Social Security Benefits for a Surviving Spouse

Key Points – Social Security Benefits for a Surviving Spouse

- How Do Social Security Benefits Work for a Surviving Spouse?

- Social Security for a Surviving Spouse Oftentimes Isn’t Considered Until One Spouse Passes Away

- Claiming Your Social Security Isn’t Just About You

- Maximizing Social Security Benefits

- Understanding the Relationship Between Pensions and Social Security

- 5 Minutes to Read

Planning for the Unexpected

One of the main reasons why our CFP® Professionals like to start working with people at least five to 10 years before retirement is so they can plan for the unexpected. Unfortunately, our CFP® Professionals have seen several instances where a couple is about to start enjoying retirement when something unexpected intervenes. The unexpected at its worst can be a severe illness or death of a spouse. So today, we’re going to talk about planning for the unexpected in terms of Social Security benefits for a surviving spouse.

When our CFP® Professionals build a comprehensive financial plan, they make sure that you and your spouse are incorporating your needs, wants, and wishes. But on the flip side, they need to make sure you and your spouse will be OK in retirement if there’s a major market downturn, a need for an unexpected purchase, a sudden health issue, death of your spouse, etc. When it comes to the death of the spouse, the impact on the surviving spouse must be top of mind. There’s a lot to process with grief alone, so something such as Social Security benefits for a surviving spouse can easily be an afterthought. Let’s explain.

What to Know About Social Security Benefits for a Surviving Spouse

Determining how you and your spouse go about claiming Social Security is one of the most important decisions during the retirement planning process. For the average 62-year-old couple there are 600-plus iterations of how to claim Social Security. The difference between the best and worst decisions can be a substantial amount of retirement income. Needless to say, it’s a critical decision that must be thoroughly thought through.

On a recent episode of America’s Wealth Management Show, Modern Wealth Management Managing Directors Dean Barber and Bud Kasper discussed couples retirement planning. When are you AND your spouse thinking about claiming Social Security? There’s a lot to consider, including the health, age, lifestyle, and longevity of both spouses, before claiming. Those are just some of the high-level things that are crucial to cover. As we mentioned, though, it’s things like Social Security benefits for a surviving spouse that don’t even cross a lot of people’s minds unless they’re working with a CFP® Professional.

“When you think about Social Security benefits for a surviving spouse, most people never think about the spousal benefit or the surviving spouse’s benefit until someone passes away. That’s the sad truth. They don’t think about what the surviving spouse is going to get. A lot of people will claim their Social Security as if it’s just them. Suddenly, someone passes away and the surviving spouse says, ‘Wait a minute. What happens with Social Security? How does that work now?’” – Dean Barber

Which Benefit Goes Away? Which One Stays?

Many people don’t understand which Social Security benefit goes away and which one stays after one spouse dies. It’s always the higher of the two Social Security benefits that stays for a surviving spouse. This is why it’s crucial to think about the age and health of each spouse before you and your spouse claim. You want to claim accordingly to get one Social Security benefit as big as you can so that the surviving spouse has a better chance to continue their desired retirement lifestyle. That’s Social Security maximization for the benefit of the surviving spouse.

An Example of Claiming Social Security with Your Spouse in Mind

The other day in our Lee’s Summit, Missouri office, Executive Advisor Matt Kasper met with a client who had a significant pension but didn’t do any survivorship. So, Matt and a few of our other Lee’s Summit-based team members decided it was best for his spouse to delay her Social Security all the way to 70.

“We’re trying to max out what her income would be in survivorship. She’s 10 years younger than her husband as well, so it was a big deal to coordinate where income was coming in. The other side of it is whether a pension could negate you from accessing survivorship through Social Security. There are pensions that make you ineligible for receiving Social Security benefits for a surviving spouse.” – Matt Kasper

Pensions and Social Security

There are other considerations surrounding pensions and Social Security as well. It falls under two categories. There’s the windfall elimination, which means that you could work your whole career and have a great pension on the public side, but then go private and qualify for Social Security. However, you won’t receive the full amount because of the pension.

The other category is a government pension offset. That’s what we were talking about for the widow’s benefit. If your pension is too elevated, you might not qualify for the full amount of the widow’s benefit.

Learning More About Social Security Benefits for a Surviving Spouse in Our Social Security Decisions Guide

We can’t stress enough that decisions regarding Social Security need to be well thought through. There are no do-overs with it either after you and your spouse claim your benefits. If you and your spouse are struggling with how to claim Social Security or don’t fully understand how it works with Social Security benefits for a surviving spouse, download a copy of our Social Security Decisions Guide below.

Social Security Decisions Guide

A Big Puzzle within a Big Puzzle

Figuring out the best Social Security claiming strategy for you and your spouse is like putting together a big puzzle. That puzzle for you and your spouse isn’t going to look the same as the one that your neighbors are working on. Even if they’re the same age, their health, lifestyles, longevity, and many other important factors associated with claiming Social Security aren’t going to be the same as yours.

And while claiming Social Security is like putting together a huge puzzle, it’s really just a puzzle within an even bigger puzzle. Social Security is a huge component of your financial plan, and it’s directly tied to other parts of the plan. For example, did you know that your Social Security can be taxable? Well, it can. Up to 85% of your Social Security benefits can become taxable if you’re not careful. That’s why you need a comprehensive financial plan to see how all the pieces of the retirement puzzle fit together.

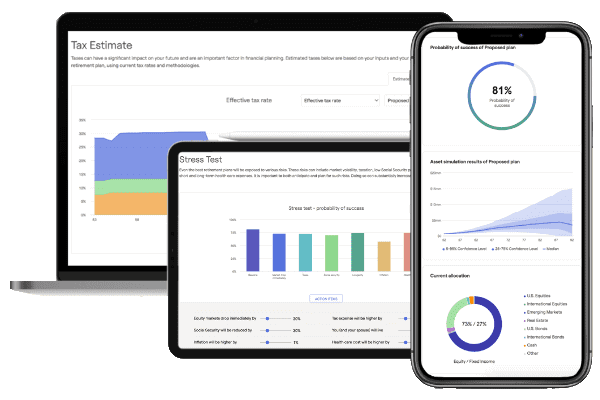

We have all the pieces of the puzzles ready for you to put together with our industry-leading financial planning tool. It’s the same tool that our CFP® Professionals use when they’re building and reviewing plans. If you want to see how the rest of your plan impacts how you claim Social Security, start building your plan today by clicking the “Start Planning” button below.

Discussing Social Security Benefits for a Surviving Spouse with a CFP® Professional

We don’t want you to make any costly mistakes when claiming Social Security. And we want to make sure that you’re aware of how things like Social Security benefits for a surviving spouse work. Our team at Modern Wealth is ready to walk with you every step of the way during the retirement planning process.

To schedule a meeting with one of our CFP® Professionals to discuss the nuances of Social Security or other aspects of financial planning, click here. We can meet with you for a 20-minute “ask anything” session or complimentary consultation, which can be in person, virtually, or by phone. We’re ready to build you a plan that can give you more confidence, freedom, and time in retirement.

Resources Mentioned in This Article

- Your Retirement Timeline

- How Much Do I Need to Retire?

- Components of a Complete Financial Plan with Logan DeGraeve

- Rising Long-Term Care Costs

- Claiming Social Security

- Starting the Retirement Planning Process

- Maximizing Social Security Benefits

- Couples Retirement Planning: What You Need to Know

- DIY Retirement: What Can Be Overlooked

- Avoiding Costly Mistakes When Claiming Social Security with Ken Sokol

Schedule a Complimentary Consultation

Click below to get started. We can meet in-person, by virtual meeting, or by phone. Then it’s just two simple steps to schedule a time for your Complimentary Consultation.

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.