Roth IRA now where it can pass to the beneficiary tax-free and be accessed tax-free later, does that give you a bigger bang for your buck on paying a lower tax rate today or being forced to pay a higher tax rate in the future?

“When you’re looking at every calendar year, one of the big challenges that we have in front of us is helping our clients that possibly didn’t accumulate wealth in a diversified way to start becoming diversified from a tax standpoint. I’m not even talking about investments yet. When we start thinking of ways to accomplish this, one of the biggest strategies is Roth conversions. But Roth conversions aren’t always good. It takes the efforts of a tax professional and your CFP® Professional to give you guidance as to what’s going to be the effective rate for getting this money from an IRA over to a Roth account.” – Matt Kasper

Again, Tax Rates Are Going Up in 2026

What’s even more complex about this is you’re trying to evaluate effective rates for the conversion and compare it relative to the tax rates when you need to start taking RMDs. This goes back to our point about tax rates going up on January 1, 2026, when the Tax Cuts and Jobs Act sunsets. We’re going back to 2017’s rates.

The fear is not just what’s going to happen in 2026, but what’s the tax code going to be like in 10, 15, 20 years. There’s a lot of concern about where the future of the tax code could be. Ultimately, it’s about being proactive and getting tax diversification into your portfolio by considering things like Roth conversions.

“Thinking about Valentine’s Day, talk about protecting your spouse if you’re married. One of the most difficult things is when you need to file a single tax return because your rates go up significantly.” – Matt Kasper

Roth Conversions Aren’t for Everyone

That made Dean think of another recent interaction with one of his clients. In December 2022, this person came in for a year-end planning meeting. She had about $20,000 left in the 22% tax bracket. Dean wanted to see what a Roth conversion would look like with converting the $20,000 to a Roth IRA in the 22%, knowing it would be tax-free forever. As Dean ran the scenario, that $20,000 Roth conversion caused an additional $11,000 of Social Security to become taxable. Suddenly, she would need to pay tax on $31,000. Dean explained that it wasn’t a good decision for her to do that.

If you oversimply the Roth conversion, you think about where your marginal tax bracket is. You take that plus your state tax and think that if you’re in the 22% bracket and need to pay 5% state tax that it’s a 27% effective rate. Well, as explained with Dean’s example, that can make a lot more of your Social Security to become taxable. Your effective rate isn’t actually 27%. It’s more like 35%. That’s one example of why Roth conversion don’t always make sense for everyone.

Social Security Is Taxed Differently Than Any Other Type of Income

That’s why you need to go through and build a full financial plan. When you go directly to an accountant or CPA, they won’t know what your retirement is going to look like in terms of your spending ability and resources, they can’t give you proper guidance. That’s why you need your CFP® Professional to be working with the CPA so that you have a financial plan in place that’s being reviewed from a tax perspective.

Think about what could’ve happen if Dean’s client with her Social Security if she wasn’t working with him and a CPA and she had converted that $20,000. That’s something that can really blindside you. Social Security is taxed differently than any other source of income, but many people don’t realize it.

“We’re talking about the whole financial plan. Some of these things will just affect that individual or couple, but so many of them have an impact on the next generation and the entire family.” – Dean Barber

The Roth Can Be the Best Type of Inheritance

Also, you can’t lose sight of how Roth conversions can impact your Medicare expenses. That can sometimes be an oversight. A Roth conversion can push you into higher costs of Medicare.

But when circling back to the next generation, the Roth can be the best type of inheritance. So, keep that in mind if Roth conversions aren’t significantly impacting your Social Security or Medicare expenses. Why? Because it’s tax-free. Yes, there is still the 10-year rule to deal with, but you don’t have any RMDs even if you die after the Required Beginning Date because there’s no Required Beginning Date for a Roth IRA.

Investments

You might have noticed that we’re nearly 5,000 words into this after and we haven’t mentioned investments when it comes to family financial planning. That’s not by accident. Investments are the engine that drives everything. But you can’t go on a trip with just the engine. You need the other aspects of the financial plan that we’ve reviewed.

“The financial plan needs to be constructed for each individual before you discuss what the investment plan should look like. You can’t design the investment plan without having the overall financial plan done first. A lot of times, people get impatient and just want to know what to do with their money. We’ll get there, but we need to go through all these other things first.” – Dean Barber

There’s an Art to Family Financial Planning

Hopefully, this has helped you realize that there’s a lot of planning to be done for your retirement, and the planning doesn’t stop once you’ve retired. If you have a family, there’s much more to consider than just your retirement. Meeting with one financial professional can get you started with family financial planning, but it really takes a team of professionals to secure a successful retirement.

“I wish I could say that I can give you all the solutions, but I can’t. I rely on our tax team and different attorneys for legal guidance and determining proper protection. We touched on each of those. That’s all to optimize the most efficient retirement that we can for you. How do we ultimately create the best legacy plan, best generational plan that you can move forward with? Leaving the most wealth at the end of the plan isn’t necessarily what’s going to be the most meaningful for you. It’s going to be different for everyone.” – Matt Kasper

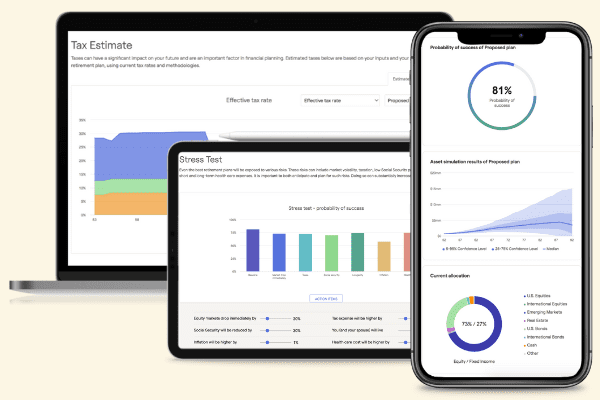

To truly see how financial planning is different for everyone, check out our industry-leading financial planning tool. How see each of the four components we covered with family financial planning within the tool and how they apply to your unique situation. You can use our tool at no cost or obligation and begin building your plan by clicking the “Start Planning” button below.

If you have any questions about any of the four components of family financial planning, just let us know. You can ask us those questions during a 20-minute “ask anything” session or complimentary consultation with one of our CFP® Professionals. We’re available to meet with you in person, virtually, or over the phone depending on what works best for you. We look forward to helping you realize the opportunities that you and your family can take advantage through family financial planning.

Sign up for our weekly newsletter which includes educational articles, videos, and more. It arrives in your inbox every Tuesday morning to keep you up-to-date.

Family Financial Planning | Watch Guide

Introduction: 00:00

The Four Components of a Financial Plan: 03:02

Estate Planning: 4:00

Risk Management: 24:06

Tax Planning: 32:00

Investments: 43:33

The Art of Financial Planning: 44:38

Conclusion: 46:13

Resources Mentioned in this Podcast

- Ed Slott in Studio

- Creating a Tax-Free Retirement with Ed Slott

- How to Avoid the Biggest Tax Traps with Ed Slott

Investment advisory services offered through Modern Wealth Management, Inc., an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Advisor. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.