Tax Planning Tips with Corey Hulstein, CPA and Marty James, CPA, PFS

START PLANNING Subscribe on YouTube

Tax Planning Tips with Corey Hulstein, CPA and Marty James, CPA, PFS Show Notes

How can you pay less taxes over your lifetime? That’s a question everyone wants to know the answer to, but there isn’t a one-size-fits-all answer. Everyone’s financial situation is different. Along with explaining the importance of having a forward-looking tax plan as a part of your personalized financial plan, Corey Hulstein, CPA and Marty James, CPS, PFS joined Dean Barber on The Guided Retirement Show to share some tax planning tips.

In this podcast interview, you’ll learn:

- The Dynamic of the CFP® Professional and CPA Working Relationship

- The Difference Between Tax Preparation and Tax Planning

- Considerations When Creating a Distribution Strategy

- The Difference Between Charitable Remainder Trusts and Charitable Lead Trusts

The CFP® Professional and CPA Working Relationship

As we begin to talk about tax planning tips, it’s important to realize that the level of tax planning that CPAs can do tends to directly correlate with their understanding of your overall financial situation. The issue with that is that not all CPAs have the same level of financial planning expertise. That’s why we have our CPAs working alongside CFP® Professionals at Modern Wealth.

Our CFP® Professional prepare and review financial plans for clients and prospective clients. Then, our CPAs review those plans from a tax perspective. They want to determine how individuals can pay as little tax as possible over their lifetime.

Tax Planning Is Not the Same Thing as Tax Preparation

Marty and Corey understand the difference that tax planning can make within an individual’s financial plan. They want people to understand that tax planning isn’t tax preparation. They’re two totally different mindsets. When you’re doing tax returns, that’s tax compliance. Tax planning, on the other hand, looks at your tax situation over the next several years.

Now, you can do tax planning during tax preparation season. This is what Marty refers to as triage planning.

“That’s when the game is over and you’re trying to figure out if there’s anything else you can do. Tax planning is more proactive. As opposed to calling it tax planning, it’s more like tax management. It’s something you’re doing throughout the year.” – Marty James, CPA, PFS

When Marty and Corey work on our clients’ tax returns, they want our clients to understand that their tax returns don’t give a true financial scope of what they have. There are also limited opportunities of what you can do besides things like HSA and IRA contributions since tax returns report on what happened in the past.

Corey echoed Marty’s sentiments about tax planning. He enjoys doing tax planning because of the long-term impact it can make.

“With tax planning, you’re looking at a three, five, 10-year horizon, which gives you a lot more opportunity to make an impact for the clients. Asset allocation is a big part of how we do that. This creates flexibility to move the puzzle pieces around to make things fit appropriately.” – Corey Hulstein, CPA

Tax Bracket Management

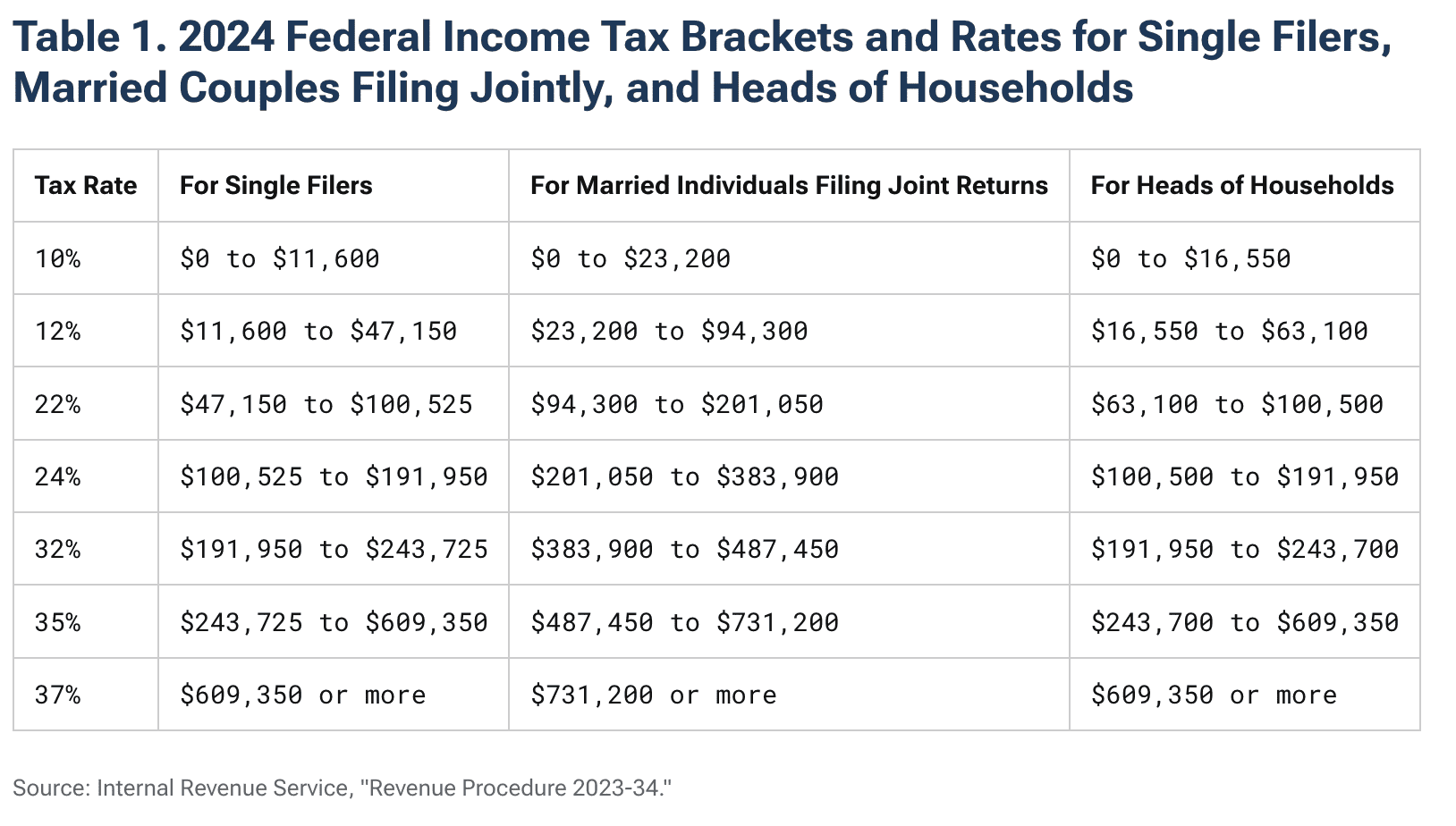

Notice that Marty said he thinks of tax planning as tax management. To be clear, he’s talking about tax bracket management. We have a progressive tax system. For the 2024 tax year, the tax rates are at 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

FIGURE 1 – 2024 Tax Brackets – Tax Foundation/IRS1

But that doesn’t mean that all your dollars will be taxed at one of those rates. For example, let’s say that you’re married filing jointly, and you and your partner have $250,000 in total income. All $250,000 won’t be taxed at 24%. The first $23,200 will be taxed at 10%, the next $71,100 ($94,300 – $23,200) will be taxed at 12%, the next $106,750 ($201,050 – $94,300) will be taxed at 22%, and the remaining $48,950 ($250,000 – $201,050) will be taxed at 24%.

Assessing Your Current and Future Tax Rates

How much room do you have left in the bracket that you think you’re going to be in for a long-term basis? Let’s say you’re in a 12% bracket right now and am not really doing any planning. Well, if you have Required Minimum Distributions that kick in in a few years and tax rates go up in 2026 if parts of the Tax Cuts and Jobs Act sunset as scheduled,2 you could move up into the new 25% or 28% bracket. The tax rates for 2026 would be 10%, 15%, 25%, 28%, 33%, 35%, and 39.6% (the same pre-TCJA tax rates from 2017).

FIGURE 2 – 2017 Tax Brackets – Bankrate/IRS3

“That wouldn’t be efficient use of your tax brackets. You would probably need to go up into that 24% bracket, especially if it’s going to be the 28% bracket. That’s where a lot of your strategies, such as Roth conversions, to bounce that up. Obviously, there are a lot of other factors that can come into play, but that’s the general concept.” – Marty James, CPA, PFS

We’re going to discuss Roth conversions more in a bit, as they’re critical to consider when it comes to tax planning tips. With bracket management, the goal is to accelerate through the tax brackets smoothly over time. We want a straight line across the board through retirement rather than having peaks and valleys. That’s where we’re going to see the efficiencies through the tax planning.

Understanding the Impact of Long-Term Tax Savings

Sometimes it’s easy for Corey and Marty to illustrate the long-term tax savings for people. And sometimes it isn’t. Take the example that Marty just gave. It’s fairly easy for Marty and Corey to explain why someone should take money out at a 12% rate today if it’s going to be taxed at 25% or 28% in a few years.

The difficult part for Corey and Marty to communicate to people is getting them to understand the performance of the accounts and measuring the cost opportunity of having to give up tax dollars today.

“That’s a trade-off because those dollars aren’t growing now in the future. There are a lot of elements involved. How long will you live? Will both spouses live for a long duration of time? What is the performance of the accounts? Have you properly allocated the accounts with proper investments based on where they’re located?” – Corey Hulstein, CPA

Make sure you’re asking yourself those questions that Corey just posed. They need to be considered as we review these tax planning tips. Seeing the impact of long-term tax savings can be difficult if you’re not working with a CPA and CFP® Professional together. Tax planning tips and opportunities can easily be missed when the client, CPA, and CFP® Professional aren’t all on the same page.

Avoiding the 3.8% ACA Surtax

Let’s go back to the example of a married couple having $250,000 in Modified Adjusted Gross Income. Once you and your partner eclipse that $250,000 threshold, a 3.8% Affordable Care Act surtax on investment earnings kicks in. Marty and Corey try to be cognizant of that when they’re doing tax bracket management so that 3.8% surtax doesn’t catch people off guard.

Understanding IRMAA

Another factor they want you to be aware of is the Medicare Income-Related Monthly Adjustment Amount (IRMAA). You’ll get charged more for Medicare premiums as your income increases. The tricky component of IRMAA, though, is that there’s a two-year lookback regarding the IRMAA income limits. Corey refers to IRMAA as a shadow tax.

“You don’t see it for two years and don’t really feel it. Then, suddenly, you get a bill in the mail and for the next 12 months, your Medicare premiums are substantially more than they were in the prior year.” – Corey Hulstein, CPA

IRMAA is also a cliff system. You need to be extremely careful because if you go $1 over the income threshold, it can cost up to $2,000 to $3,000, depending on if you’re single, married, or what tier you’re bumping into. That’s expensive tax. And don’t forget that the tax is multiplied by two for married couples.

So, let’s say that a couple decides to buy a new car and uses money out of an IRA to purchase it. They need to understand that doing so could bump them up to the next IRMAA income level and potentially cause more of their Social Security to become taxable. People really need to look at where they’re pulling their money from. You may want to take more one year from one type of an account and less another year.

Spending from a Roth IRA

We can’t talk about creating a distribution strategy (and tax planning tips) without discussing Roth IRAs. If you have most of your retirement savings in a traditional 401(k) or IRAs, it’s critical to understand that the money in those accounts are tax-deferred. That means you won’t be taxed on it until you take it out of the account.

It might sound great to not pay tax until you absolutely need to, but keep in mind what we’ve shared about tax rates potentially going up after 2025. Hence why Marty referenced Roth conversions—converting funds from a traditional IRA to a Roth IRA—as a tax planning tip.

While you’re required to pay tax on the conversion, Roth IRA earnings grow tax-free as long as you’ve attained 59.5 and have had the money in the account for at least five years and the distributions are tax-free. However, it’s difficult for some people to adopt the mindset of spending from their Roth IRAs.

“Having that Roth IRA as you enter retirement can be a great bracket management tool. Roth IRAs can hide some of these shadow taxes or even lower that tax on Social Security.” – Dean Barber

Using the Roth IRA Legacy Planning and Bracket Management

From Marty and Corey’s perspective, the main reason they see people not wanting to spend from Roth IRAs is because they want to use it as a legacy planning tool. And don’t get us wrong. The Roth IRA can be a very powerful way to build generational wealth. But it can be an effective bracket management tool for you as well.

“We’re just creating a tax-free pool of money that you can draw on whenever we need to so we don’t blow up your tax bracket in the future. When that vehicle it would show up, we can access that. Or even if we’ve got enough money in the Roth, we can access combination of Roth and pre-tax money. It’s a great tax vehicle to have.” – Marty James, CPA, PFS

Thinking of a Roth IRA as a Get-Out-of-Jail Free Card

Each account serves multiple purposes. We don’t have just one agenda for each one of these account types. For example, Corey considers one of the purposes of Roth IRAs to function as a get-out-of-jail free card.

“When something in life happens and the cost of that is going to be significant through taxation, that’s a perfect time to utilize it. If we can move that money over to a Roth at a cheaper rate than what we have today, that’s a win. We don’t want to do that all the time, but it is great when we’re in a bind.” – Corey Hulstein, CPA

Other Ways to Get Money into the Roth

There are a few ways to get money into a Roth IRA. You can make a contribution to a Roth IRA if your income limits aren’t too high. When you put money into a Roth 401(k), there’s now the potential for the company match to go into the Roth portion of the 401(k). And then there are Roth conversions.

Some people elect to do Roth conversions during the last few years of their career while others prefer to do them in retirement. It depends on your unique situation on which method could make more sense, if Roth conversions make sense for you at all.

“That goes back to the financial plan as you’re looking at what your retirement cash flow is going to look like. We want to have a good idea of what that taxable income is going to be because that’s what we’re measuring against.” – Marty James, CPA, PFS

In-Plan Roth Conversions

Marty also joined Dean and Bud Kasper, CFP®, AIF® on America’s Wealth Management Show to discuss in-plan Roth conversions. An in-plan Roth conversion gives you the opportunity to convert pre-tax assets to Roth assets within your 401(k) plan to build a bigger tax-free nest egg. The decision to contribute directly to a Roth 401(k) or do an in-plan Roth conversion usually depends on the flexibility you have on your current asset location.

“If you need to create more flexibility with the plan, that’s a great time to start paring back some of those pretax contributions to maximize conversions today. Getting more money over to the Roth or even to a non-qualified account is a great example as well.” – Corey Hulstein, CPA

An Example of an In-Plan Roth Conversion

Let’s say that you’re in your mid-50s and planning to retire in your mid-60s and it’s clear that you’re on track to have enough saved for retirement. In this example, you’re maxing out your plan at $24,000 a year. However, your company is only matching up to the first $12,000. That second $12,000 might be going into the Roth portion of the 401(k), but that’s only $12,000 a year getting into the 401(k).

Instead of doing that, how much Roth could you convert in plan for that same $12,000 cost to get much more in that Roth 401(k)? Maybe you can get $50,000, $60,000 into the Roth in a given year by doing an in-plan Roth conversion. Instead of putting money into the plan, you’re just going to pay a tax.

“That strategy can work because you’re just magnifying the amount of money going into that Roth. You need to remember the tax in there is really just a loan from the government. They’re going to want their money back with earnings.” – Marty James, CPA, PFS

You need to take both strategies and see which one gives you the highest probability of success. This is why it’s important to have that CFP® Professional do the planning work up front so that CPAs can come in from a tax perspective and help clients make the best decisions for their specific situations.

Utilizing ACA Tax Credits

Let’s move on to another tax planning tip that involves ACA tax credits. You might remember that we mentioned planning around the ACA surtax earlier as a tax planning tip. Well, if you’re retiring before becoming eligible Medicare (before 65), there’s another tax planning tip involving the ACA system and Roth conversions that we want you to be aware of.

If you plan to access the ACA system for health care, doing a larger Roth conversion before you retire could be an effective tax planning strategy. You can access that money to keep your income lower and get the premium tax credits.

Trust Planning

Let’s move on to some tax planning tips involving trust planning, specifically charitable remainder trusts and charitable lead trusts.

Charitable Remainder Trusts

A charitable remainder trust might be appropriate for someone who wants to give a large sum of money today but also might still want to access some of those funds. With charitable remainder trusts, you put money into the trust today and get a present value deduction based on when the charity is going to receive the money. If the charity doesn’t receive it for 10 years, that’s going to look a lot different than if it doesn’t receive the money for 20 years.

“That’s because that’s going to minimize that present value calculation. It also allows you to take some income stream off those invested assets that you donated up to the point of completion of that trust.” – Corey Hulstein, CPA

Charitable Lead Trusts

Then, there are charitable lead trusts. It’s designed to offer financial support to charity for a certain period and then the leftover assets will go toward your family (or other beneficiaries). The interest income comes back to you where you pay taxes on it, but you do generate income tax deduction up front.

If you’re very charitably inclined, you could consider utilizing a charitable remainder trust or charitable lead trust to potentially do a larger Roth conversion early in retirement. However, charitable lead trusts and charitable remainder trusts aren’t quite as appealing today due to the estate exemptions.

“Today, we’d potentially prefer a donor-advised fund, where your horizon is a little bit shorter than either one of these trusts. Qualified Charitable Distributions (QCDs) are going to be great options as well. Again, it’s going to depend on the situation.” – Corey Hulstein, CPA

Other Unique Tax Planning Tips

Let’s begin wrapping up this discussion on tax planning tips by sharing some tax planning tips for people that have something that they’re wanting to sell. That could be a business, property, farmland, etc. If that sounds like it could pertain to you, IRS Section 453 on deferred installment sales is something they might want to consider.4

Let’s say that you have some farmland that you want to sell. One choice is cash and then paying taxes on the entire capital gain all at once in one year. The other option is acting as the bank and holding the paper for the person buying it. They would pay you every year until that contract is ballooned or done depending on how amortization works on it.

Understanding Principal and Interest

A component of each one of the payments you receive will be principal on that note and part of it will be interest. Let’s say that out of that principal that 60% of it is capital gains and 40% of it is your basis. You would be stretching your taxes out over a longer period, which can help in certain situations with the net investment income tax.5

“There are a lot of reasons to do it. And the risk is that you’re the bank, so you need to go through the same procedures that any bank would do if you’re going to do that.” – Marty James, CPA, PFS

There are two components of each payment you receive. If you have a five-year note and get $100,000 a year on that note, there is a portion of that $100,000 that is interest. That interest component is always ordinary income. The other portion goes to that gross profit percentage and that is going to be capital gain income.

“It’s smoothing your tax brackets out over a duration of time rather than absorbing a 20% capital gain plus net investment income tax. There might be an avenue that we can get this money out at 15% and potentially no net investment income tax.” – Corey Hulstein, CPA

Tax-Efficient Investing

Our final tax planning tips are going to focus on tax-efficient investing. We already discussed the Roth, as tax-free is the most tax efficient as you can get. But we also want to discuss municipal bonds and tax-efficient equity investing via direct indexing.

Opportunities in Municipal Bonds

Let’s start with municipal bonds. It’s the first time in about 20 years that Dean has been this excited about the investment opportunities within municipal bonds.

“Until two years ago, it was hard to for justify some of the municipal bond interest rates because we were getting 0% on everything else. But with where interest rates are now, you can get a good deal tax-free.” – Marty James, CPA, PFS

In addition to that, if interest rates do fall and we enter a recession, Marty says those bonds will likely appreciate. That presents the opportunity to have capital gains on your bonds.

What Is Direct Indexing?

One of the most inefficient ways in a taxable account to invest in equities is in equity mutual funds and equity ETFs. But with direct indexing, the wrapper gets taken off the mutual fund or ETF and allows the investor to establish their own cost basis in each individual share. That’s much more tax efficient.

“It’s a little bit of a hybrid of an ETF and a mutual fund in the sense that it can be actively managed. But you’re not fighting the capital gain distributions from a mutual fund, so you’re moving in and out of positions continuously. You’re harvesting losses and getting back into a similar position that has the same upside growth potential.” – Corey Hulstein, CPA

You’re generating these short-term losses today to offset any gains that you want to take out in the future. As Corey mentioned, it’s an actively-managed strategy that’s accelerating some losses—not at your detriment—to create tax efficiencies.

A Direct Indexing Example from 2023

If you tuned into Dean’s Monthly Economic Updates throughout 2023, you’ll probably remember that he talked a lot about the Magnificent Seven. Microsoft, Apple, Nvidia, Amazon, Tesla, Meta, and Google were the seven companies really driving the growth in the S&P 500.

That meant there were 493 companies that weren’t really doing that much for you. You could have accelerated some of the deductions at that time while keeping that upward growth potential going by investing in similar companies.

Do You Have Any Questions About These Tax Planning Tips

Corey and Marty covered quite a bit of ground with the tax planning tips that they reviewed. Some of the tax planning tips could create significant tax savings for you; some of them not so much. And some of the tax planning tips could even lead to unintended consequences and not make sense for you at all.

That’s why we can’t stress enough how critical it is to work with a CFP® Professional who helps you build an individualized financial plan that has been reviewed by a CPA for tax planning opportunities. If you have questions about the tax planning tips that Marty and Corey reviewed and are wondering if they could work well for you, start a conversation with our team below.

We’re excited to learn more about your unique situation to see which of these tax planning tips can make a difference for you as you’re planning to get to and through retirement.

Resources Mentioned in This Article

Past Guided Retirement Show Episodes

- Components of a Complete Financial Plan with Logan DeGraeve, CFP®, AIF®

- The CFP® Professional and CPA Relationship with Logan DeGraeve, CFP®, AIF® and Corey Hulstein, CPA

- Tax Planning During Tax Preparation Season with Corey Hulstein, CPA

- Strategic Investing Through Retirement with Stephen Tuckwood, CFA

- Retiring Single with $1.5 Million Saved: How Much Can You Spend with Will Doty, CFP®, AIF®

- Revisiting Roth vs. Traditional with Bud Kasper, CFP®, AIF® and Corey Hulstein, CPA

- Family Financial Planning with Matt Kasper, CFP®, AIF®

- Understanding the SECURE Act 2.0 with Ed Slott, CPA

- Affordable Care Act Subsidies – How to Qualify for Them with Marty James, CPA, PFS

- Understanding Donor-Advised Funds and Charitable Giving with Christopher Rigsby, CAP®

- Strategic Investing Through Retirement with Stephen Tuckwood, CFA

Other Articles and Videos

- How Do I Pay Less Taxes?

- What Is Tax Planning?

- 2024 Tax Brackets: IRS Makes Inflation Adjustments

- Understanding Retirement Asset Allocation

- RMD Strategies for Before and After Retirement

- What If We Go Back to Old Tax Rates?

- Tax Rates Sunset in 2026 and Why That Matters

- Roth Conversions Before and After Retirement

- 5 Reasons Not to Convert to a Roth IRA

- Longevity Risk in Retirement and How to Plan for It

- Couples Retirement Planning: What You Need to Know

- DIY Retirement Planning: What Can Be Overlooked?

- How Does a Roth IRA Grow?

- How Do Capital Gains Taxes Work?

- Taxes on Retirement Income

- How to Spend When You First Retire

- 5 Long-Term Strategies for a Better Retirement

- Converting to a Roth IRA: What Are the Pros and Cons?

- Roth Conversion Rules

- How to Build Generational Wealth

- 2024 401(k) and IRA Contribution Limits

- The Roth IRA Five-Year Rule

- Retirement Cash Flow: What You Need to Know

- Retiring Before 65: What You Need to Consider

- 4 Ways Retirees Can Give Back

- Estate Tax: How Will My Assets Be Taxed When I Die?

- What Is a QCD? Qualified Charitable Distribution

- Have I Saved Enough to Retire?

- What Is a Monte Carlo Simulation?

- Examining Municipal Bonds in 2024

- Active vs. Passive Management

- 5 Tax Planning Examples

- Magnificent Seven Stocks Continue to Drive the Market

- What Is Driving the Stock Market?

Other Sources

[1] https://taxfoundation.org/data/all/federal/2024-tax-brackets/

[2] https://taxfoundation.org/blog/tcja-expiring-means-for-you/

[3] https://www.bankrate.com/taxes/2017-tax-brackets/

[4] https://www.irs.gov/pub/irs-wd/201616004.pdf

[5] https://www.irs.gov/newsroom/questions-and-answers-on-the-net-investment-income-tax

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.