Retiring Single with $1.5 Million Saved: How Much Can You Spend with Will Doty, CFP®, AIF®

START PLANNING Subscribe on YouTube

Retiring Single with $1.5 Million Saved: How Much Can You Spend with Will Doty, CFP®, AIF® Show Notes

At Modern Wealth Management, we enjoy guiding couples and individuals from various walks of life through the retirement planning process. Hence why we came up with the name of our podcast, The Guided Retirement Show. Many of the case studies we’ve reviewed in our podcasts, articles, and other content have focused on couples retirement planning. Today, Will Doty, CFP®, AIF® and Dean Barber are going to dive into a case study that geared toward all the single folks out there. Everyone’s situation is unique when it comes to retirement planning, whether you’re retiring single or married. Maybe you’ve been single for most or all your life. Or maybe you were married and are now single following a divorce or death of a spouse. No matter your situation, you need to have a plan for retirement. In this article and podcast, we’re going to run through a case study of someone retiring single with $1.5 million in retirement savings. Let’s review some things they’ll need to think about.

In this podcast interview, you’ll learn:

- The difference between the three tax buckets

- How to determine your plan’s probability of success

- What IRMAA stands for and how it works

- The importance of having a personalized financial plan

Do You Fit the “Millionaire Next Door” Mold?

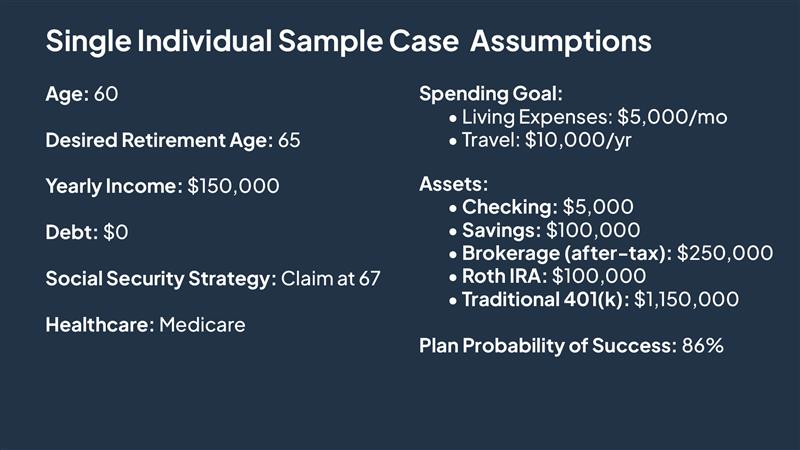

The planning for retirement that needs to take place for single individuals than for married couples. With this case study, we want to highlight some of the different that single individuals could face while planning for retirement. Check out Figure 1, below, for an overview of the sample single individual we’ll be using in this case study.

FIGURE 1

The single individual in this case study falls into the category of what a lot of Modern Wealth advisors sometimes refer to as “the millionaire next door” that can oftentimes live below their means. This individual is 60 years old and wants to retire at 65. They have about $1.5 million in retirement savings.

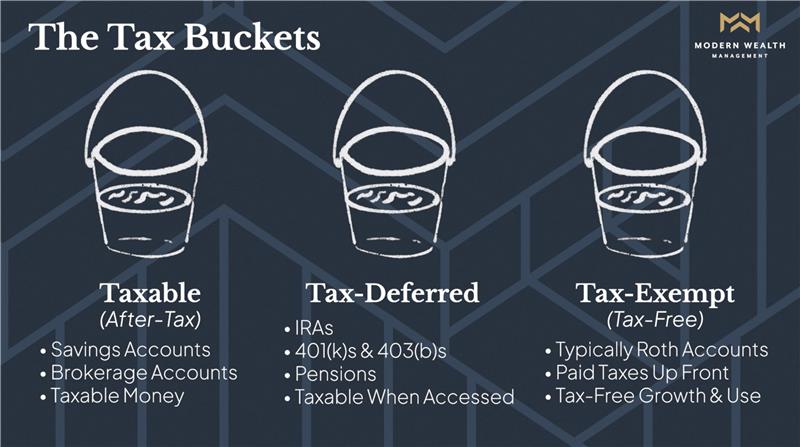

The Three Tax Buckets

After being prudent about saving, how can this individual go from working for their money to having their money working for them for the rest of their life? Let’s first break down the investment vehicles in which their money is saved to and review the three tax buckets shown in Figure 2.

FIGURE 2

As you can see in Figure 1, most of their assets ($1.15 million) are saved in their traditional 401(k). That falls under the tax-deferred tax bucket in Figure 2. While it’s great that they’ve been diligent about saving to the traditional side of their 401(k), keep in mind that that money has yet to be taxed. It will grow tax-deferred until they begin taking money out of the account.

The tax bucket that this sample individual has the second-most money in is the taxable (after-tax) bucket. This individual has $250,000 saved in brokerage accounts and $100,000 in savings accounts.

And last but certainly not least, this individual has $100,000 in Roth IRAs, which is the tax-exempt (tax-free) bucket. That money has already been taxed and will grow tax-free. The distributions will be tax-free as well.

Social Security Considerations

Just as a benchmark, we have this individual claiming Social Security at full retirement age. For someone who 60 today like this individual, full retirement age is 67.1 So, for the first two years of retirement, this person will live purely off their assets.

Expenses and Debt

This individual has about $9,250 in home expenses and has no debt. Those home expenses consist of homeowner’s insurance, property taxes, and a little bit of maintenance for their home.

A large portion of expenses in retirement can oftentimes be health care costs, which can be one of the leading wealth-eroding factors in retirement. The plan for this individual is to go on Medicare for health insurance upon entering retirement since they’ll become Medicare eligible at 65. If they change their mind and retire prior to 65, they would need to think about what to do for health insurance. Options could include private insurance, Affordable Care Act (ACA), or COBRA.

There are also some expenses that are fun to think about, such as vacations. This individual enjoys traveling, so they’re planning to spend $10,000 a year on vacations until they turn 80. Expenses outside of the individual’s home, health care, and vacations will be about $5,000 a month ($60,000 a year). That $5,000 a month includes potential one-time expenses, such as needing to replace appliances, getting a new car, and other unexpected expenses.

“When we’re planning that distribution phase, we don’t want that monthly expenses to be paid from your savings account and go toward a future item like an oven. Those are big one-off expenses. Those really need to be carved out and planned for.” – Will Doty, CFP®, AIF®

What’s This Individual’s Probability of Success?

After breaking down how much this individual has saved, where they’ve saved to, and how much they plan to spend in retirement, their plan results in an 86% probability of success to get to and through retirement without needing to make any changes to their spending.

Let’s say that they did want to spend a little bit more. The ideal range when it comes to probability of success is from 75% to 90% (being much higher than 90% probably means that you’re overfunded). With this sample individual being 60, they could increase their spending to $5,600 a month, but it would drop their probability of success to 76%.

To be clear, whether they have a 76% or 86% probability of success, that doesn’t mean that they have a 24% or 14% chance of running out of money in retirement. It means that there’s a 76% or 86% probability based on a historical perspective that they would be able to spend exactly like they intended, keep up with inflation, and never have to worry about running out of money.

The other 24% or 14% of time, they may have to make adjustments to their budget at some point in time. Generally, that’s a temporary adjustment. Your plan’s probability of success is something we’re monitoring in our reviews. It’s going to bounce around over time.

“We’re going to get periods of time where the market just doesn’t cooperate and we’re not getting the growth that we need. Or if we get something like (the Great Recession in) 2008, that could really change somebody’s life. We make those adjustments along the way, but the main thing is just making sure that we’re staying above a successful level.” – Will Doty, CFP®, AIF®

Key Tax Considerations

Another huge consideration throughout the retirement planning process is taxes. In the sample individual’s scenario, remember that they have $250,000 in a brokerage account that is after-tax money they can live on prior to needing to take Required Minimum Distributions. That can help keep them at a very low tax rate before those RMDs kick in.

What’s IRMAA?

There’s also another tax that some people aren’t aware of that’s known as the IRMAA tax. IRMAA stands for Income-Related Monthly Adjustment Amount.2 Medicare looks at your income every year and potentially adjusts your Medicare premiums. If you’re income goes up too much, your Medicare premiums rise.

In this scenario, when those RMDs kick in, that automatically pushes this person into the that first rung of IRMAA two years down the road because IRMAA has a two-year lookback.

“They are now paying more for Medicare the rest of their life. And there’s no way out of that if they don’t make adjustments earlier.” – Will Doty, CFP®, AIF®

Knowing this, it’s advisable for this person to consider Roth conversions between 65 and their required beginning date for RMDs to see if they could pay an additional IRMAA tax for a few years, but avoid paying it for the balance of their life. That could positively impact their probability of success and result in big savings. But in some cases, it might not make sense. That’s why it’s something they need to test for.

In-Plan Roth Conversions

In this instance, this individual might want to consider in-plan Roth conversions. If their 401(k) has a Roth option, they might want to consider the difference between contributing to the Roth side versus the traditional side. With in-plan Roth conversions, they could do a conversion from the traditional side of the 401(k) to the Roth side of the 401(k). That way, they could have more money in Roth, reduce their future RMDs, and keep them out of the IRMAA tax.

“The question that we should be asking as financial planners is how do we mitigate taxes as much as possible? Taxes are going to be a fact of your life as long as you have money or make money in living United States. The question is what methods are available to control those taxes to make those taxes less?” – Dean Barber

If we can reduce taxes through different strategies, maybe we take the individual’s $5,000 a month and 86% probability of success to $5,500 a month and still have an 86% probability of success. You don’t want to leave any stone left unturned when it comes to tax planning opportunities that might be available to you.

Additional Background Info About This Sample Individual

As we mentioned earlier, everyone’s situation is different, whether you’re retiring single or married. In this sample person’s scenario, they’ve been single for their whole life and have no kids. So, if you’re planning on retiring single but do have kids, legacy is an additional consideration that you could have.

Do You Want to Leave a Legacy?

If you want to leave money behind to your children, grandchildren, etc., think again about how you’re saving to the different tax buckets so you can leave a more tax-efficient legacy. That has become even more important thanks to the rules that have been put in place with the SECURE Act and SECURE 2.0.

Thinking About Long-Term Care

For someone who is retiring single, one luxury that they unfortunately won’t have is a significant other to care for them in the event that they require some form of long-term care.

“The ideal thing would be if this individual could stay in their home, get some kind of a long-term care policy that would pay for in-home health care in the event that they needed it, so that they could maintain their dignity. Those are things that people need to think about that can impact the plan as well.” – Dean Barber

Do You Want to Plan to Spend Down Your Assets?

The fear of running out of money is a very legitimate fear for those retiring married or single. Some people will want their plan set up so that they never run out of money. But others might want to spend down their assets and assume that they could run out of money in their mid to late 90s. No one knows how long they’ll live. Is that a risk you would be willing to take?

One thing that’s important to keep in mind is that it’s very likely that you’ll be more spry, healthy, and mentally sharp at 65 than 85. This is why we had the sample individual spending $10,000 a year on vacations until age 80. It’s part of the idea of front-loading your spending in retirement. Remember that your wealth isn’t just about how much money you have. We break wealth down into four categories—financial wealth, social wealth, health wealth, and time wealth. And they all go hand in hand with one another. It’s important to maximize your wealth, and not just from a financial standpoint.

“There’s only one today. There’s only one tomorrow. You’ve got to take advantage of that. That’s one of the things we talk about as we work with single individuals and married couples. Let’s not die with a mattress stuffed full of money that we could have enjoyed. Let’s see what you can really do.” – Dean Barber

From a planner’s perspective, Will, Dean, and the rest of our advisors don’t want to have anyone thinking in retrospect that they could’ve spent a lot more each year. That’s why we have review meetings with our clients—ideally twice a year at least—to revisit their respective goals-based financial plans.

An Investment Plan and Financial Plan Aren’t One in the Same

When we say “financial plan,” we’re not just talking about your investments. Your investments are like the engine that makes your overall financial plan run. Your financial plan won’t be complete without your goals, a forward-looking tax plan, estate plan, and risk management objectives.

“What should I invest my money in” is a question we’re asked all the time by prospective clients. The thing is that we can’t accurately answer that before going through the entire planning process and learning more about your situation. And there are actually quite a few things more important than rate of return on your investments.

“We need to identify the rate of return that the money needs to achieve. I like to call it your Personal Return Index. That’s the only number that we should be focused on. And then the question becomes, how do we achieve from a historical perspective that return with the least amount of risk possible?” – Dean Barber

What’s Your Risk Tolerance?

As we’re getting to know prospective clients, we’ll want to assess their risk tolerance because we need to understand how they think and feel about money. And more importantly, we need to determine what your plan says you need to be achieving? There could be a conflict between the two.

Maybe you have a very high risk score, but you plan shows that you don’t need to take a lot of risk. That can be problematic if the market is shooting up and you’re in conservative state, you probably won’t be able to handle it well emotionally.

In that instance, you may want to bucket the money. Take a portion of it and invest it. But you don’t have to take on that much risk. People think that the greater the risk, the greater the reward. However, that’s not true, especially when you’re in your distribution phase of your life.

“There becomes a point when you take too much risk that it decreases your probability of success because of the sequence of returns.” – Dean Barber

It’s Your Personalized Financial Plan

Whether you’re retiring as a single individual or are married, we hope that you found the case study we reviewed to be insightful. There might be some similarities you have with the sample individual, but the bottom line is that your situation is unique and that there are so many planning techniques for you to consider. The last thing you want to do when you’re planning for retirement is to guess and hope that you can use the same planning techniques as someone else.

There are a lot of retirement rules of thumb that people blindly abide by without confirming if it’s really the best option for them. There’s the 4% safe withdrawal rate rule, owning your age in bonds, claiming Social Security when you retire, etc. Those rules of thumb might not align with the goals you’ve laid out within your plan. We want you to explore all alternatives to every aspect of their retirement so that you have more confidence that you’re doing the right things with your money, freedom from financial stress, and time to do the things you love.

“I always say, ‘You’ve worked hard for your money. Now it’s time for your money to go to work for you.’ The question is, how do you make sure that it goes to work for you in the right way? These different planning techniques can have a huge impact on what a person can do.” – Dean Barber

Do You (or Someone You Know) Have Questions About Retiring Single?

Whether you’re single or have some close friends who are single and planning for retirement, make sure to send them this article and podcast. If you have any questions about what Will and Dean covered or if you have questions about retiring single, schedule a conversation with our team below.

We look forward to addressing your (or your friends’) questions about retiring single and are ready to guide you on a personalized journey to and through retirement.

Resources Mentioned in This Article

- Starting the Retirement Planning Process

- Couples Retirement Planning: What You Need to Know

- How Much Do I Need to Retire?

- Financial Checklist After the Death of a Spouse

- 6 Habits of Self-Made Millionaires and Their Expectations

- Retirement Savings by Age

- Transitioning into Retirement by Following These 5 Steps

- Where Should I Be Saving for Retirement?

- Understanding Your Tax Allocation

- 401(k) Planning for 2024 and Beyond

- 5 Long-Term Strategies for a Better Retirement

- How Does a Roth IRA Grow?

- Retiring Before 62: What You Need to Know

- Retiring with Debt: What’s OK?

- Health Care Costs During Retirement

- 7 Wealth Protection Tactics

- Retiring Before 65: What You Need to Know

- Health Insurance Options for Retirees Under 65

- Setting Up a Spending Plan for Retirement

- Unexpected Expenses in Retirement and How to Plan for Them

- Making BIG Purchases in Retirement

- What Is a Monte Carlo Simulation?

- Reasons People Run Out of Retirement Money

- 10 Ways to Fight Inflation in Retirement

- The Great Recession’s History Remains Relevant

- Taxes on Retirement Income

- RMD Strategies for Before and After Retirement

- 2024 Tax Brackets: IRS Makes Inflation Adjustments

- Roth Conversion Rules

- RMD Age for 2023: What’s Your Required Beginning Date?

- How to Maximize In-Plan Roth Conversions in 401(k) Plans

- How to Reduce RMDs with 5 Strategies

- Tax Planning Strategies with Marty James, CPA, PFS

- What Is Tax Planning?

- Family Financial Planning with Matt Kasper, CFP®, AIF®

- What Is the SECURE Act?

- Understanding the SECURE Act 2.0 with Ed Slott, CPA

- 5 Long-Term Care Questions to Ask

- Longevity Risk in Retirement and How to Plan for It

- Components of a Complete Financial Plan with Logan DeGraeve, CFP®, AIF®

- What Should I Invest My Money In?

- 5 Factors More Important Than Rate of Return

- Retirement Rules of Thumb: Let’s Bust Them

Other Sources

[1] https://www.ssa.gov/benefits/retirement/planner/agereduction.html

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.