The Great Wealth Transfer Has Arrived

Key Points – The Great Wealth Transfer Has Arrived

- What Is the Great Wealth Transfer?

- How Would You Spend Your Inheritance?

- How to Build Generational Wealth

- Having a Forward-Looking Tax Plan and an Updated Estate Plan

- 6-Minute Read

How Much Wealth Is Moving in the Great Wealth Transfer?

Schedule a Meeting Get the Retirement Plan Checklist

Have you heard about the Great Wealth Transfer? Well, it’s here,1 and it’s important to understand how you’ll be impacted by it. Whether you’re on the giving end or receiving end of a wealth transfer, there are several things that everyone needs to know about how multigenerational wealth transfers works.

The buzz surrounding the Great Wealth Transfer started in 2022 following a study by Cerulli Associates.2 According to the study, $72.6 trillion is projected to transfer to heirs between 2022-2046. Additionally, nearly $12 trillion is projected to be donated to charity over that timeframe.

Why Is the Great Wealth Transfer Happening Now?

It shouldn’t be a surprise that the Great Wealth Transfer is taking off. The Baby Boomer generation plays a key role in the Great Wealth Transfer with being the wealthiest generation by a wide margin according to Federal Reserve data.3 Figure 1, below, shows that Baby Boomers have accrued $78.55 trillion as of Q1 2024. The next closest generation is Gen X, which has roughly half that much.

FIGURE 1 – Wealth by Generation – The Federal Reserve

The Baby Boomers range in age from 60-78 in 2024, so many of them have likely either retired or are approaching retirement. If leaving a legacy is important to them—whether that’s during retirement or after they pass on—they need to understand how that wealth is transferring to their heirs and/or to charity. They also need to understand what assets they own, and so do the people (or charities) receiving their inheritance.

How Would You Spend Your Inheritance?

While Gen X figures to benefit most in the near term from the Great Wealth Transfer,4 it’s important for Millennials and even Gen Z to begin thinking about how wealth transfer could impact them as well. If you were to receive an inheritance, how would you spend it?

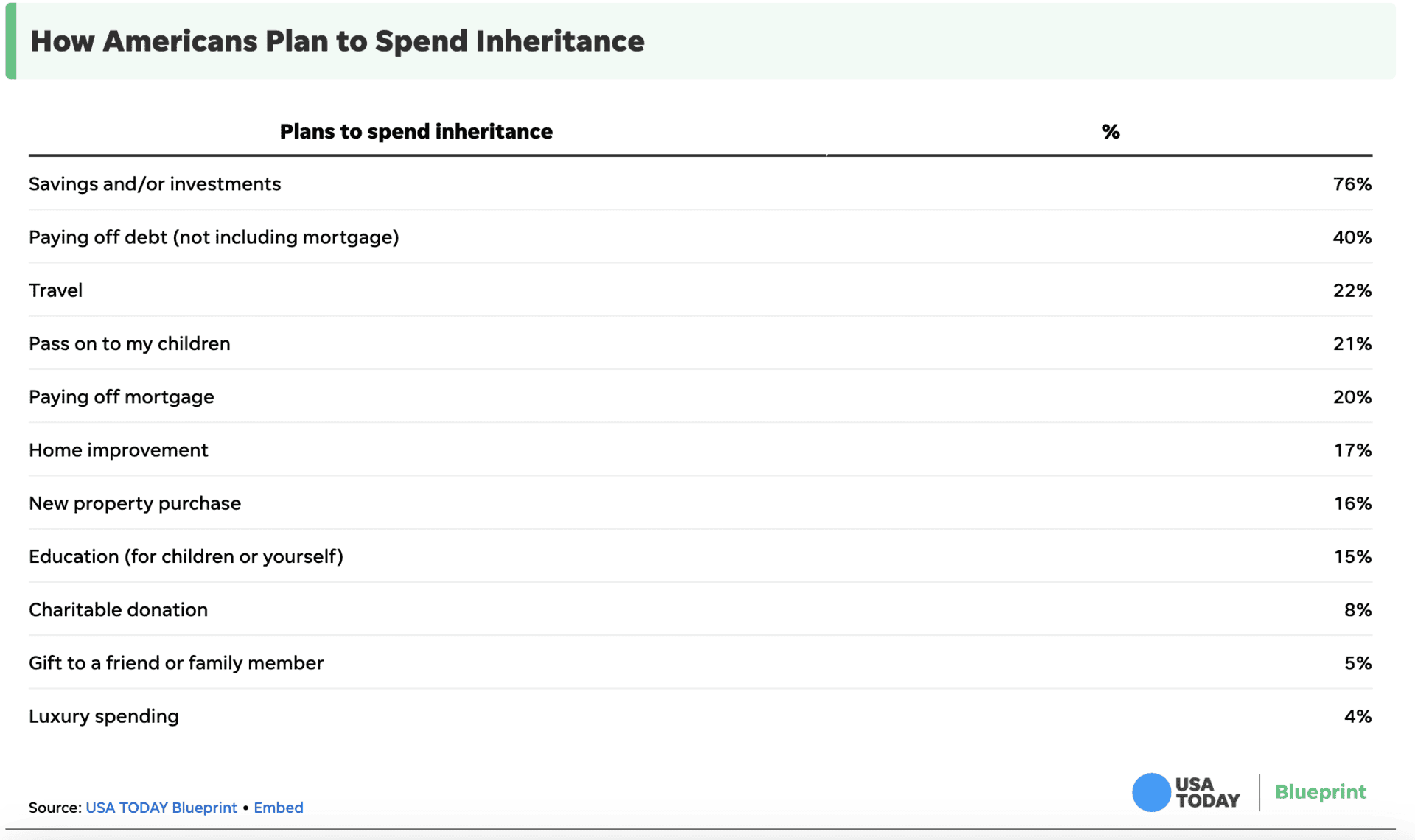

A November 2023 USA Today Blueprint study polled Americans between the ages of 18 to 42 to get a better understanding of their expectations with being on the receiving end of the Great Wealth Transfer.5 Sixty-eight percent of the people surveyed either have received or believe they will receive an inheritance. The average inheritance they expect to receive is about $320,000. Those who expect to receive an inheritance plan to use most of it for savings and/or investments and paying off debt.

FIGURE 2 – How Americans Plan to Spend Inheritance – USA Today Blueprint

Having a plan for how to spend an inheritance is important. But before you begin planning how you’ll spend it, do you understand what you’re inheriting? There is a wide range of assets that you can inherit, such as real estate, consumer durable goods, corporate equities and mutual fund shares, defined benefit and defined contribution pension entitlements, private businesses, and retirement accounts.

FIGURE 3 – Assets by Generation – Federal Reserve6

It’s Not About How Much You Save; It’s About How Much You Get to Keep

The Great Wealth Transfer was top of mind for Logan DeGraeve, CFP®, AIF®, and Corey Hulstein, CPA, during our Retiring with $2 Million video. They reviewed the financial plans of three sample couples who were retiring with $2 million. One couple had all their money saved in tax-deferred accounts, one couple had their $2 million in a brokerage account, and one couple distributed their money across tax-free, taxable, and tax-deferred accounts.

The main takeaway from the video was that building wealth (and generational wealth) isn’t about how much you save; it’s about how much you get to keep. The plan of the couple that prioritized tax diversification projected that they would be able to leave a legacy of more than $4.5 million. Meanwhile, the couple that saved strictly to tax-deferred accounts and the couple that saved all their money in a brokerage account would only be able to leave behind about $3.1 million and $3.8 million, respectively.

As the Great Wealth Transfer continues, are you prepared if you receive your inheritance during your peak earning years? If most of your inheritance is in the form of inherited IRAs (tax-deferred accounts), we want to make sure you’re aware of the potential tax implications since you’ll be required to pay tax on those dollars when taking distributions.

Having a Forward-Looking Tax Plan

Most non-spouse beneficiaries are now required to withdraw all the funds from an inherited IRA by the end of the 10th year following the account owner’s death. On top of that, they’re subject to Required Minimum Distributions within that 10-year payout period.

This is one of many reasons why it’s important for you and your loved ones to have a forward-looking tax plan. If you have most of your financial wealth in a 401(k) and/or IRAs, you need to start planning ahead for how to lower those RMD amounts. Your heirs will hopefully appreciate that as well.

In our Retiring with $2 Million video, Corey and Logan spent a lot of time talking about future tax rates. The tax rates outlined within the Tax Cuts and Jobs Act are scheduled to sunset after 2025,7 meaning they would revert to the higher rates from 2017. That potentially makes it more important to get money out of the tax-deferred bucket and into the tax-free bucket while we have lower tax rates.

Roth Conversion or No Roth Conversion?

To do a Roth conversion—converting funds from a traditional IRA to a Roth IRA—you must pay tax on the conversion. However, the tax-free growth on Roth IRA qualified distributions and the earnings on Roth IRA contributions may potentially contribute to wealth building and legacy planning.

That being said, there are also reasons why it may not make sense to convert to Roth IRA. If you want a large portion of your legacy to go to charity, consider Qualified Charitable Distributions. If you’re 70½ or older, you can donate up to $105,000 a year directly from an IRA to a qualified charity without it showing up on your tax return. That’s another way to spend down your IRAs and reduce your future RMDs without converting to Roth.

The tax planning strategies that work best for your friend or colleague might not be the best choices for you. It truly depends on your individual situation. As you’re building your forward-looking tax plan, make sure you have copies of our Tax Reduction Strategies and Roth Conversion Case Studies white papers handy.

Estate Plan

Along with having a forward-looking tax plan, having an up-to-date estate plan is also critical, especially during the Great Wealth Transfer. Make sure that you have these following five estate planning documents.

- Last Will and Testament

- Revocable Living Trust (think of this as being an extension of you)

- Beneficiary Designations

- Advance Healthcare Directive: Living Will and Medical Power of Attorney

- Financial Power of Attorney

Many people don’t realize that a will is part of a trust. If you have a simple will, your assets are likely to go through probate. Probate can potentially be a lengthy and costly process. It’s important that your family is on the same page about your respective estate plans and know who is getting what. Don’t forget to update your beneficiaries on an annual basis and after major life events to avoid potential family in-fighting.

Giving with Warm Hands Instead of Cold Hands

One thing that shouldn’t be lost during the Great Wealth Transfer is that wealth transfer doesn’t need to wait until you die. We encourage giving with warm hands rather than giving with cold hands so you can witness your loved ones benefiting from your hard-earned wealth.

Giving with warm hands can be done in many different ways. A few examples include setting up a 529 plan for your grandchildren or children. If you’ve been wanting to take a family vacation with all your children and grandchildren, let’s see if we can make that work within your financial plan if spending time with family and traveling are your top priorities in retirement.

We’re Here to Help You and Your Family

No matter how you want your wealth to transfer, communicating your goals and wishes with your family is key. News about the Great Wealth Transfer will likely make more and more headlines over the next couple of decades. We want to help you and your family accomplish your respective objectives, and wealth transfer can be a big component of that.

If you have any questions about the Great Wealth Transfer data we’ve shared or, more importantly, about how your wealth will transfer to the next generation (or vice versa), start a conversation with our team below.

Wealth transfer can be difficult to talk about with family, but it doesn’t need to be if you thoroughly plan for it. Our team is here to help you with that. Let’s make sure you and your loved ones are making the most out of your financial wealth.

the Great Wealth Transfer Is Upon Us : Watch Guide

00:00 – Why does the Great Wealth Transfer matter?

02:36 – Passing On Wealth in the Right Ways

05:54 – How do American’s Plan to Spend their Inheritances?

07:08 – The SECURE Act

08:54 – Taxes

13:49 – Is Passing Your Money Onto the Next Generation Right for You?

15:54 – Trusts

19:42 – Family Meetings Are Valuable

Resources Mentioned in This Article

- Family Matters: A Multigenerational Outlook on Financial Planning

- How to Build Generational Wealth

- Peak 65: Nearly 4.4 Million Americans Projected to Turn 65 in 2024

- Family Financial Planning with Matt Kasper, CFP®, AIF®

- Estate Planning Mistakes to Avoid with Tim Denker

- Charitable Giving in Retirement

- Retirement Savings by Age

- What Should I Invest My Money in?

- Retiring with Debt: What’s OK?

- Taxes on Inherited Property

- Consumer Debt Is at an All-Time High

- Active vs. Passive Management

- Pension Plans: Defined Benefit Plans vs. Defined Contribution Plans

- Retirement Planning for Small Business Owners with Drew Jones, CFP®, AIF®

- Revisiting Roth vs. Traditional with Bud Kasper, CFP®, AIF® and Corey Hulstein, CPA

- Retiring with $2 Million

- Tax Planning Tips with Corey Hulstein, CPA, and Marty James, CPA, PFS

- Rules for Inherited IRA Distributions – What Are the Latest Changes?

- RMD Questions: What Are Required Minimum Distributions?

- How Do I Pay Less Taxes?

- Have I Saved Enough to Retire?

- What Is Tax Planning?

- What If We Go Back to Old Tax Rates?

- Tax Rates Sunset in 2026 and Why That Matters

- 2024 Roth Conversion Decisions

- Roth Conversion Rules

- Converting to a Roth IRA: What Are the Pros and Cons?

- Taxes on Roth IRAs

- 5 Reasons Not to Convert to a Roth IRA

- What Is a QCD? Qualified Charitable Distribution

- 5 Estate Planning Documents That Everyone Needs

- What Is a Living Trust and Do I Need One?

- What Is Probate and Why Should I Avoid It?

- 529 Plans and Planning for Your Grandchildren’s Futures

- Planning a BIG Family Vacation

Downloads

Other Sources

[4] https://www.cnbc.com/2024/06/18/great-wealth-transfer-gen-x-gains.html

[5] https://www.usatoday.com/money/blueprint/credit-cards/study-great-wealth-transfer-plans/

[7] https://taxfoundation.org/blog/tcja-expiring-means-for-you/

Investment advisory services offered through Modern Wealth Management, Inc., a Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management a Registered Investment Advisor. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.