Thinking About Unretiring? Why Retirees Are Rejoining the Workforce

Key Points – Thinking About Unretiring? Why Retirees Are Rejoining the Workforce

- Reviewing a Paychex Survey About Retirees Going Back to Work

- Why Would Someone Think About Unretiring?

- Understanding What You Can and Can’t Control in Retirement

- Knowing That You Can Plan for Retirement Risks Out of Your Control

- The Many of Emotions of Retirement

- 7 Minutes to Read | 24 Minutes to Watch

Why Would Someone Consider Unretiring?

As a full-service wealth management firm, we strive every day at Modern Wealth to help people get to and through retirement. So why are we publishing an article about unretiring? Well, there are a few reasons. Logan DeGraeve, CFP® and Chris Rett, CFP® are going to help us break down some statistics about retirement considerations and discuss why someone would think about unretiring.

Schedule a Meeting Get the Retirement Plan Checklist

Key Factors in the Retirement Planning Process

Deciding when to retire is a decision that can’t be taken lightly. Whether it’s figuring out how much you need to retire, determining your retirement goals/lifestyle, or if you want to leave a legacy, there’s so much to think about before you leave the workforce and retire. That’s why it’s critical to start planning for retirement at least five to 10 years before you retire.

“The concept of retiring means something different for a lot of people. For some people, every day is a Saturday in retirement. They just want to do the things they want to do.” – Logan DeGraeve, CFP®

But unretiring people have different reasons for unretiring too. With the various economic headwinds that we’ve faced over the past couple of years, the fear of running out of money in retirement has escalated worldwide. That fear has remained with a lot of people in retirement to the point where they’re at least thinking about unretiring. We’ll share some proof of that momentarily.

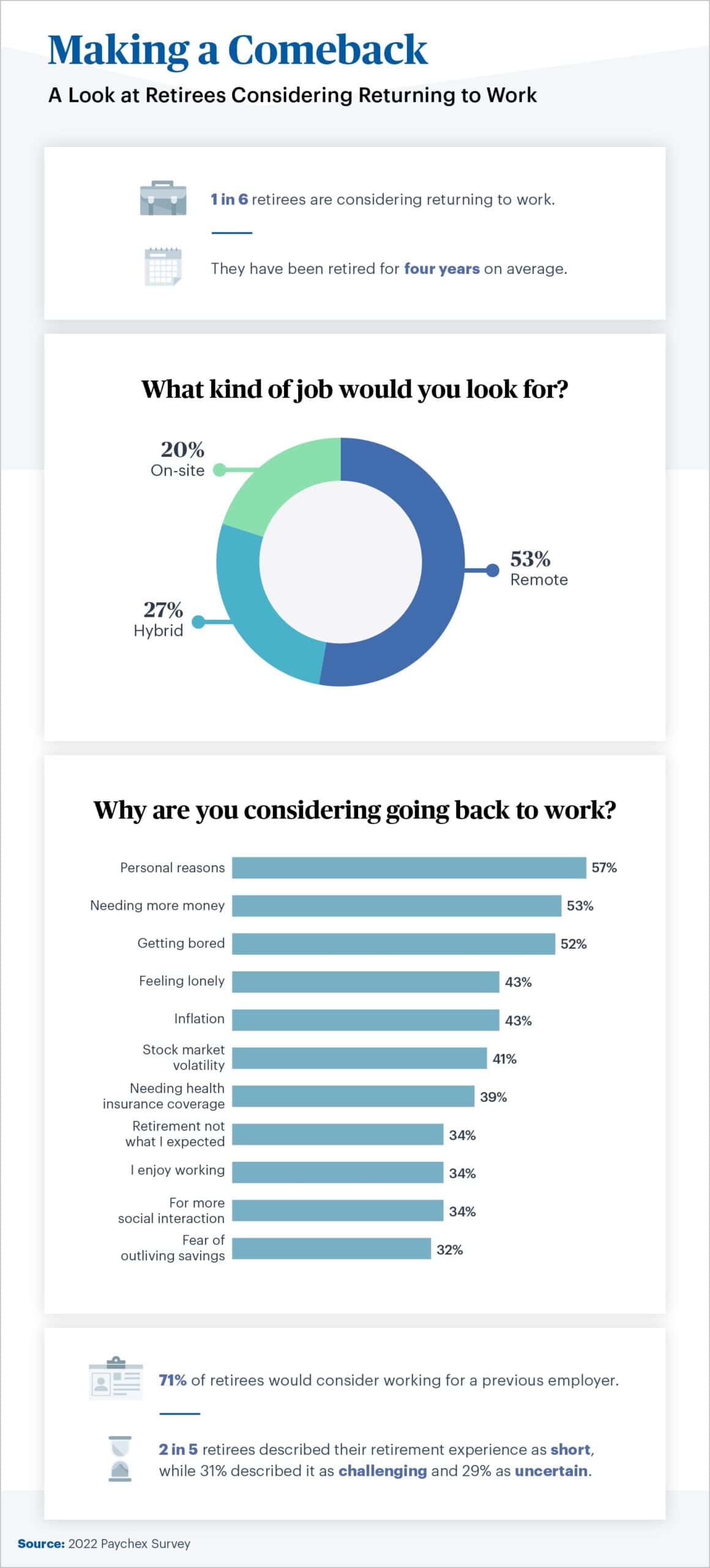

Let’s look at a 2022 Paychex survey to get a better gauge of how much unretiring has been on people’s minds. Paychex surveyed 930 Americans—consisting of retirees and people who have unretired. They also surveyed more than 200 hiring managers. Here are a few findings of the survey that we found to be quite alarming.

- One in six retirees have been thinking about unretiring.

- Nearly 75% of retirees who returned to work sense that they’re being judged by their co-workers.

- More than half of the people who unretired returned to work because they needed more income.

- More than 60% of hiring managers have been unsure about hiring retirees.

You can see more statistics from the Paychex survey on unretiring in Figure 1.

FIGURE 1 – Making a Comeback – Paychex

If You’re Unretiring for Personal Reasons, Still Make Sure You Have a Personalized Financial Plan

Let’s start breaking down the survey responses from Figure 1 with the No. 1 reason why people are thinking about unretiring. If you’re like one of the people who are considering going back to work for personal reasons, we respect your confidentiality.

We couldn’t agree more that retirement should be a personal decision. That’s why if you decide to head back to work, there’s one thing that you still need to pack with you besides your lunch. That’s your personalized financial plan. Your forward-looking plan can give you more confidence that you’re doing the right things with your money, freedom from financial stress, and time to spend doing the things you love.

Current Expenses vs. Expected Expenses

This isn’t your co-worker, neighbor, or best friend’s financial plan you’re going off of. It’s your financial plan. When you’re building your plan, think about your current expenses compared to your expected expenses in retirement. Hopefully, that’s something you thoroughly thought through if you’ve already retired and are thinking about unretiring. From realizing the potential outcomes of deciding between Roth and traditional to figuring out how you and your spouse are going to claim Social Security, understanding your cash flow in retirement is crucial.

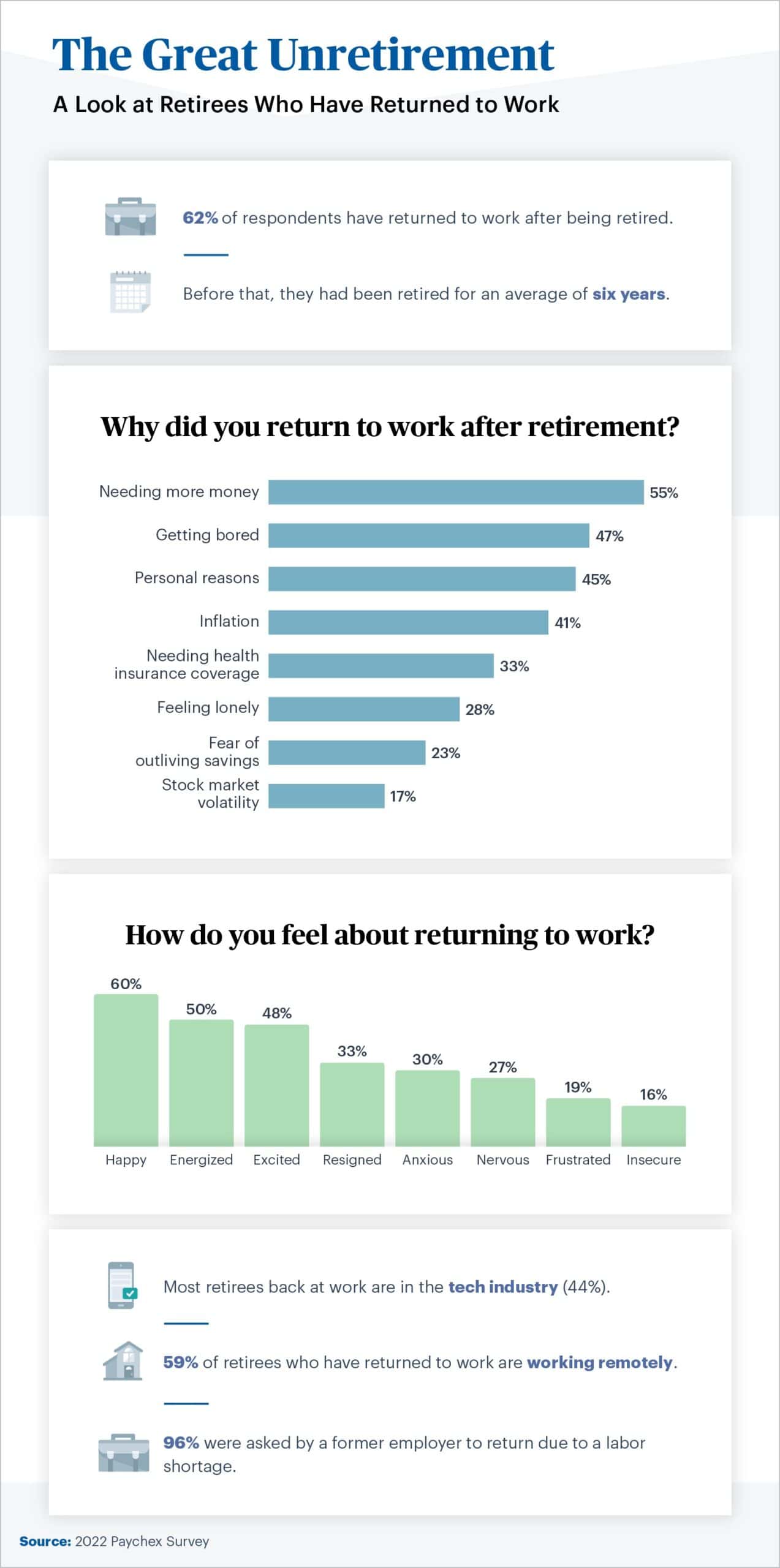

Below in Figure 2, you’ll see that 62% of the people in the Paychex survey did go back to work after retirement. More than half of those people said they unretired because they needed more money. So, simply ask yourself, what does your money need to do for you to accomplish your needs, wants, and wishes?

FIGURE 2 – The Great Unretirement – Paychex

When you’re working, you obviously have a paycheck to fall back on if there’s a big market downturn, higher inflation, or if you or your spouse long-term care stay. How are you going to structure your retirement income so that you and your spouse can retire with confidence? Again, there’s a lot of thought that needs to go into that, which is why it’s important to start planning for retirement at least five to 10 years before retirement.

“How can we prevent someone from unretiring if they want to stay retired? A lot of people unretire because they have a plan of hope. They hope inflation doesn’t run rampant. They hope they get a 10% return on their investments every year with no downturns.” – Logan DeGraeve, CFP®

People that retired with a plan of hope in 2022 or the end of 2021 retired into a very tough environment. The bond market was down 13%. That was supposed to be your safe money. And the stock market was down around 20% while inflation was running rampant. That period proved that plans of hope don’t work.

Controlling What You Can Control

You’ll notice that inflation and stock market volatility were also popular answers for considering unretiring in Figure 1. It’s critical to understand that while those are retirement risks that you can’t control, you can plan for them. Let’s focus on inflation a little bit more to drive home our point. Before the past couple of years, we hadn’t been in a high inflationary environment for quite some time. With that being the case, we met with several people who thought that they could build a financial plan that only had a 1% or 2% inflation factor.

Well, we can all now see where problems can arise with that. We generally apply a 4% inflation factor when building financial plans but bump it up to 6% for health care costs. Why? Because health care costs tend to inflate even higher than the basket of goods at the grocery store. So, while you can’t control inflation in retirement, you can plan for it.

“It all starts with a plan. A good plan factors in scenarios that you can’t even fathom. For example, hyperinflation. We had double-digit inflation for the first time in 40 years. A good plan will factor that in.” – Chris Rett, CFP®

We want to make sure that you’re effectively gauging your retirement readiness and planning for the various things that can cause people to go back to work. That should be apparent if you review our Retirement Plan Checklist. It consists of 30 yes-or-no questions and an age-based timeline of things to consider leading up to and during retirement. Download your copy below!

What Is Your Retirement Lifestyle Going to Look Like?

Getting bored and feeling lonely were two other popular responses among retirees and people who returned to work in Paychex’s survey. That circles back to our earlier point of determining your retirement lifestyle. A lot of people think transitioning from working life to retirement is seamless. But what are you going to do in place of all the time you were working? If you’re unsure how to answer that, the feelings of boredom and loneliness can easily consume your retirement.

Do you want to travel more in retirement? Do you want to buy a summer/winter home? Maybe you want to golf more or take up a new hobby? Your wants and wishes in retirement have a price tag just like your everyday expenses do, so they need to be built into your plan as well. Remember that your retirement lifestyle at the beginning of retirement will look much different than the last few years of your life. Make sure that you keep your plan up to date as your goals and life circumstances change.

If you have a new retirement goal but are unsure you can afford it, put it into your plan. Think of your plan as a permission slip. There have been so many times where our clients have told us about a new retirement goal that they don’t think they can afford. But when we incorporate it into the plan, their plan’s probability of success doesn’t change. Their plan gave them permission to go after their new goal.

Of course, there have been other times where someone’s probability of success declines a little bit when incorporating their new goals into their plan. That doesn’t mean that you can’t still go after your new goal. Retirement planning is full of trade-offs.

“The need to retire needs to be an objective feeling, not something that’s subjective and feeling like you need more money. It’s objective to say that you can retire now if you want to without the need of unretiring. It’s a choice to go back to work if you want to.” – Chris Rett, CFP®

What If You’re Thinking About Unretiring Because You Love Your Job?

If you’re a Modern Wealth client and/or regularly tune into America’s Wealth Management Show or The Guided Retirement Show, you’re probably well aware that retirement planning is full of trade-offs. Modern Wealth Managing Directors Dean Barber and Bud Kasper have said on several occasions that they can retire now, but choose not to because they truly enjoy working. They know they can retire because they have clarity from their respective financial plans that they’ll be OK. They’re financially independent.

If you look back at Figure 1 one more time, you’ll notice that 34% of the retirees surveyed have considered going back to work because they enjoy working. If you’re retired and fall into that demographic, that’s OK!

- Make sure that it’s truly what you want to do.

- If you’re unretiring and are financially independent, understand that you can retire again on your own terms. You’re working because you want to and not because you need a paycheck.

It’s safe to say that even though they’re only in their 30s that two of the most popular people in the world right now—American singer Taylor Swift and Kansas City Chiefs tight end Travis Kelce—are also financially independent. You’ve probably heard plenty of news about them and their dating rumors, but we’re going to talk about another member of the Kelce family and retirement to wrap up this article.

Retiring and Unretiring Can Be Emotional

Travis’s brother, Jason, is a center for the Philadelphia Eagles and has had a very successful NFL career in his own right. He’s also financially independent. A little over a year ago, he started documenting what he figured would be his last season. Many of you probably know how that season played out on the field. Travis and the Chiefs defeated Jason and the Eagles in the Super Bowl.

However, there was much more going on in Jason’s life besides football. He and his wife, Kylie, were expecting their third child and he started a new podcast with Travis. Jason and Kylie welcomed their third daughter just a few days after the Super Bowl, but his dad duties weren’t the only thing keeping him up at night. Despite all the aches and pains from the gridiron, Jason couldn’t fathom the idea that he might have taken off his shoulder pads for the last time. And Eagles fans eagerly wanted a definitive answer on whether he’d be back for another season or if the Eagles would need to replace their all-pro center.

Working with a Team of Financial Professionals

If you’re a diehard football fan, you probably already know what Jason’s decision ended up being. But we’re not going to spoil it for you in case you’re wanting to watch his great documentary, KELCE. One of the main takeaways as far as we’re concerned wasn’t his final decision. It was the raw emotion he showed while contemplating retirement. Retiring and unretiring can be very emotional. That’s one of many reasons why it’s critical to work with a team of professionals when planning for retirement.

“Purchasing a car or house is based on feeling. You don’t do it because it’s logical. If you purchased one of those in the last year and a half, that payment is more painful than three years ago. Sometimes unretiring because of needing more money is more of a feeling than reality.” – Chris Rett, CFP®

Chris and Logan have had several instances where clients or prospective clients have told them that they’re going to keep working even though they had a plan that told them they were financially independent and could retire with a high probability of success. If you want to keep working because you truly enjoy it, more power to you. But if you’re financially independent and are thinking about unretiring because you feel like you need more money, what’s your opportunity cost look like?

“The opportunity cost is that they’ve reached their peak earning years. They’re making more money than they’ve ever made. There can be a lot of incentive to keep working, but a good financial plan can quantify your decisions for you.” – Logan DeGraeve, CFP®

If you keep working for two to three more years, you can spend more in retirement. You won’t run as high of a risk of running out of money in retirement, can take less investment risk, and can leave more behind to your kids or grandkids. But is that extra money worth the time you’re sacrificing?

Building a Plan That Brings You Confidence in Retirement

When one of our CFP® Professionals meets with someone for the first time, they’re not going to ask you anything about your investments. They’re likely not even going to talk about anything related to your finances. They first want to know what’s important to you so you can begin defining your retirement lifestyle. Then, they’ll begin creating a spending plan for your retirement to accommodate your needs, wants, and wishes.

Notice though that we said it’s critical to work with a team of professionals, not just one financial advisor. At Modern Wealth, we also have CPAs, CFAs, insurance specialists, and estate planning specialists. We mean it when we say we’re a full-service wealth management firm. We have a team that works for you throughout the retirement planning process.

Whether you’re thinking about retiring or unretiring, you need a plan that gives you clarity with whatever decision you’re making. Even if you just want to know where you stand, have a conversation with us. You can schedule a 20-minute “ask anything” session or complimentary consultation with one of our CFP® Professionals by clicking here. We can meet with you in person, by phone, or virtually. Let’s build a plan that gives you confidence about your financial life.

Why Are Americans Unretiring? | Watch Guide

00:00 – Introduction

02:00 – What Is Unretiring Mean for Different People?

02:50 – Plan of Hope

04:23 – Paychex Study on Unretiring

05:49 – Keep Working or Retire?

11:26 – Controlling What You Can, and Planning for What You Can’t

17:12 – Start Planning Early & Talk with Your Partner

18:32 – What Is Your Purpose in Retirement?

20:13 – What We Learned Today

Articles

- Meet Modern Wealth Management

- How Much Do I Need to Retire?

- Starting the Retirement Planning Process

- The Fed and the Markets Face Multiple Headwinds with Brad Kasper

- Rising Long-Term Care Costs

- Making a Big Purchase in Retirement

- What Is a Monte Carlo Simulation?

- Revisiting Roth vs. Traditional with Bud Kasper and Corey Hulstein, CPA

- Maximizing Social Security Benefits

- How to Mitigate Inflation on Health Care Costs

- Planning a Large Family Vacation

- Can I Retire Early? Becoming Financially Independent

- Investment Risk in 2023 with Garrett Waters

- How to Build Generational Wealth

- When Is It Time to Stop Saving for Retirement?

- Setting Up a Spending Plan for Retirement

Past Shows

- Getting Ready for Retirement: Don’t Retire without Doing These Things First

- Retirement Readiness: Are You Ready to Kick Off Your Retirement?

- Your Retirement Lifestyle: What Do You Want Your Retirement to Look Like?

- How to Build Generational Wealth

- Federal Reserve Takes Recession Out of Its Forecast

- 10 Ways to Fight Inflation in Retirement

- Retirement Cash Flow: What You Need to Know

- DIY Retirement Planning: What Can Be Overlooked?

- Couples Retirement Planning: What You Need to Know

- Longevity Risk in Retirement and How to Plan for It

Downloads

Schedule a Complimentary Consultation

Click below to get started. We can meet in-person, by virtual meeting, or by phone. Then it’s just two simple steps to schedule a time for your Complimentary Consultation.

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.