5 Tax Secrets Retirees Need to Know

Key Points – 5 Tax Secrets That You Need to Know in Retirement

- Tax Planning Isn’t Just for the Ultra-Wealthy

- Comparing 2023 Tax Brackets to 2026 Tax Brackets

- Understanding Some of the Pros and Cons of Roth and Traditional

- Tax Secrets Related to Social Security

- 6 Minutes to Read | 24 Minutes to Watch

5 Tax Secrets Retirees Need to Know

Did you know that you have more control over your taxes in retirement than at any other time of your life? It’s true, but you need to understand some very important tax secrets—AKA, tax planning strategies—to take advantage of it.

These really shouldn’t be considered as tax secrets since everyone should know about them. The problem is that a lot of people think that tax planning is only for the rich. That couldn’t be further from the truth. We’re going to share tax planning strategies that everyone should be aware of. Make sure to then share this article with your friends as well. If more people are aware of these tax planning strategies, they won’t need to be referred to as tax secrets anymore.

Tax Secret No. 1: Bracket Management

In an article that we published on March 17 titled, What Are the Tax Brackets?, we mentioned that tax brackets wouldn’t just be a hot topic through the end of the 2022 tax season. Well, we weren’t kidding! Tax planning is all about assessing your current tax bracket compared to your future tax bracket and figuring out how to pay the least amount of tax possible over your lifetime. Understanding how to manage the tax brackets is a tax secret that everyone needs to know.

Bracket management ties into what we refer to as distribution planning. What accounts are we taking from to fund your lifestyle?

“Everybody has a budget and knows what they need to spend on an annual basis to make their plan work. What funds you’re pulling from is going to directly impact what tax bracket you fall in.” – Corey Hulstein, CPA

Since we’re in a marginal tax system, all your income isn’t taxed the same. Whether you’re single or married, the first bucket of money is taxed at 10%. As your income increases, it will start getting taxed at higher rates.

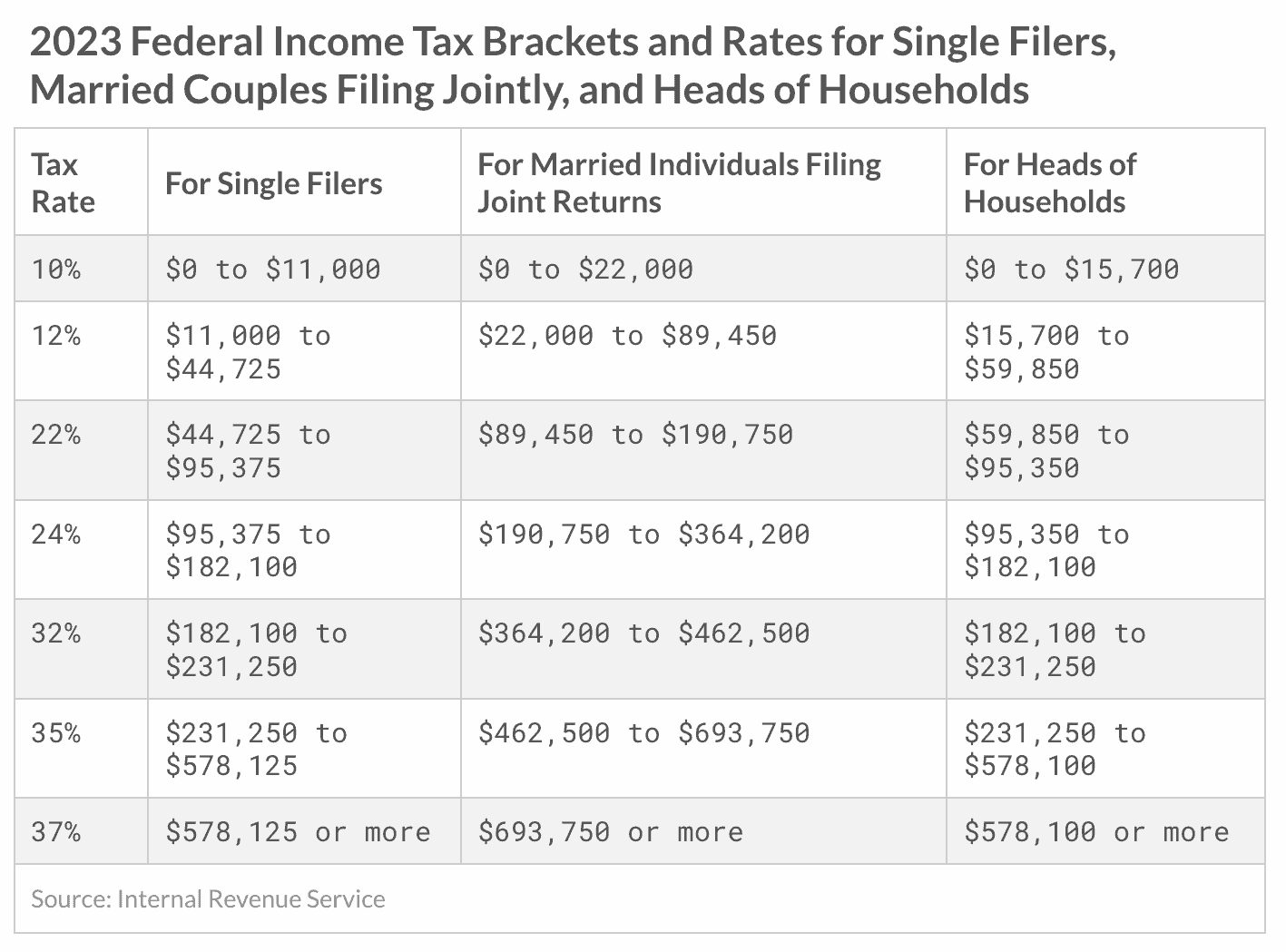

See the 2023 tax brackets for single filers, married filing jointly, and heads of households below.

FIGURE 1 – 2023 Tax Brackets – Tax Foundation

Looking Ahead to the 2026 Tax Brackets

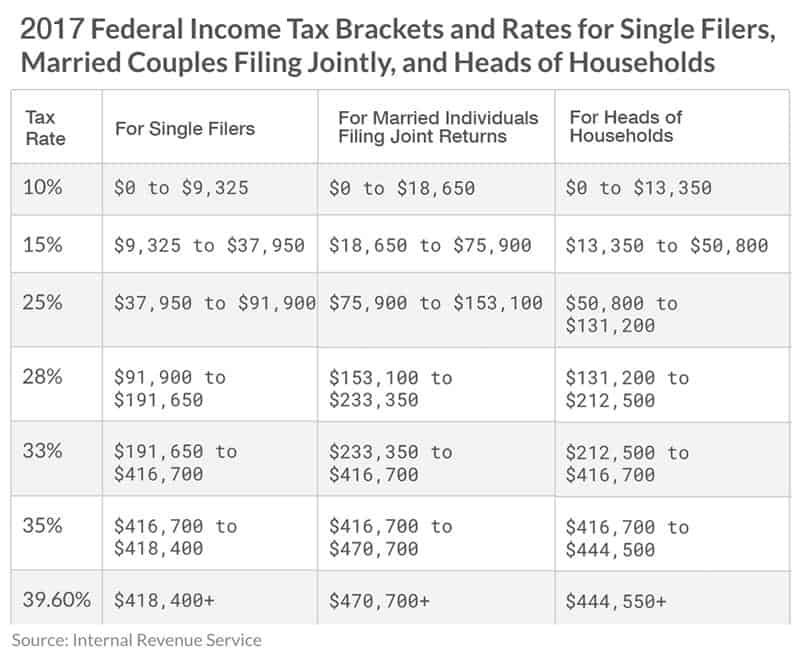

If you have future years where you know your income will be higher, could that throw you into a higher bracket? It’s also important to keep in mind that tax rates are scheduled to go up in 2026 when the Tax Cuts and Jobs Act sunsets on December 31, 2025. On January 1, 2026, we’ll go back to the higher rates of 2017 unless Congress steps in and says otherwise. See the 2017/2026 tax brackets below to get a better understanding of how much higher tax rates will be in 2026.

FIGURE 2 – 2026 (2017) Tax Brackets – Tax Foundation

When we’re managing brackets, we’re hedging against things that can happen in the future that would be negative to us. That can include higher tax rates or an early death of a spouse, forcing the surviving spouse to become a single tax filer.

“Those RMDs don’t get any smaller and they’re going to lose the smaller of the couple’s Social Security benefits. But there’s not a big difference as far as what the income is from a tax return perspective.” – Logan DeGraeve, CFP®

Tax Secret No. 2: Roth Conversions

While it might not be comfortable to pay more tax now, can you see where it can make sense to do so with today’s rates being lower than the projected rates for 2026? That leads us right into our second tax secret, which is Roth conversions. When doing a Roth conversion, you’re converting a traditional IRA to a Roth IRA. While a traditional IRA grows tax-deferred, a Roth IRA grows tax-free. However, in order to get that tax-free growth, you must pay tax on the conversion.

“Nobody likes paying taxes in calendar years when they didn’t need to, but you’re doing it for the big picture. You don’t need to pay a lot more in taxes down the road, especially inside of that survivorship type of position where it can get very excessive as a single filer.” – Matt Kasper, CFP®

We’ve done a lot of Roth conversions for our clients who want to take advantage of today’s lower rates. However, Roth conversions aren’t for everyone. There can be unintended consequences of Roth conversions, such as higher Medicare Part B premiums knowing that rates are set to go up in 2026 (AKA, the IRMAA tax). Matt took some time to break down some key Roth conversion decisions for 2023 as a part of our Modern Wealth Management Educational Series. Make sure to check it out in case you missed it.

The moral of the story is that you can’t do proper Roth conversion planning without doing your financial plan first. That starts with establishing your goals, hopes, and dreams. Roth conversions aren’t just a one size fits all and end up being the greatest thing ever for everyone.” – Logan DeGraeve, CFP®

Tax Secret No. 3: QCDs

Those of you that know Matt’s dad, Bud Kasper, know that he’s a converted Rothaholic. Bud certainly hasn’t made it a secret about how he feels about taxes. He wants you to join him in being a Rothaholic by becoming a member of our Rothaholic Club.

It also isn’t a secret that tax-free growth can be a wonderful thing, especially in retirement. But there’s a case to be made to keep some money in traditional if you’re 70½ or older and charitably inclined. That’s where Qualified Charitable Distributions come into play. QCDs are third on our list of tax secrets that you need to know in retirement.

“There are scenarios where you can over convert to a Roth IRA. What we’re trying to avoid is essentially paying tax by converting funds over to a Roth IRA when you could use something like a Qualified Charitable Distribution.” – Corey Hulstein, CPA

A QCD is distribution of up to $100,000 from an IRA that goes directly to a qualified charity. They aren’t taxed and won’t show up on your tax return. QCDs and Roth conversions are two of the most popular tax planning strategies. To learn more about them and other ways to mitigate taxes over your lifetime, download our Tax Reduction Strategies guide below.

Download: Tax Reduction Strategies Guide

Doing early planning is important. Look at things like Required Minimum Distribution and how those are structured for the upcoming year. If you’re going to give the charity anyway, you’d rather use that Qualified Charitable Distribution to offset the RMD. If you’ve already taken the RMD for the year, there’s still value in that QCD. But we would rather utilize the QCD against the RMD first.

Tax Secret No. 4: Tax-Loss and Tax-Gain Harvesting

Next up on our list of tax secrets is tax-loss and tax-gain harvesting. Tax-loss and tax-gain harvesting is something that we always like to do when we’re doing year-end tax planning. Capital gains and losses are treated differently than ordinary income. One nice thing about tax-loss harvesting is that it allows you to offset ordinary income in the current year with capital losses. And whenever the market rebounds, loss harvesting allows you to offset future gains up to the extent of your losses.

Capital gains are taxed at a 0%, 15%, or 20% tax rate. It hinges on where your other source of income are and what level of income you have. Essentially, the capital gains rate at 0% coincides with the 12% tax bracket for your ordinary sources of income. It’s right around $90,000 of taxable income if you’re married filing jointly.

If you expect higher capital gains taxes at some point, you might want to consider harvesting those gains in years with lower tax rates. Let’s say you have a 0% tax rate on long-term capital gains. It could be beneficial to realize some of those gains and reset the basis. It’s important to structure your capital gains and take advantage of those at 0% when they’re available.

In years where you’re dipping into that 15% tax bracket of capital gains, you might look at a loss harvesting strategy. For people who are higher income earners with more than $250,000 of adjusted gross income, there’s this lovely thing called net investment income tax. That’s an extra 3.8% tax on your investment income.

“Those are different strategies we’d want to look at to manage what those capital gains are going to be at the end of the year.” – Corey Hulstein, CPA

As we’re heading into the fourth quarter, it’s the perfect time to meet with your financial advisor because you want to make sure that you are building in all the tax-loss and tax-gain harvesting strategies before you get through the end of the year.

Tax Secret No. 5: Social Security Optimization

Rounding out our list of five tax secrets is Social Security optimization. Did you know your Social Security is taxable as ordinary income if you have additional retirement income? Well, it is. And it likely isn’t feasible to live on Social Security income alone. Up to 85% if your Social Security can be taxable, so it’s critical to understand the difference between the best and worst Social Security claiming strategies.

“We can’t put Social Security decisions on an island. We need to fit Social Security options within a bigger picture of what’s going on with your financial plan. Where else do you have resources to meet your spending objectives and goals?” – Matt Kasper, CFP®

For the average 62-year-old couple (62 is when you become eligible to claim Social Security), there are 600-plus iterations of how they can claim Social Security. It’s critical to consider your spouse when you’re claiming Social Security. If you were to suddenly pass away, remember that your spouse would only be able to keep the higher of your two benefits. Unless you’re in dire need of income at 62, it isn’t advisable to immediate claim Social Security when first eligible. The longer you delay, the bigger the benefit will be when you eventually claim.

There needs to be a fine balance of weighing out all the factors when deciding how to claim Social Security. What’s the health dynamic of you and your spouse? Is one spouse a significantly higher earner than the other? We want to maximize the benefits for you and your spouse.

Bonus: Did You Know Your Standard Deduction Goes Up When You Turn 65?

Many people don’t realize that their standard deduction goes up at age 65. It goes up $1,500 for single filers and $3,000 for married couples filing jointly once one spouse turns 65. It’s much more of a tax secret than a tax planning strategy. However, it applies to various tax planning strategies, so that’s why it’s on here as a bonus item. Let’s review the 2023 standard deduction levels before concluding this article.

- Single and Under 65: $13,850

- Married Filing Jointly and Under 65: $27,700

- Single and 65 or Older: $15,350

- Married Filing Jointly and 65 or Older: $30,700

That means that you can have more adjusted gross income prior to when you begin paying taxes on it. So, you take your adjusted gross income and then deduct the amount for whichever category you fall under above. The amount that’s left over is what you’re taxed on. Keep in mind that we’ll see the standard deduction get cut in half in 2026.We’ve been kind of spoiled here for a while with having such high standard deductions.

“How does that impact us when we get to 2026? Will we need to go back to itemized deductions and keeping track of everything just to try to get above what those lower standard deductions will potentially be?” – Matt Kasper, CFP®

Do You Have Any Questions About These Tax Planning Strategies?

Hopefully, these “tax secrets” weren’t secrets to you and you were already aware of them. Rather than taking immediate action with these tax planning strategies, remember to always consult with a tax professional first. The beauty of working with a CFP® Professional that works alongside a CPA is that the CPA will review your plan for tax planning opportunities like the ones we’ve discussed.The takeaways from today are working with a financial planner and a CPA in conjunction, understanding that each account is meant to behave a little bit differently than the others, and having a solid financial plan where all these things are working in unison.

“Have a vision for what the long-term looks like and understand what you can do in the current year to maximize not only today, but 10, 15, 20 years from now.” – Corey Hulstein, CPA

Our team at Modern Wealth isn’t good about keeping these tax secrets away from people because we put our clients’ needs first. We’re always looking for ways in which we can help people mitigate taxes over their lifetime. So, if you’re wanting to learn how these tax planning strategies could work for you, let us know. We won’t keep these tax secrets away from you.

You can schedule a 20-minute “ask anything” session or complimentary consultation with one of our CFP® Professionals and/or CPAs by clicking here. We can meet with you in person, by phone, or virtually depending on what works best for you. We look forward to figuring out what tax planning strategies can work best within your comprehensive financial plan.

5 Tax Secrets That You Need to Know in Retirement | Watch Guide

00:00 – Introduction

01:33 – #1 Bracket Management

05:55 – #2 Roth Conversions

10:37 – #5 Social Security (Logan skipped ahead!)

15:05 – #3 QCDs (Qualified Charitable Distributions)

18:31 – #4 Tax Loss/Gain Harvesting

21:32 – What We Learned Today

Articles

- Tax Planning Strategies with Marty James

- What Are the Tax Brackets?

- Tax Planning Tips with Corey Hulstein, CPA and Marty James, CPA, PFS

- Roth Conversions Before and After Retirement with Will Doty

- 2023 Tax Brackets: IRS Makes Inflation Adjustments

- Roth Conversion Decisions for 2023

- Maximizing Social Security Benefits

- Social Security Benefits for a Surviving Spouse

- Why You Need a Financial Planning Team

- Components of a Complete Financial Plan with Logan DeGraeve

- Tax Rates Sunset in 2026 and Why That Matters

- 5 Tax Planning Examples

- RMD Questions: What Are Required Minimum Distributions?

Past Shows

- What Is Tax Planning?

- Converting to a Roth IRA: What Are the Pros and Cons?

- What Is a QCD? Qualified Charitable Distributions

- Retiring at 62: What You Need to Consider

- Meet Modern Wealth Management

- Your Retirement Lifestyle: What Do You Want Your Retirement to Look Like?

Downloads

Schedule a Complimentary Consultation

Click below to get started. We can meet in-person, by virtual meeting, or by phone. Then it’s just two simple steps to schedule a time for your Complimentary Consultation.

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.