The 4-Year Presidential Election Cycle and the Stock Market

Key Points – The 4-Year Presidential Election Cycle and the Stock Market

- Breaking Down the Presidential Election Cycle Theory

- Remembering Yale Hirsch

- Does History Back Up the Presidential Election Cycle Theory?

- There Are Many Factors More Important Than Rate of Return

- 5 Minutes to Read

The Relationship Between the 4-Year Presidential Cycle and the Stock Market

What’s in store for 2024? That question has likely crossed a lot of people’s minds in recent weeks, whether it pertains to your family, job, community—the list goes on. One thing that makes 2024 unique is that it’s an election year. Along with wondering what candidate will win, there’s always speculation about how the stock market will perform during an election year. So, we’re going to examine the relationship between 4-year presidential cycle and the stock market.

We want to be clear that we’re not here to tell you who you should be voting for in November’s presidential election. Regardless of which side of the political aisle you tend to be on, we simply want you to understand what history has to say about the 4-year presidential cycle and the stock market.

The Presidential Election Cycle Theory

No matter who wins the 2024 presidential election, it’s sadly going to have a little bit of a different flavor to it for the employees and readers of the Stock Trader’s Almanac. That’s because it will be the publication’s first election without its late inventor, Yale Hirsch, who passed away in 2021 at the age of 98. In the same year (1968) that Richard Nixon defeated Hubert Humphrey to become the 37th president of the United States, Hirsch published the inaugural edition of Stock Trader’s Almanac.

In addition to Hirsch’s son, Jeffrey Hirsch, serving at the editor-in-chief of Stock Trader’s Almanac, Yale’s legacy is still felt in many ways. One of them is through the study of the presidential election cycle theory that he created. The presidential election cycle theory focuses on stock market performance throughout a 4-year presidential election cycle following a presidential election.

Hirsch’s Reasoning

Yale Hirsch’s research showed that the stock market’s lowest returns during a 4-year presidential election cycle tend to come in the first year of a term. Returns then improve in the second year and the third year before dipping in the final year of the term. The 4-year presidential election cycle and the tracking of stock market performance then starts over even if the incumbent is reelected.

Hirsch’s reasoning behind this theory is fairly simple to understand. After the president gets elected, their focus is usually geared toward their principles and proposed policies that helped them get voted into office. But once they begin to gear up for reelection, the president’s focus typically shifts toward improving economic conditions to increase their chances of being reelected. In turn, stock market performance tends to improve during the second half of a presidential term.

Does History Back Up the Presidential Election Cycle Theory?

While Hirsch’s theory seems sound, we want to see if history agrees with it and what other nuances there might be in the relationship between the 4-year presidential cycle and the stock market. The data below from the Stock Trader’s Almanac goes all the back to 1896. Here are the average stock market returns from the Dow Jones Industrial Average since then for post-election, mid-term, pre-election, and election years.

- Post-election year: 3%

- Mid-term year: 4%

- Pre-election year: 10.2%

- Election year: 6%

Several aspects of Hirsch’s theory have been debated by market analysts over the year. For example, instead of seeing lower returns in post-election years, the S&P 500 actually improved when Donald Trump, Barack Obama, and George W. Bush began their respective terms.

One thing has been quite clear, though. The third year of the 4-year presidential cycle by far and away has had the strongest stock market returns. Let’s look at some other data that was recently analyzed by U.S. Bank investments strategists to get more informed and see some other nuances in the relationship between the 4-year presidential cycle and the stock market.

Looking Back at the Last 75 Years

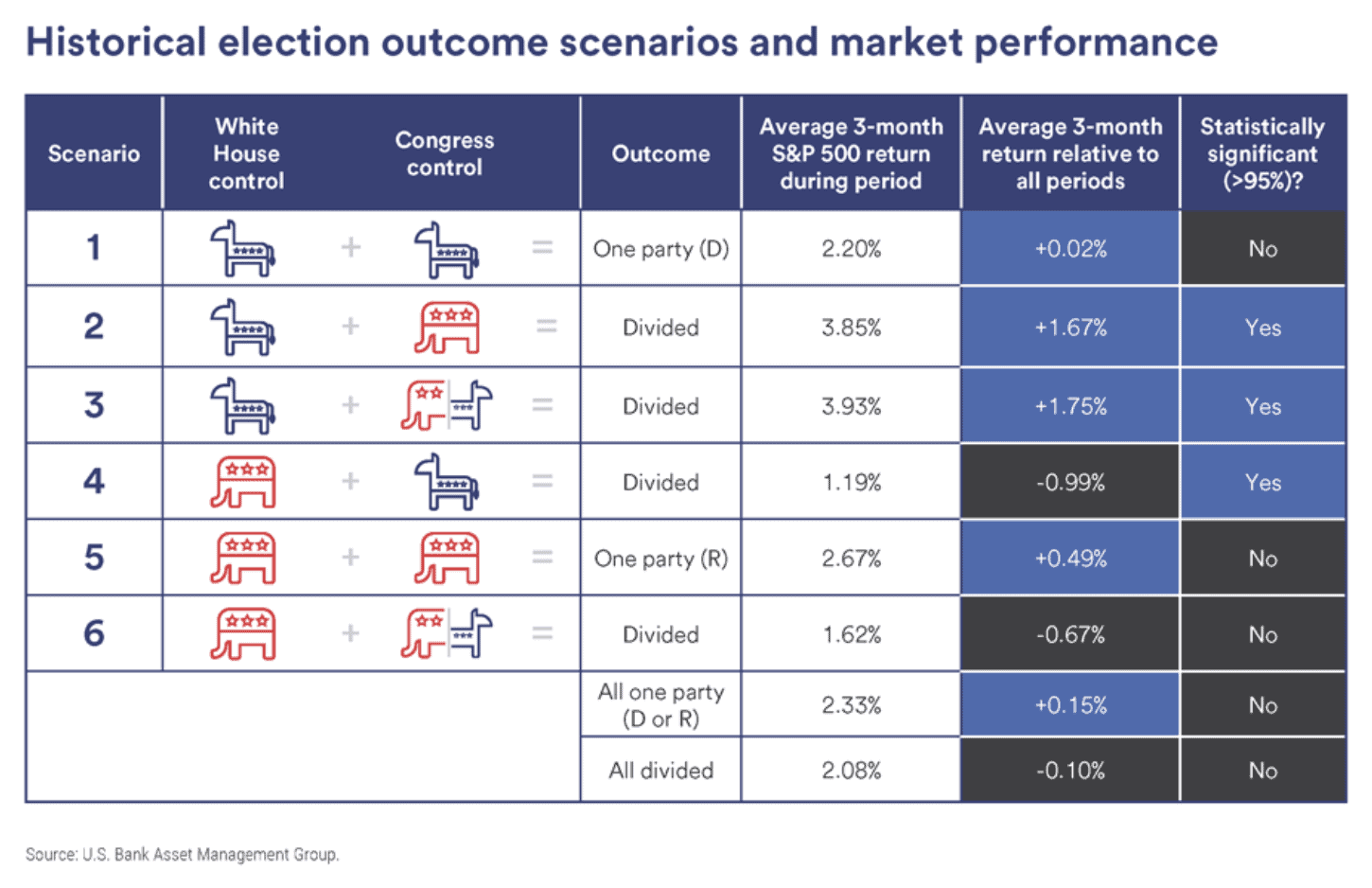

The U.S. Bank investment strategists’ research consisted of reviewing stock market performances from the past 75 years and patterns that persisted across 4-year presidential election cycles. The strategists looked at the average three-month returns after every presidential election over that period. Then, they looked at the average three-month returns over the last 75 years altogether.

When comparing those averages, the strategists utilized something called a t-statistic (t-test) to understand any potential correlation between what party has control in the White House and Congress and returns in the stock market. The purpose of the t-test is to figure out if party control has a significant impact on stock market performance.

What Has Happened to the Stock Market When Party Control Changes?

When breaking down the relationship between the 4-year presidential cycle and the stock market, one particular area of interest is what happens to the markets when one party has control of the White House and Congress. Do you think that one party controlling the White House and Congress leads to stronger stock market performances?

There is oftentimes a lot of hype about that possibility, whether it’s Republican or Democratic control, but the data that the U.S. Bank strategists doesn’t back that up. Let’s look at some scenarios of stock market returns when party control has been split.

These findings show that there have positive absolute returns in excess of long-term average returns when there has been Democratic control of the White House and full Republican control of Congress. The same goes for when there has been Democratic control of the White House and split party control within the House and Senate. On the flip side, there have been positive absolute returns modestly below long-term average when there has been Republican control of the White House and full Democratic control of Congress.

There’s a Laundry List of Things That Impact Stock Market Returns More Than Election Results

There’s no doubt that there will be more and more headlines about the 2024 presidential election over the next year. Some of them might very well be about the 4-year presidential cycle and the stock market. However, there are so many things that impact stock market returns more than election results. Some of those factors include, inflation, interest rates, and the economy.

Remember that rate of return also isn’t the end-all-be-all with retirement planning either. In case you missed it, make sure to tune into our America’s Wealth Management Show episode, 5 Factors More Important Than Rate of Return. Dean Barber and Bud Kasper CFP®, AIF® covered the following five topics in depth:

- Risk

- Taxes

- Inflation, Interest Rates, and Economic Health

- Time

- A Life Plan with Goals for Retirement

Have Any Questions?

All the noise that typically leads up to presidential elections can oftentimes create economic uncertainty. Finding a way to eliminate that noise is critical so that you can have more confidence that you’re doing the right things with your money, freedom from financial stress, and time to spend doing the things you love.

The data we shared on the relationship between the 4-year presidential election cycle and the stock market is purely intended for educational purposes. Trying to time the market based on where we’re at within the 4-year presidential election cycle isn’t advisable, as there are many other factors that can impact the markets—and more importantly, your retirement.

If you have any questions about the 4-year presidential election cycle and the stock market or other factors that could potentially impact your ability to get to and through retirement, let us know. To address your questions, start a conversation with our team below.

We hope all is well with you throughout this election year. No matter what side of the political aisle you’re on, we’re ready to build a financial plan that helps you achieve your objectives while taking on the least possible amount or risk.

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.