Retiring During a Recession

Key Points – Retiring During a Recession

- Stress Testing Your Financial Plan to Receive Some Clarity During Uncertain Times

- Determining Your Plan’s Probability of Success

- Creating a Plan for a Sample Couple to Show Financial Planning Techniques to Keep in Mind When Retiring During a Recession

- Maximizing Social Security, Tax Reduction Strategies, Fighting Inflation, and So Much More

- 13 Minutes to Read | 28 Minutes to Watch

The Uncertainty of 2022 Continues

Uncertainty has been the theme of 2022. We’ve experienced some jaw-dropping market volatility and inflation, and after back-to-back quarters of negative GDP growth, we’re technically in a recession. All this uncertainty has only enhanced our firm’s commitment to help people continuing living their one best financial life. In this Modern Wealth Management Educational Series event, Drew Jones joins Dean Barber to discuss what it’s like to retire during a recession.

Sign Up for the Modern Wealth Management Educational Series

Alleviating the Anxiety That Come Can with Retiring During a Recession

There are several financial experts who aren’t convinced that we’re in a recession despite the two consecutive quarters of GDP growth. Nevertheless, even the thought of retiring during a recession can create a lot of anxiety.

Before Dean and Drew dive deep into what retiring during a recession looks like, though, there’s something that they want you to want. When our CFP® professionals build someone’s financial plan, they use our industry-leading financial planning tool to stress test it for the possibility that they could retire during a recession.

“What our financial planning tool is doing from a very simple standpoint is running a thousand different simulations on your plan,” Drew said. “It’s saying that what if you have the worst-case scenario, best-case scenario, and everything in between.”

Defining Your Plan’s Probability of Success

From there, you’ll learn the probability that your plan will be successful. So, let’s say your plan has a 99% probability of success. That means you’re sacrificing someplace. You’re either saving more than you need to, not spending as much as you could, or taking on more risk than you need to. That 99th percentile is assuming that everything goes bad for a very long time, which is highly unlikely.

The Sample Plan

To help illustrate what it’s like to retire during a recession, Drew created a sample plan. That sample plan is for a 60-year-old wife and 63-year-old husband that want to retire in two to three years. With being just a few years out from retirement, most of the $1.2 million that they have in retirement savings is in their 401(k). They haven’t done many Roth conversions and have a goal of having $5,000 a month to spend in retirement. This scenario is common among the near-retirees when we first start working with them.

If you feel like you find yourself in a similar situation as this couple, we hope you find this sample plan helpful. What’s more is that we hope you discuss it with other people you know who could do be in a similar situation and people who are younger than you that can also learn from it.

“We want to start educating people in their 40s and 50s as to where they should be saving, using the Roth 401(k) and IRA, creating a decent amount in savings inside a taxable account and not just putting everything into a tax-deferred account,” Dean said. “You don’t want to put yourself into a corner once you get into retirement because it’s all going to be taxable.”

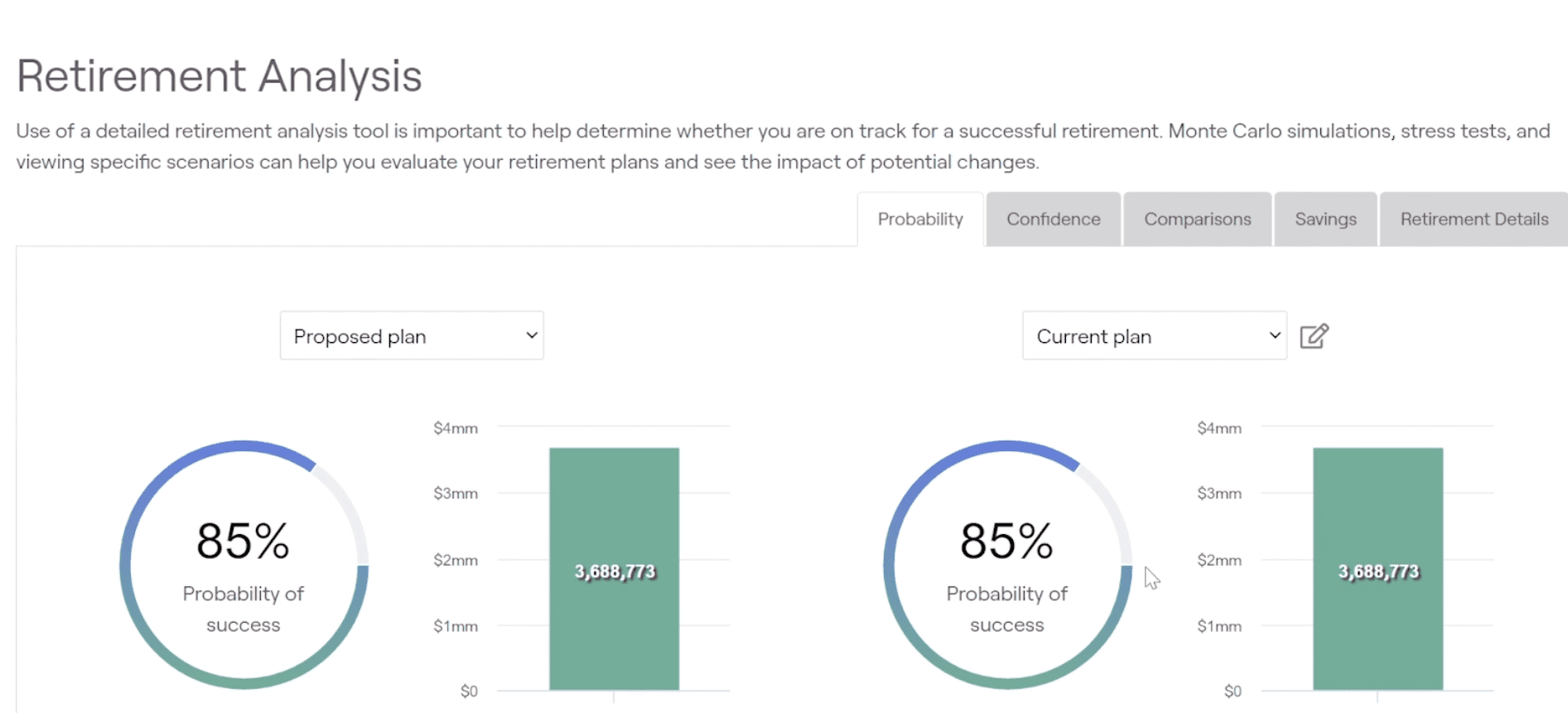

Assuming a 60/40 Initial Allocation for the Sample Plan

When Drew built this sample plan, he initially assumed a 60/40 allocation, meaning 60% equity and 40% fixed income. Let’s see what the probability of success would be for that allocation below in Figure 1.

FIGURE 1 – Probability of Success

As you can see, the sample plan with a 60/40 allocation would have an 85% probability of success. Ideally, we want to see it in the 75-90% range, so the 60/40 allocation for this sample plan falls in there. A probability of success anywhere in that zone means that you probably won’t have to cut spending or make any major life alterations.

“It’s basically saying that 85% of the time, this sample couple would be able to spend exactly how they wanted to spend and do all the things they wanted to do, and they wouldn’t have to alter spending,” Dean said. “But there’s a 15% that at some point, they may have to alter spending for a short time. There could be some trade-offs that they need to talk about.”

What’s Important to You?

Ideally, you won’t need to worry about making too many trade-offs, but that’s why we take you through a prioritization exercise in the early stages of building the plan in our Guided Retirement System. We want to know what’s most important to you and outline your wants, needs, and wishes in case trade-offs do need to be made.

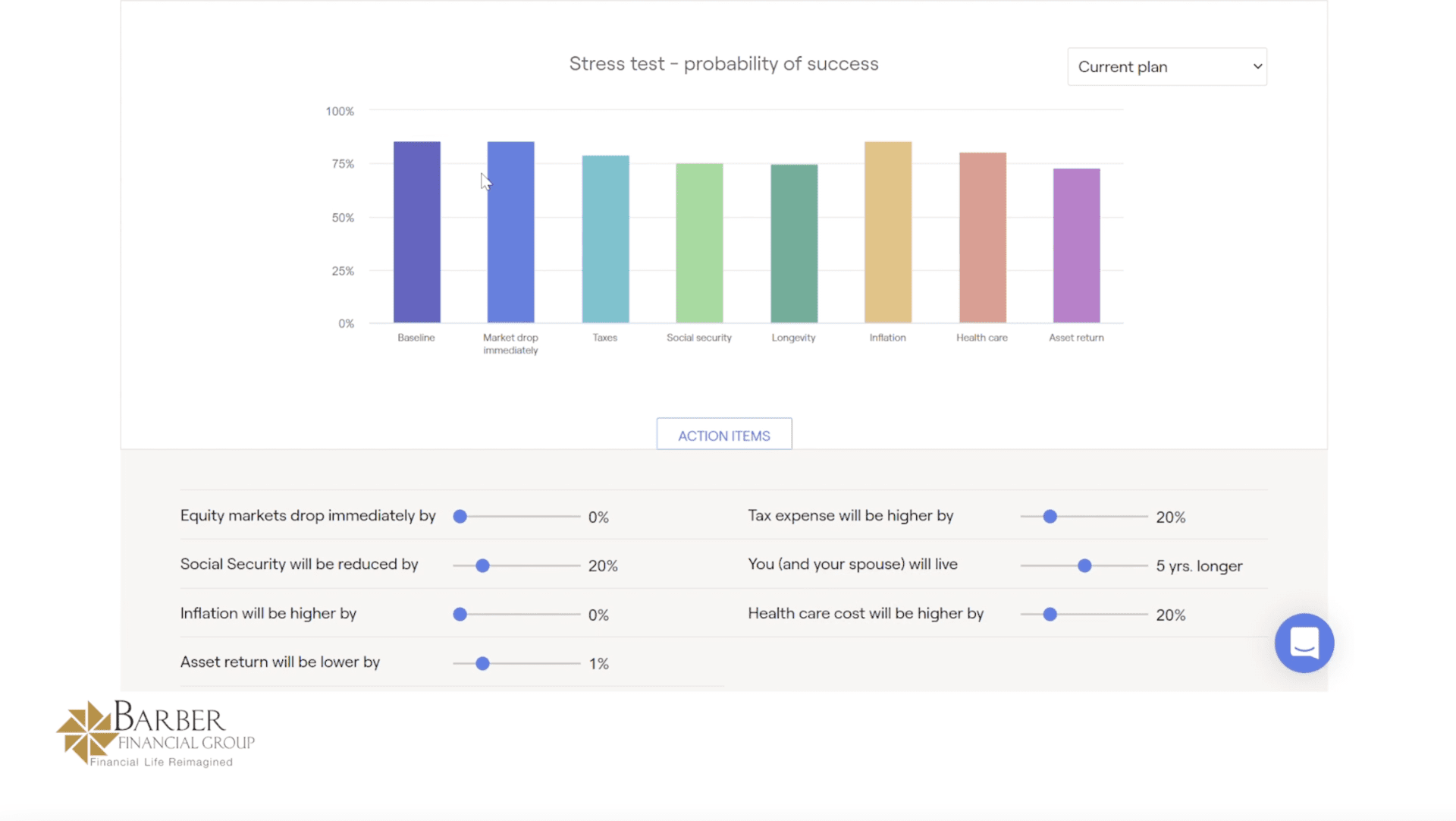

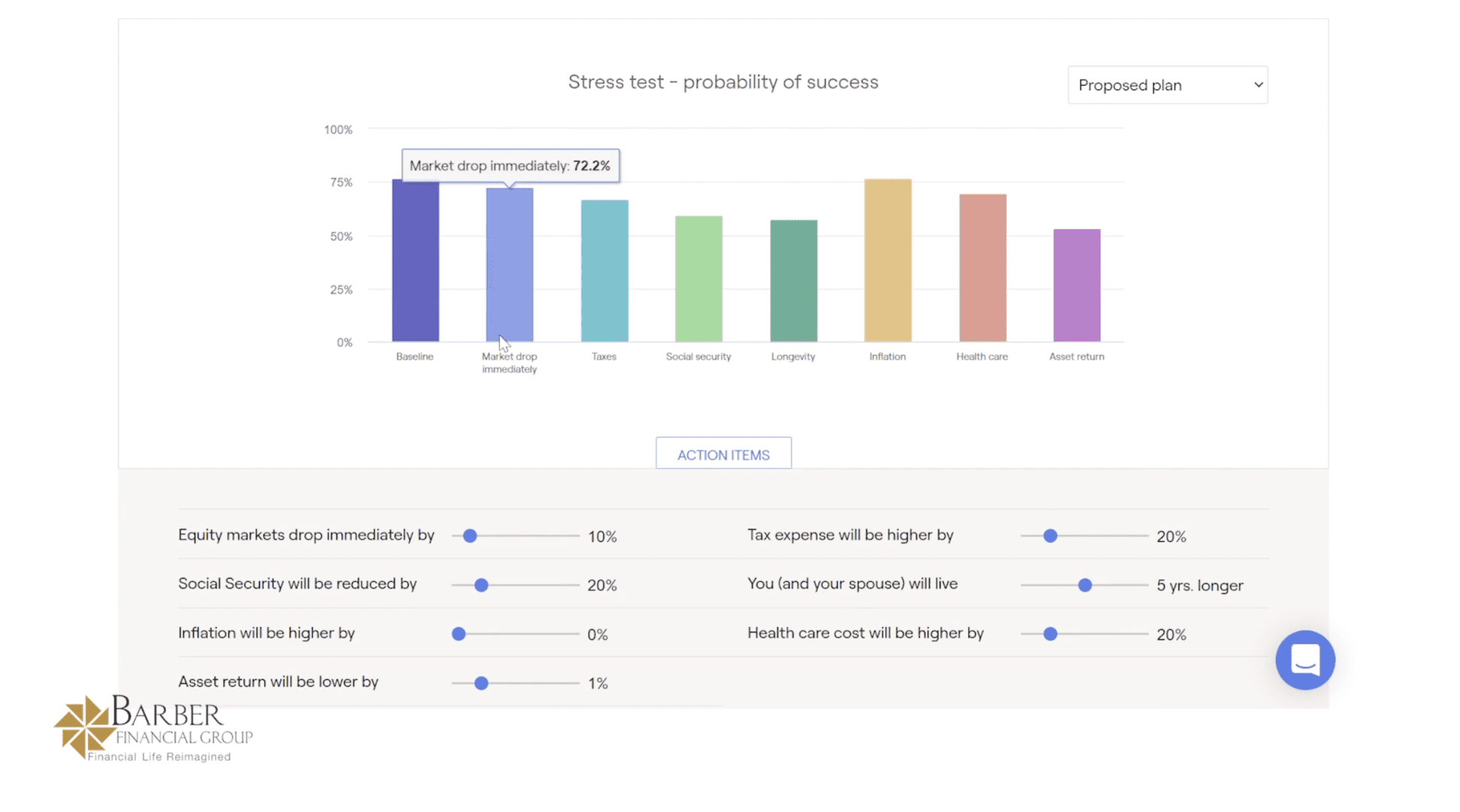

Stress Testing Your Plan

Still using the 60/40 allocation and knowing that it has an 85% probability of success, let’s stress test the plan to see what would happen if there was a bad market early in their retirement. After all, we’re trying to model what it’s like to retire during a recession. Below in Figure 2, you can see the variety of stress tests that we can run.

FIGURE 2 – Stress Testing

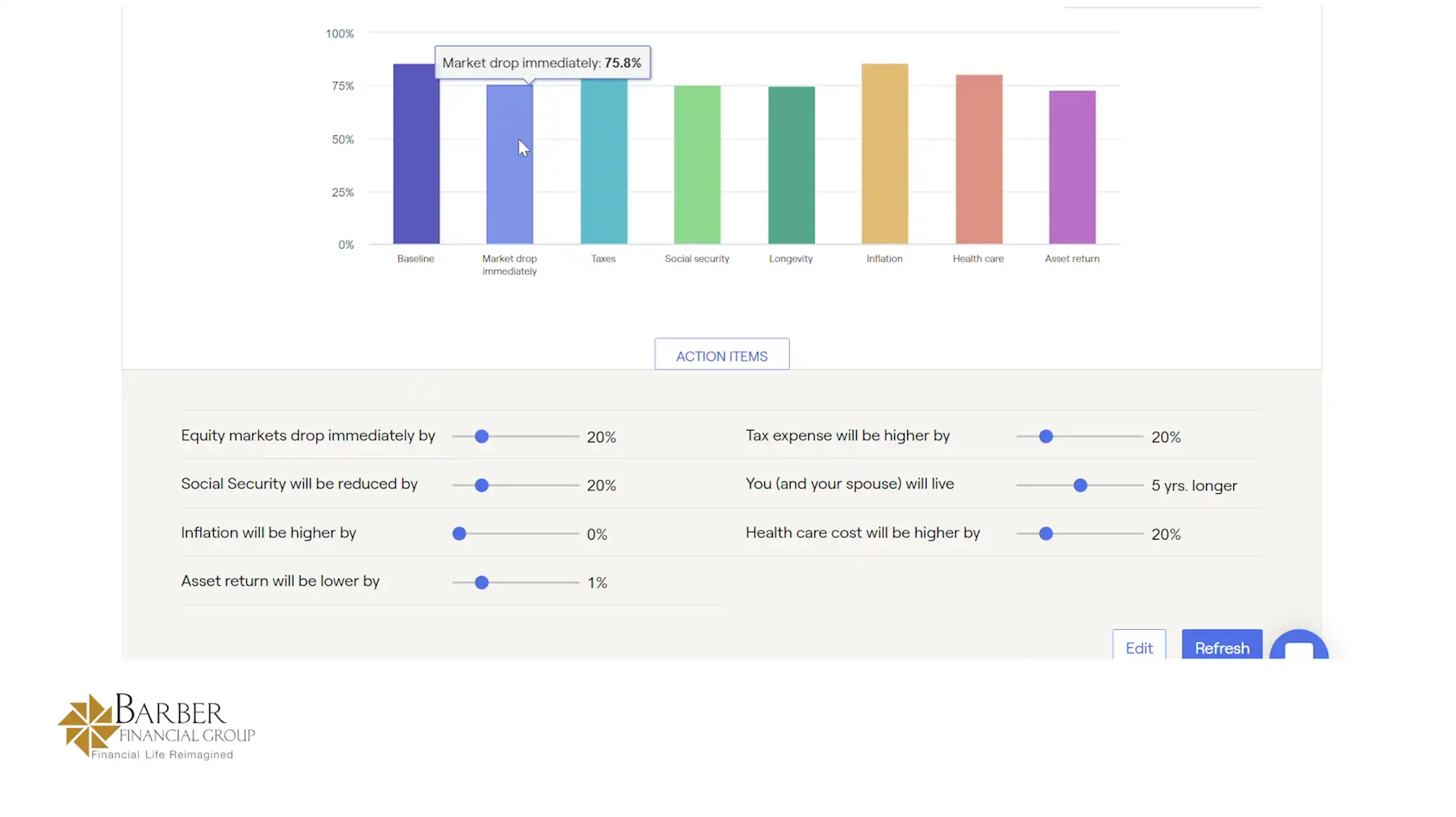

So, let’s say that we do see a market drop of 20% in your first year of retirement. Below in Figure 3, you can see that the probability of success would fall to 75.8%.

FIGURE 3 – 20% Market Drop

“It can make a big impact on somebody’s plan,” Drew said. “For the people who have recently retired or are approaching retirement, I think that’s some of the anxiety that they’re feeling. They know about the market drop, but maybe haven’t seen the numbers with how it directly impacts their plan.”

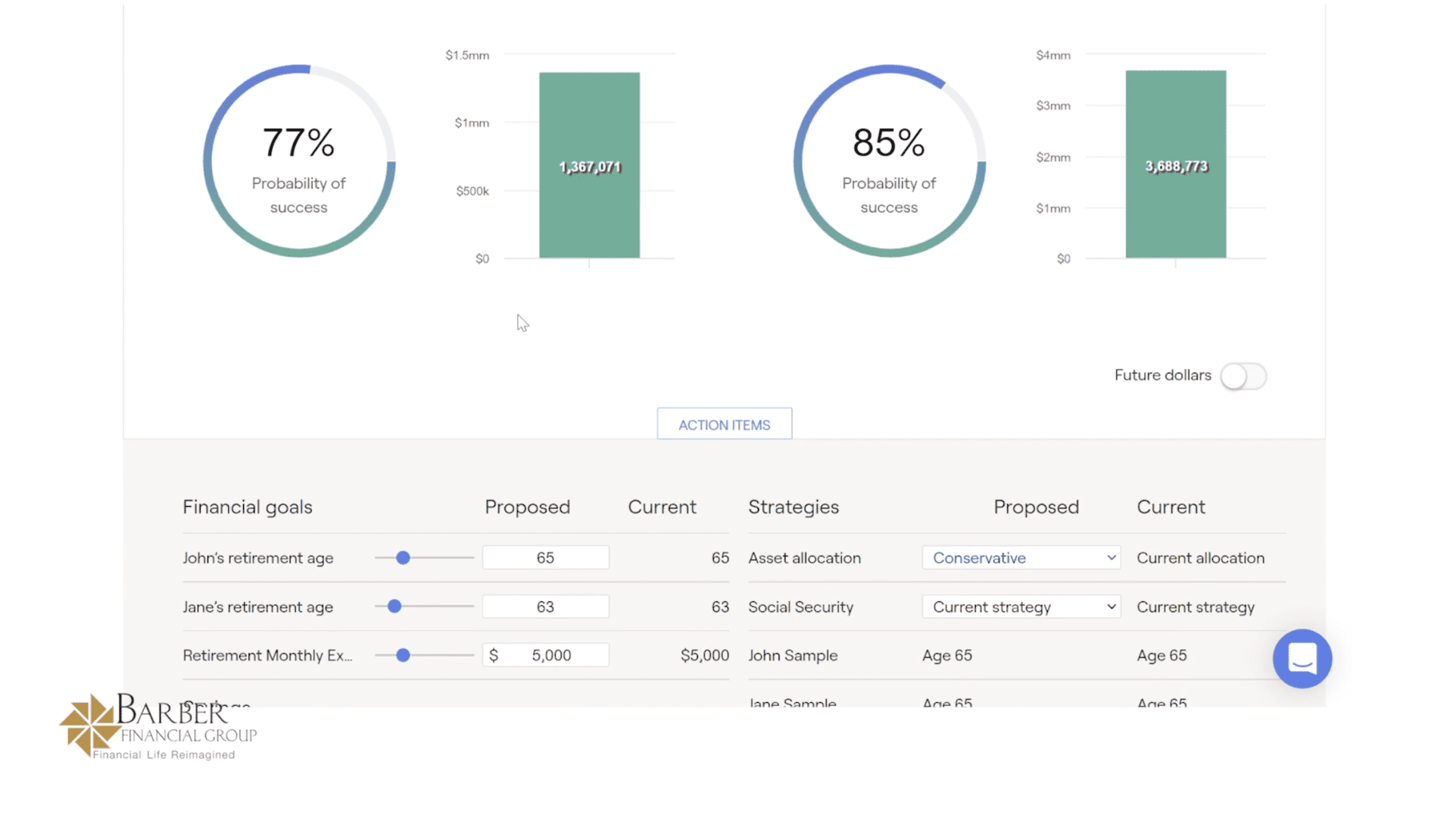

What We They Take a More Conservative Approach?

Now, let’s adjust the sample couple’s asset allocation so that it’s more conservative and see what that does to their probability of success. You can see below in Figure 4 that their probability of success still is only at 77%.

FIGURE 4 – Conservative Asset Allocation

The takeaway here is that a conservative approach isn’t always the answer. It is in that 75-90% range still, but it’s getting close to the point where some alterations or trade-offs might need to be made.

What If It’s Just a 10% Market Drop?

Now, let’s run that same stress test with a conservative allocation, but with a 10% drop in the market instead of 20%. The probability of success is even lower at 72.2%, as you can see below in Figure 5.

FIGURE 5 – 10% Market Drop

“This is where financial planning becomes dynamic. We know that a conservative portfolio can still get us by,” Dean said. “We may choose to use that more conservative portfolio for six to even 18 months until we get more certainty back. If we did that and limited the losses to 10% and then go back to that 60/40 portfolio, that’s going to beef up our probability of success and not let us leak down into the 70s. That’s why it’s critical to have multiple interactions with a CFP® Professional each year.”

The Clarity That Comes from a Financial Plan

With all the volatility we have experienced recently, Drew has been letting clients know that these uncertain times are the times that they benefit the most from having a financial plan.

“I don’t want to say that they take the plan for granted, but when times are good, you see the good times and the probability of success and are like, ‘OK. I get it and can do whatever I want,’” Drew said. “But it’s these times like we’re in right now with the possibility of retiring during a recession where the rubber meets the road in the plan and it tells you that you’re still OK or if you need to make some adjustments. Hopefully you can continue doing the things you want to do because you’re getting that temperature check from your plan.”

The idea here is that it’s OK to sometimes reduce the risk in your portfolio. But Drew is showing with this sample plan that if you permanently reduce the amount of risk, your probability of success takes a big hit because the fixed income part isn’t making a big enough return to support distributions.

Retiring During a Recession Requires More Than a Rate of Return

When it comes to retiring during a recession or market downturn, there’s more to consider than just asset allocation. Here are two specific things that Dean is keeping top of mind.

Optimizing Social Security

First, let’s look at Social Security claiming strategies. For this sample couple, they planned to start claiming Social Security at 65. Well, if we continue to see higher inflation, there are ways to lessen the impact of it that you’re feeling. Once of things is income, and the income for this couple is Social Security.

“So, that’s a conversation we can have,” Drew said. “Yes, that couple was thinking about turning Social Security on at 65, but to maximize Social Security for them, turning it on at 70 is in their best interest.”

Below in Figure 6, you can see the difference between them claiming at 65 and waiting until 70.

FIGURE 6 – Optimal Social Security Strategy

By waiting until 70 to claim Social Security, the sample couple would have $352,458 more as opposed to claiming at 65 if they had a life expectancy of 92. The break-even point would be in their early 80s.

Social Security Is Different for Everyone

However, Drew can’t just tell them to take Social Security at 70 because it’s not quite that simple. Drew needs to know their other sources of income, their health situation, their family’s health history—just to name a few main factors. Of course, the big unknown is when they will pass away.

It’s a big if to assume both spouses in the sample couple will live until 92. But even if they both don’t live quite to 92, they’re going to receive a lot more in Social Security by claiming at 70 instead of 65. That’s significant income they can use or that they can leave behind to their family.

“When we look at Social Security claiming strategies, it’s never the same for two couples,” Dean said. “Maybe for another couple, one spouse will claim at 62 and the other will claim at 66. We run all those different scenarios with our financial planning tool to see all the iterations.”

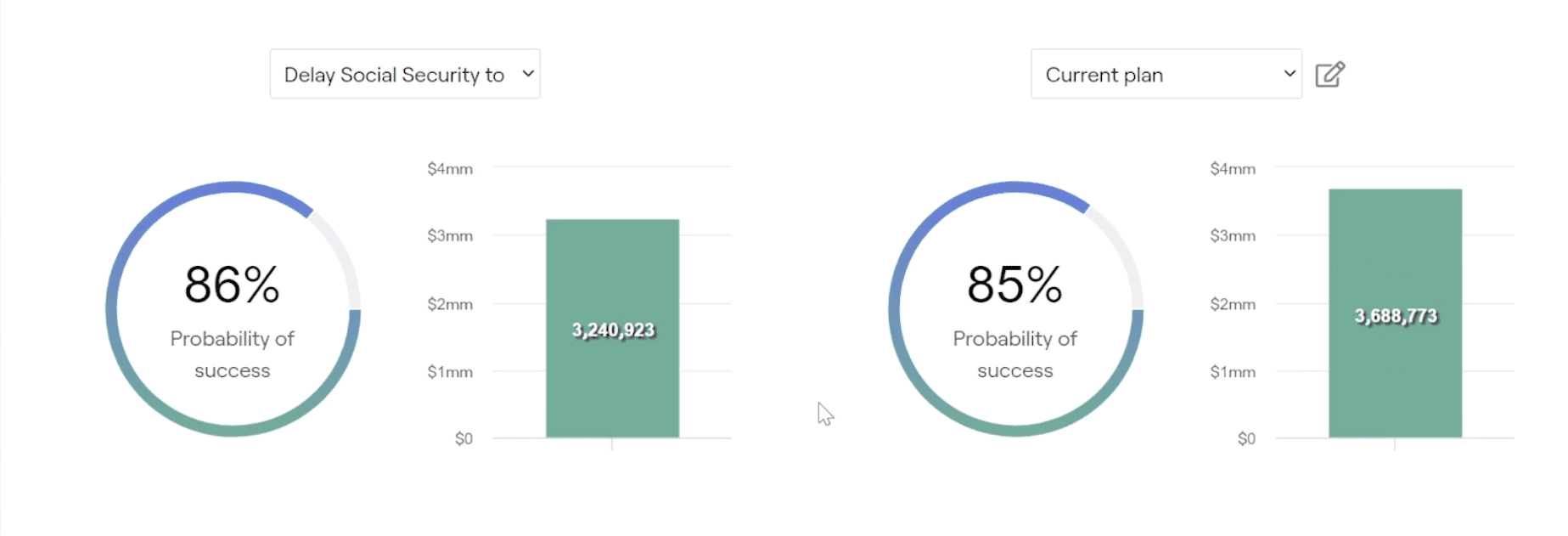

Going Back to Probability of Success

Before we move on to tax reduction strategies, let’s circle back to what the probability of success would look like for that sample couple by delaying Social Security until 70. Figure 7, below, shows that they would have an 86% probability of success, so still slightly higher than that original 85% probability of success.

FIGURE 7 – Delaying Social Security

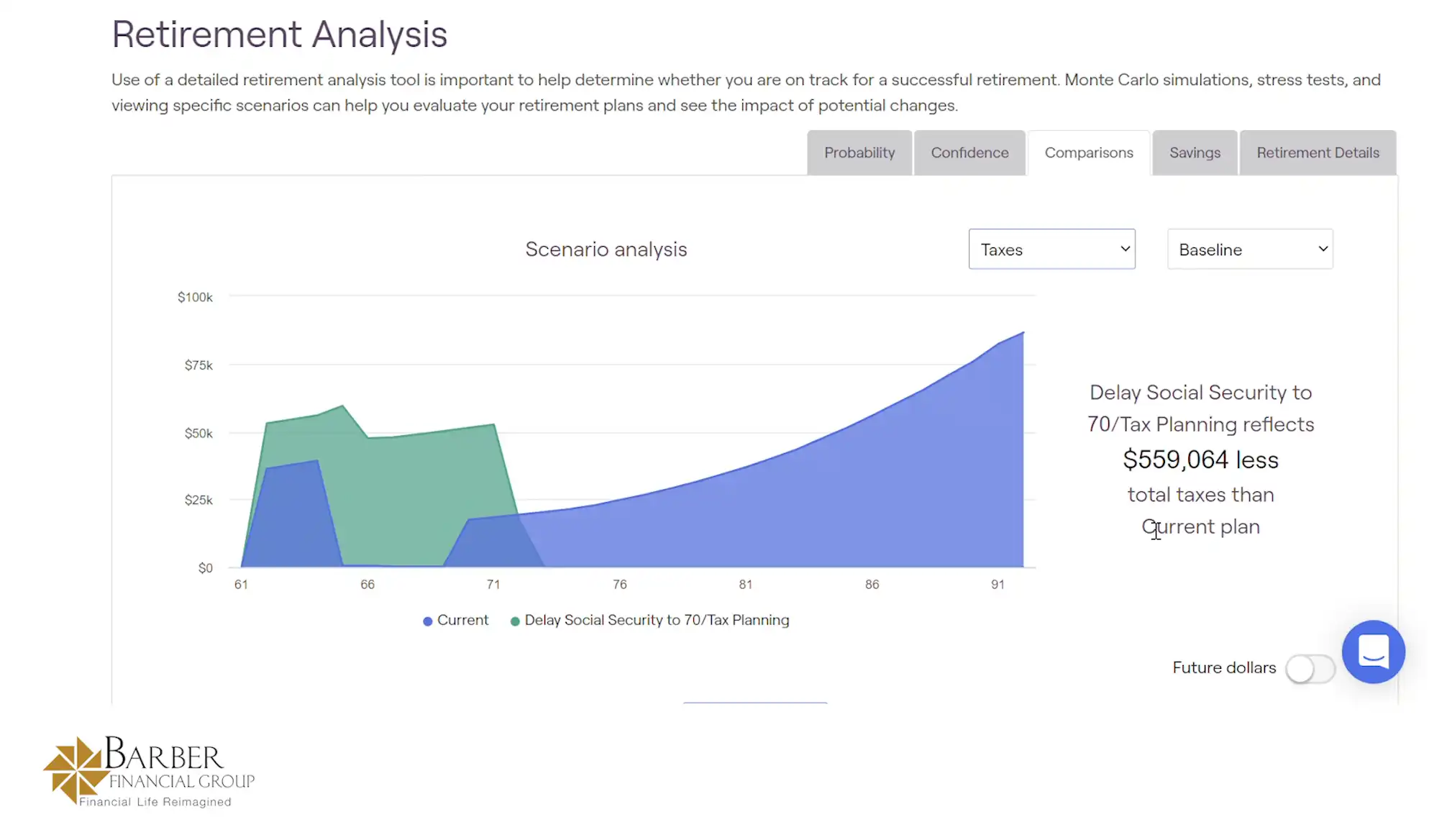

On to Tax Reduction Strategies

As a reminder, this sample couple’s income in retirement is coming from their 401(k)s and Social Security. But they don’t have pensions, farmland, rental income, etc. That brings us to the question, what tax planning strategies can this sample couple utilize? Would Roth conversions work well for them? Drew says that Roth conversions are certainly an option for them. Let’s examine why that is and look at the overall scope of tax planning on their plan.

In this scenario, we’re talking about delaying Social Security until they’re 70 and proactive tax planning. We’re overlaying two different strategies. As you can see below in Figure 8, the shade of green is the period where the tax planning strategies take place.

FIGURE 8 – Tax Planning

In this case, the sample couple is paying more taxes in the early years before a significant drop-off before they turn 71.

“We know that the current tax law sunsets in 2026. Our financial planning tool knows that and that we’re in lower tax brackets until then,” Drew said. “So, let’s take advantage of it. If they do live to 92, they’ll have nearly $560,000 in less taxes paid by doing proactive tax planning over their lifetime.”

Taxes Are Part of Your Plan Whether You Like It or Not

That’s where a lot of people can get confused when it comes to tax planning. They focus on paying as little tax as possible in one year rather than over their lifetime.

“Until people come to grips that if you live in the United States and make money or have money, taxes are going to be a fact of your life. The example we’re showing here is a lifetime tax bill, assuming that the couple lives until 92,” Dean said. “It’s showing that they’re going to pay $560,000 less in taxes in their lifetime. And they have an increase in Social Security over more than $350,000. That’s $900,000-plus of less money paid in taxes and more income in Social Security. It’s almost an additional $1 million for this couple in additional spending or to leave to the next generation.”

That’s why the probability of success keeps ticking up because the financial planning tool knows that the couple has that additional income over their lifetime due to when they claimed Social Security and proactive tax planning.

Don’t Forget About Inflation

While tax planning and how you claim Social Security are no doubt key components of a comprehensive financial plan, it’s also no secret that there’s been something else that’s been even more on people’s minds so far in 2022. Let’s address inflation’s impact on retiring during a recession.

Drew is assuming a 3.97% inflation rate for the sample couple’s plan. What that’s doing is looking at the last 40 years of inflation. So, think about inflation back in the late 1970s and early 1980s where it was significantly higher. But we’ve also had years since then where there was hardly any inflation. When you look back over the last 40 years, the average inflation rate is 3.97%.

If you look over the past 20 years, though, a 3.97% inflation rate would be a conservative approach since inflation had been much lower than until the past 18 months. Inflation is yet another factor we stress test for to show people what their probability of success could look like with different inflation rates. Let’s look below at Figure 9 to see what the probability of success would be for the sample couple if we used a 5% inflation rate instead of roughly 4%.

FIGURE 9 – 5% Inflation

Their probability of success would slip just out of that 75-90% probability of success comfort zone to 74.1%.

“If we did average 5%, it doesn’t mean that these people are going to go broke,” Dean said. “It just means that they may have to adjust their spending in the future.”

Now, let’s look at Figure 10 below to see what the sample couple’s plan would look like with 6% inflation.

FIGURE 10 – 6% Inflation

Inflation Can Make You Live Like You’re Broke

Their probability of success drops all the way to 59.9%, so that’s getting to be a bit uncomfortable. However, it’s important to remember that would be assuming that we would have 6% inflation every year. The likelihood of that happening throughout your retirement isn’t very good. The same can be said for having 2% inflation throughout your retirement.

“I think another key point about inflation is that it’s not something that will cause someone to go broke,” Dean said. “Inflation will just cause someone to live like they’re broke because they start cutting down on the discretionary things. The daily things that we do have become so much more expensive that they forgo other things.”

Make a Plan for When You’re Going to Spend the Most in Retirement

While Drew and Dean are just going over a sample couple’s plan for retiring during a recession here, sitting down with a CFP® Professional to see what your cash flow looks like with the different inflation rates factored in can really hit home. The CFP® Professional can also help you understand which stage in life that you’re going to spend the most money.

“For your retirement years, that’s typically going to be the first 10 to 15 years. When you get into your late 70s/early 80s, you’re not spending like you were in your 60s,” Dean said. “Most people don’t have the energy or desire to continue doing the things that they were doing. The spending for couples in retirement will usually be higher in the first few years, then level off, and then sometimes even start to drop off.”

While retirement spending may start to drop off briefly after leveling off, it will likely go back up eventually due to healthcare expenses as you get older. That can also be simulated with our financial planning tool.

Asset Allocation Is Just One Piece of the Puzzle

One of the most difficult things to do in life—and especially financial planning—is to be patient. If your portfolio is up, you feel good. But if it’s down, you feel bad and the uncertainty and fear can lead to make emotional financial decisions. That’s not an ideal situation.

With the market being down right now, being patient is pivotal. We hope that this webinar has also shown that financial planning techniques can be applied to your plan to help you through difficult market conditions and that asset allocation is just one piece of the puzzle.

“Drew has illustrated the fact that financial planning techniques that you can apply are more valuable than just looking at asset allocation. The asset allocation adjustments were very minimal with how they impacted the sample couple’s plan,” Dean said. “It’s the financial planning techniques that our CFP® Professionals and CPAs use that can make a big difference. That’s especially the case when people are retiring during a recession or other uncertain times.”

Looking Back at 2021

Although retiring during a recession can be an unsettling feeling, it’s still important to remember that we just had a great year in the stock market in 2021. If someone started 2021 with a 60/40 portfolio, they likely ended the year closer to 70/30. It was at that time, though, where our financial planners realized that it could help people to take some of their winnings from 2021 and set them aside for future needs.

“Whenever you’re building the plan, part of doing it is to build a risk profile. People can get greedy when markets are up like they were in 2021,” Drew said. “And if they’re not doing reallocations in their 401(k)s and other accounts and making rebalances, they can get overweighted in equities. Sometimes during this risk profile, we can see how much risk their 401(k) or outside accounts are taking. But when we run them through the risk profile, it’s coming in at a significantly lower number and saying that they’re not as aggressive as their 401(k) is doing right now.”

Looking at the Rest of 2022 and Beyond

Dean and Drew could spend hours discussing the many financial planning techniques. Their goal by reviewing the sample couple’s plan, though, was to highlight that some of the things that have the biggest impacts of financial planning are outside of the stock market. The financial planning techniques that Drew and Dean discussed are also in your control.

“It’s putting all the puzzle pieces together,” Drew said. “Because how on earth would you know the impacts of making these other decisions and the impact on your plan and probability of success without having a financial plan?”

Do You Have Questions About Retiring During a Recession?

There are even more details about these financial planning techniques that Dean, Drew, and the rest of our team are focusing on behind the scenes. It’s important to us to provide people clarity and confidence with these financial planning techniques, especially when they’re faced with retiring during a recession.

If you want to see how these financial planning techniques that Dean and Drew reviewed can apply to you, we encourage you to try our financial planning tool out for yourself. It’s the same financial planning tool that our CERTIFIED FINANCIAL PLANNER™ Professionals use, and you can use it from the comfort of your own home by clicking the “Start Planning” button below.

That being said, it’s important to know that the financial planning tool was created to be used by financial professionals. So, if you’re hitting a few road blocks or have questions as you’re using the tool, that’s OK! By scheduling a 20-minute “ask anything” session or a complimentary consultation, one of our CERTIFIED FINANCIAL PLANNER™ Professionals can answer your questions and screen share with you as you’re building your plan with our financial planning tool.

We hope Dean and Drew’s discussion brought to light a few things that can help you live your one best financial life. Remember, there is still light at the end of the tunnel even when retiring during a recession. A financial plan can help lead you through that tunnel.

Schedule Complimentary Consultation

Click below to get started. We can meet in-person, by virtual meeting, or by phone. Then it’s just two simple steps to schedule a time for your Complimentary Consultation.

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.