When Will the Bear Market Be Over?

Key Points – When Will the Bear Market Be Over?

- A Little Bit of Optimism in the Markets in October

- The Fed Continues to Raise Rates, But for How Much Longer?

- Looking at Laddering Treasuries

- How Dean Knows When the Bear Market Will Be Over

- 6 Minutes to Read | 10 Minutes to Watch

October Offers a Little Bit of Hope

The Federal Reserve is spoiling our holidays. We also have a Federal Reserve that has admitted that it might need to raise rates more than it thought. But there are also signals that this bear market could be over. Could a bull market could be just around the corner?

Is the Bear Market Over?

Hello everybody! I’m Dean Barber, founder and CEO of Modern Wealth Management. Welcome to the Monthly Economic Update. We’re recording this on November 3. A lot of things happened in October. It’s generally the spookiest month in the market. However, October gave people a little bit of hope this year.

The question is, is the bear market over? Are the bulls back in charge after a big run-up in the market in October? Or is this just a traditional bear market trap or short rally in a longer-term bear market?

How Much Higher Will the Fed Funds Rate Go?

The Federal Reserve is at it again by raising the Fed funds rate another 75 basis points. Let’s look at what’s happening in the overall markets and the Fed funds rate. I’ll also talk a little bit about what we think we’ll happen for the balance of the year and what it means for stocks and bonds. And ultimately, when will all this craziness come to an end?

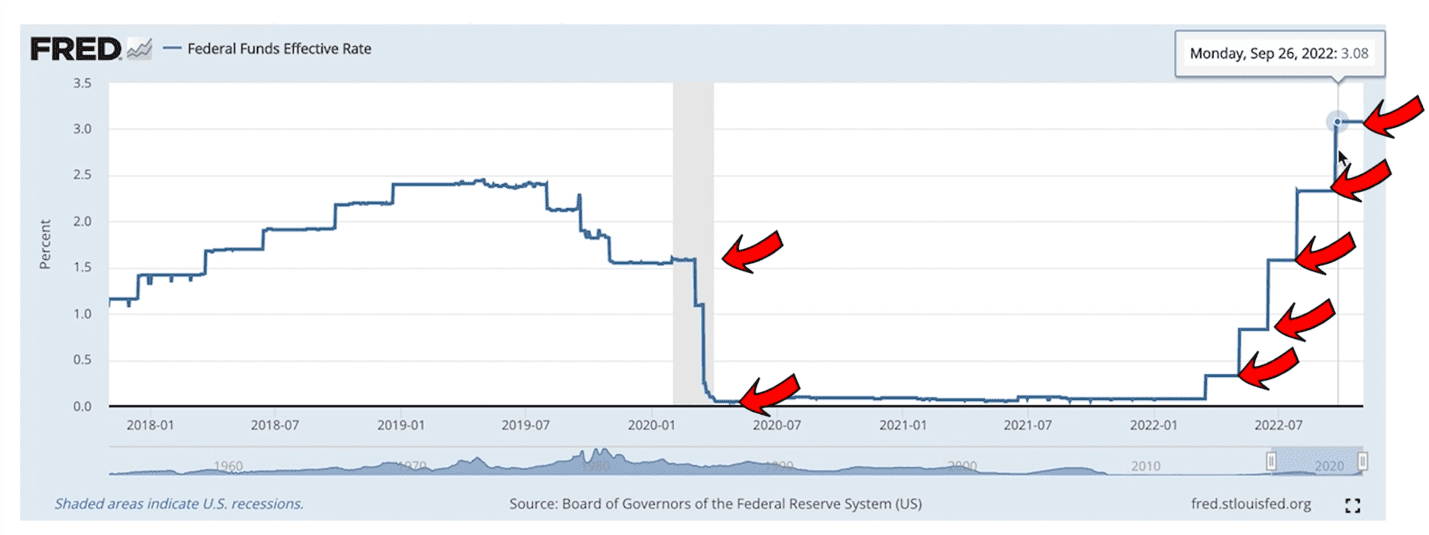

FIGURE 1 – Federal Funds Effective Rate – Board of Governors of the Federal Reserve System

Let’s first look at the Fed funds rate in Figure 1. I want to back up to the beginning of COVID in March 2020 when the Fed funds rate was around 1.5%. Everybody knows that as soon as COVID hit, the Fed took interest rates down to 0%. The Fed held interest rates at 0% until March 2022. We’ve seen stairstep rate increases ever since. We’re now at 3.08%. We think that the Fed will likely raise rates again between 50 and 75 basis points in December.

Jerome Powell did make a comment during his press conference on November 2 that the Fed may need to raise interest rates more than what they initially thought. He said they would rather overshoot by raising too much than risk what happened in the late 1970s and begin to ease rates because of some economic pain. Then, suddenly inflation could come back at an even higher rate than what it was prior to their rapid increase in the late 1970s.

Moving on to the Treasuries Yield Curve

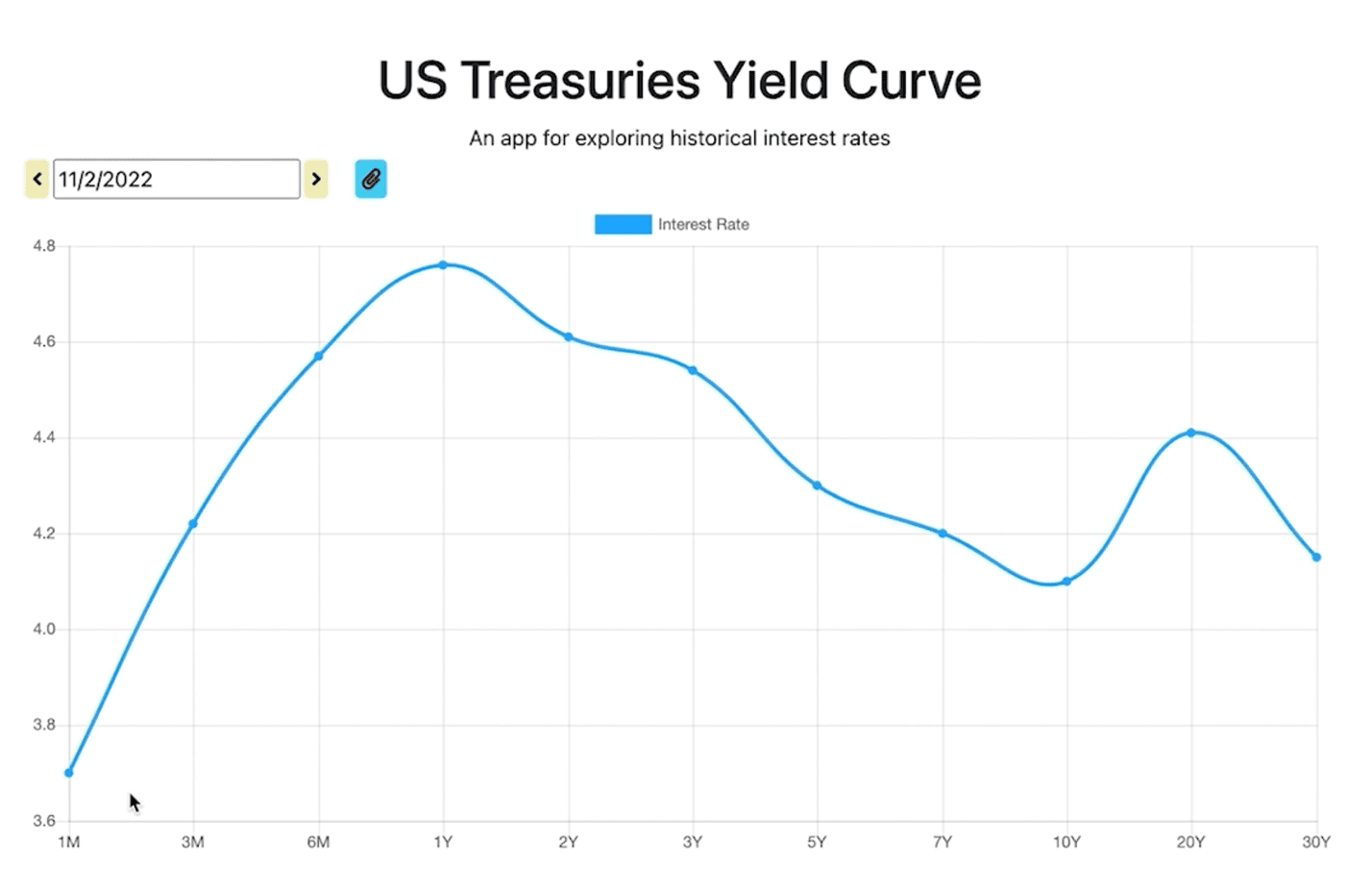

FIGURE 2 – U.S. Treasuries Yield Curve – U.S. Department of the Treasury

Now, let’s look at the U.S. Treasuries yield curve in Figure 2. You can buy a one-month treasury at 3.7%, three-month treasury at 4.22%, six-month treasury at 4.57%, and one-year treasury at 4.76%. That’s the peak. That’s the highest interest rate we can get on a treasury.

Laddering Treasuries

Let’s then look at the 10-year treasury. You can get them at 4.1%. If you commit to putting your money into a 10-year treasury, you’re basically saying that you’re going to be happy with 4.1% per year over the next 10 years. But remember those treasuries that I just reviewed. If you’re seeking some safety, we can help you in that safety by laddering some of these treasuries.

It’s the first time in the last 20 years that I’ve seen this opportunity. You can buy a little bit of three-month, six-month, and one-year. As soon as your three-month rolls out, you can turn around and see what interest rates are doing then. Maybe you buy a six-month one so that in three months, your six-month one is going to be due. You just keep rolling those out there so you have some good quarterly liquidity and have safety within your account.

Then, when the quarterly liquidity comes out, maybe there is opportunity elsewhere. Maybe it’s time to get back into the equity markets and enjoy a nice ride up. Maybe you’re enjoying the safety of the treasuries and want to continue doing that. At any rate, there are opportunities out there. There are things that we can do. We can reduce the volatility a little bit and give you some chance for safety.

Bonds Closely Follow Stocks on the Decline

FIGURE 3 – Stocks and Bonds – Portfolio Analytics

When we look at the stock and bond markets in Figure 3, I’m going to show you two things—the AGG and SPY. The AGG is the iShares Core U.S. Aggregate Bond ETF. The SPY is the S&P 500 ETF Trust. Looking at these two over the last 12 months, you’ve got the bond aggregate down 15.66% and the S&P 500 negative by 17.1%.

Earlier in the week, we had both down just about 16.5%. In the 35 years I have been in this industry, I have never seen bonds over 12 months follow stocks so closely during a decline.

The reason it’s declining all has to do with what I showed you in Figure 1, which is the Fed jacking up interest rates. We haven’t seen a period of these aggressive rate hikes since the early 1980s.

Market Performances

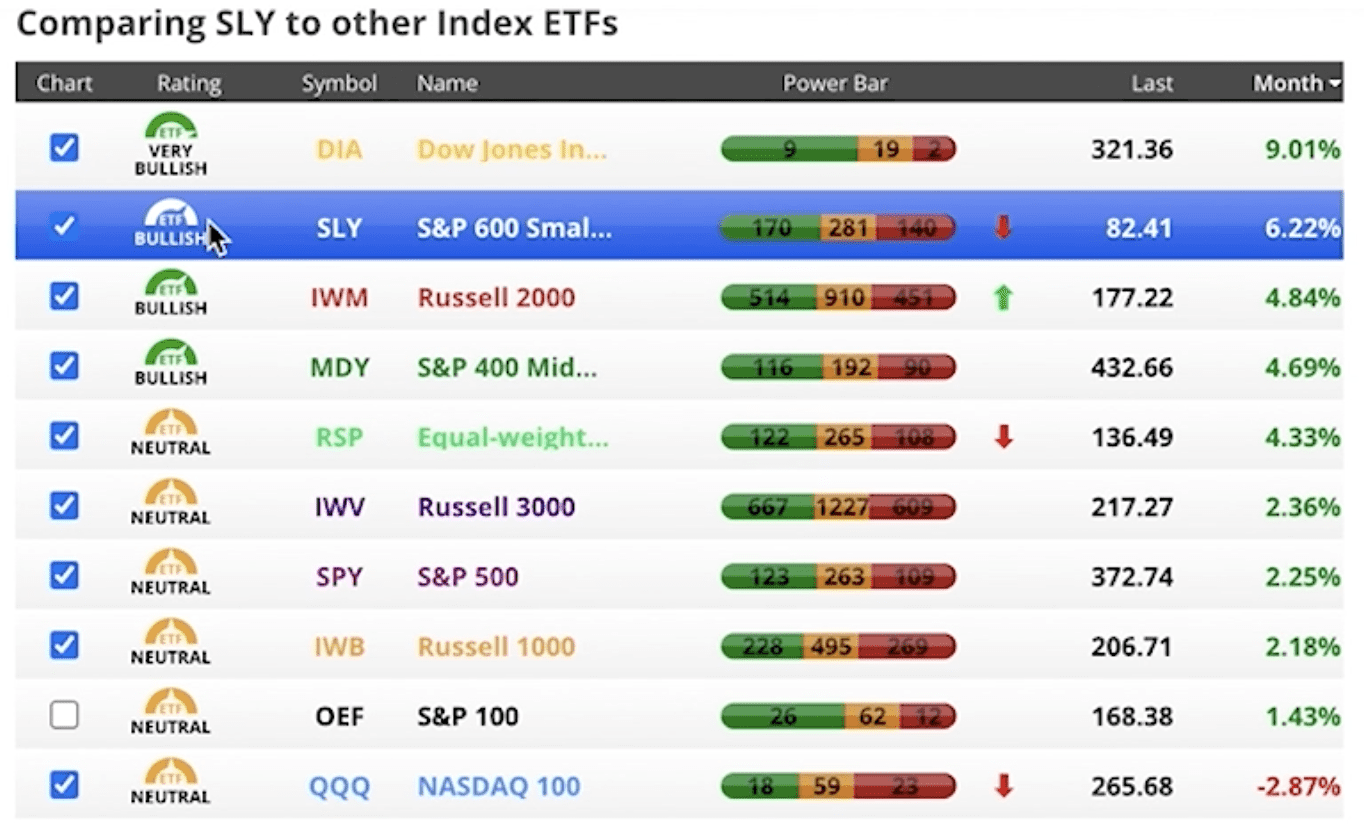

FIGURE 4 – Market Performances Over the Past Month – Chaikin Analytics

Now, let’s look at the rest of the markets and see what happened in the month in Figure 4. The Dow Jones Industrial Average, the S&P 600 Smallcap, Russell 2000, and S&P 400 MidCap are all showing bullish signs. That means they have more companies within those indices in bullish territory as opposed to ones that are in bearish territory.

So, we’re getting some bullish signs here. There is a reason that they’re getting bullish signs. The Dow Jones Industrial Average over the last month is up 9%. The S&P 600 Smallcap is up 6.22%. The worst performing index over the last month is the tech-heavy NASDAQ 100 at -2.87%.

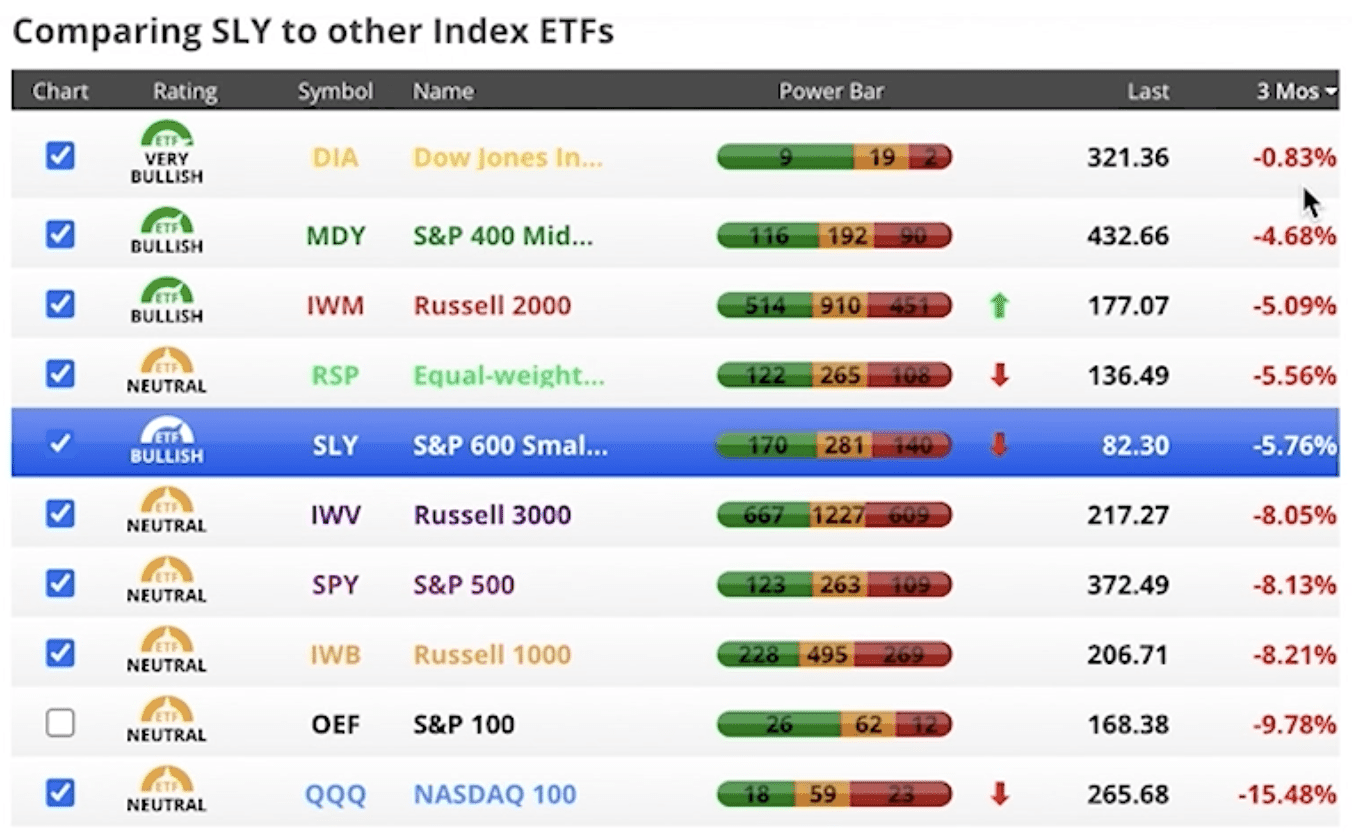

FIGURE 5 – Market Performances Over the Past Three Months – Chaikin Analytics

If I back this up over three months in Figure 5, some of our players change. The NASDAQ 100 is down 15.48% and the Dow Jones Industrial Average is down by 0.83%. And of course, the S&P 500 is down by 8.13%.

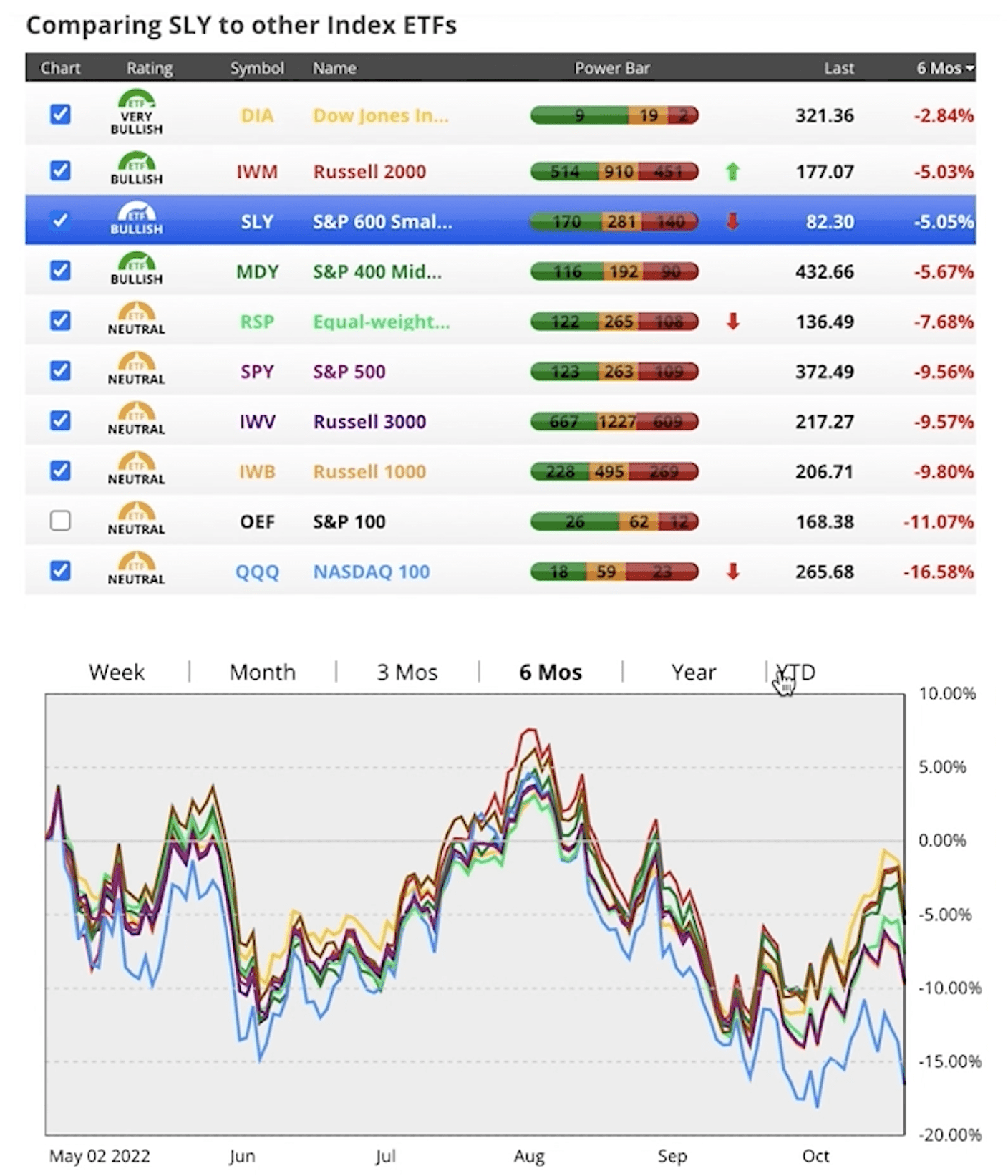

FIGURE 6 – Market Performances Over the Past Six Months – Chaikin Analytics

And in Figure 6, we’ll back things up over the last six months. You can see the volatility here.

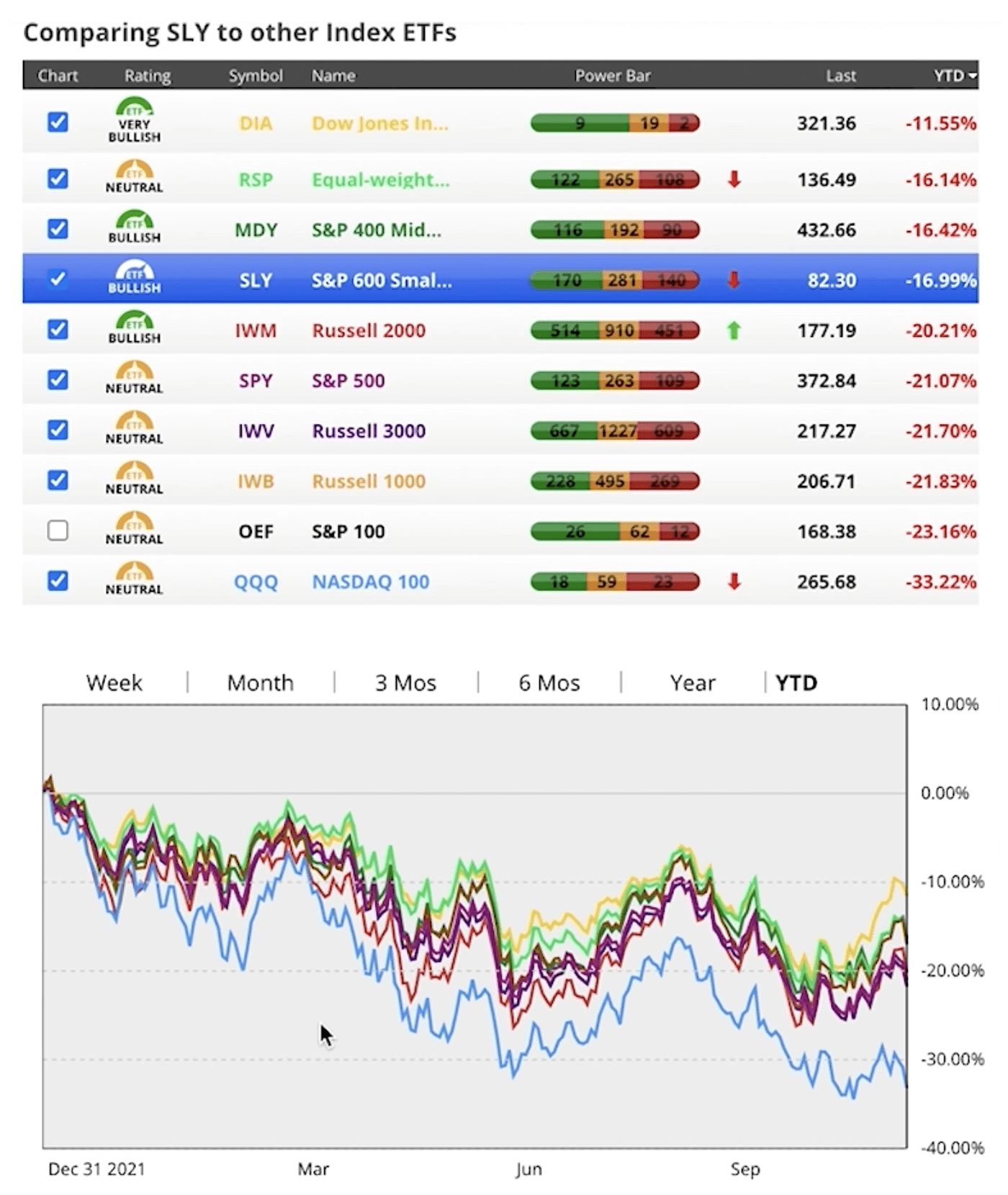

FIGURE 7 – Market Performances Over the Past Year – Chaikin Analytics

How We’ll Know When the Bear Market Will Be Over

Then in Figure 7, we’ll back this up to a year-to-date. You can see lower lows continuing to happen and lower highs continuing to happen. I’ll pick on the NASDAQ. This is a classic bear market. This will play out until the bear market is over. And the question is, when will the bear market be over?

I can tell you the day that the bear market is going to be over. That’s when Jerome Powell will say we’ve beat inflation and we’re done raising rates.

The question is, when will that day come? We don’t know that day, but we know that at that time, the markets will have some clarity about what’s going on in the future. That could also spark a major rally in bonds.

Patience Remains Pivotal

I know I’ve been saying this all year long, but it’s critical that we be patient when we’re in times like we’re in today. We must understand that the world isn’t ending. These companies whose stock prices are trading lower than what they were at the beginning of the year aren’t going away. Our American consumer is not going away.

We are doing everything we can to dampen the volatility and increase the safety exposure to your portfolio. However, we are still in a scenario where it’s tough to do that right now. We’re doing the best that we possibly can.

Stay Engaged with Your Financial Advisor

I would encourage you to keep open lines of communication with your financial advisor. Go through your financial plan. I’ve spoken with many of you personally. We’re looking at your plan and its probability of success. Even with everything that has gone on this year, there have been many cases where there have been few, if any changes, with people’s probability of success.

Understanding Your Overall Plan in Light of Inflation

I know that inflation is out there and it’s making you feel like you can’t spend as much as you could before. Don’t fall into the trap of thinking that you can’t continue doing the things you want to do because some things have become more expensive.

This is where your CERTIFIED FINANCIAL PLANNER™ Professional can sit down with you and increase what you need to spend to keep up with inflation. Let’s show that in the plan and see what that does to your probability of success.

Clarity, Confidence, and Control in Your Financial Life

The bottom line is that everything we do is designed to provide three things—clarity, confidence, and control in your overall financial life. Right now, we know one thing for sure. We can’t control the Federal Reserve, stock market, or that maniac in Russia that is raging war on Ukraine. There are so many things that are out of our control, but there are many things that we can control.

Opportunities for Growth When the Bear Market Is Over

If we can keep a sensible head about us, look at things from a logical perspective, and keep emotion out of it, we’ll all get through this together. When it’s all said and done, there will be opportunities for growth in the stock and bond markets.

The next time I talk to you will be in December. I’m a little early here, but I hope everybody has a wonderful Thanksgiving. I hope you can spend some time with your friends and family. In the meantime, if you have any questions or need anything from us at Modern Wealth Management, please call us at (913) 393-1000 or schedule a 20-minute “ask anything” session or complimentary consultation with one of our CFP® professionals. We also want to remind you that you can use our industry-leading financial planning tool from the comfort of your own home. You can begin building your financial plan at no cost or obligation by clicking the “Start Planning” button below.

Thanks again for taking the time to join me for the Monthly Economic Update. If you found this valuable, please share it with your friends. If you’re watching us on YouTube, give us a thumbs up and subscribe.

Schedule a Complimentary Consultation

Click below to get started. We can meet in-person, by virtual meeting, or by phone. Then it’s just two simple steps to schedule a time for your Complimentary Consultation.

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.