401k in Retirement: Managing Your Biggest Asset

Key Points – 401k in Retirement: Managing Your Biggest Asset

- What Are You Supposed to Do with Your 401k in Retirement?

- How Do Retirees Protect Their Assets from Years Like 2022?

- How Are Workers Supposed to Manage Their 401(k)s in Times Like Last Year?

- Rothification of 401(k) Under SECURE 2.0

- 13 Minutes to Read | 33 Minutes to Listen

How to Go About Managing Your 401k in Retirement

According to Fidelity, retirees lost an average of 23% in their 401(k) savings in 2022. That’s devastating. But that begs the question, why do retirees still have money in 401(k) accounts? Bud Kasper and Logan DeGraeve are going to discuss how to protect assets like your 401k in retirement, especially during difficult times in the market.

Understanding Risk in Your Portfolio

During your working years, you put money into your 401(k) every paycheck, so you’re dollar-cost averaging into the investments within the 401(k). With the market being as volatile as it’s been in recent months, people have been very concerned about their 401(k)s, especially in retirement.

Managing your 401(k) can be challenging if you don’t understand risk. That’s especially true if you’ve accumulated a lot of wealth as you get into your peak-earning years. When the market is down like it has been, you need to understand how to make alterations by safe-guarding or promoting more income as opposed to growth. And managing your 401(k) is going to be way different for someone in retirement compared to someone who just started working. We’ll elaborate on that throughout the article, but first, check out and download our 401(k) Survival Guide. It reviews many important things to think about regarding your 401(k) as you’re nearing retirement.

Download: 401(k) Survival Guide

A Staggering Statistic About 401ks in Retirement

Can you wrap your head around the fact that retirees lost an average of 23% in their 401(k) in 2022? That’s a huge blow to your 401(k) in retirement. And it shows that a lot of people had more risk in their portfolio than they realized.

The problem with a lot of 401(k)s is that they have few options and have a lot of target date funds. We’ve shared the problems with target date funds on several occasions.

“If you lost 23% in your 401k in retirement, what other accounts do you have? If you’re going to spend from an account in 2023 that lost 23% in 2022 and have long-term bonds as your safe hedge that were down around 13% and you’re spending it.” – Logan DeGraeve

That stat truly shows that people have struggled to grasp how to manage risk within their portfolios. But what should someone who is still in a 401(k) in retirement do? We know that stocks are oftentimes a good place to invest but haven’t been lately. So, take some risk off the table.

“Whether you had 25% or 50% of your 401(k) in a stock-managed mutual fund, ETF, or whatever the case may be, maybe it’s time to back off that until things clear up a little bit.” – Bud Kasper

Managing Your 401k in Retirement Starts with a Financial Plan

People oftentimes have a lot of questions about how to manage their 401(k). It’s going to be different for everyone, but it all starts with having a financial plan in place. A financial plan lets you know how much risk you need to take on to accomplish your goals. A lot of times, you can take some risk off the table—at least with the money they’re planning to spend in the next couple of years.

We’re almost a quarter into 2023. That 23% average loss in 401(k) savings for retirement from 2022 isn’t likely going to come back in another quarter. That’s why you want to have buckets within your portfolio. It was hard to find places of safety in 2022, but there were places you could go in a portfolio that likely weren’t down 23% or more. It’s important to work with a CFP® Professional who can help you understand where those places of safety might be so you can understand how to manage risk within your 401(k).

“We’ve been through these types of situations before. It’s never comfortable. Everyone is asking what’s going to happen next. There are a lot of questions to be addressed about that.” – Bud Kasper

What’s Your Probability of Success?

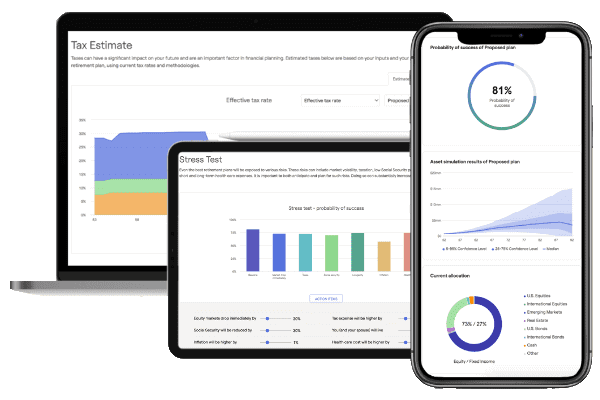

It’s even more uncomfortable for people who are trying to manage their 401(k)s in retirement. In the past year, Bud, Logan, and our other CFP® Professionals have met with many people who have asked how this market correction has impacted their probability of success in retirement. Since they have a financial plan in place that helps them understand how to manage risk. They’re still on track to do the things that they want to do in retirement.

“That gives them clarity and confidence that they’re all right. Nothing has impacted them and they can take a deep breath. They can still take a trip that they want to go on or whatever it may be. But if you only have a 401(k) consultant to move money around, they can’t answer those questions. An online retirement calculator can’t determine how that 23% loss in 401(k) savings in retirement moved things.” – Logan DeGraeve

A good CFP® Professional can analyze the risk you’re taking in your 401(k). For example, when times were very rough in 2022 and the S&P 500 was down 20% and the bond aggregate was down around 13%, how were people down 23% if they’re not taking on more risk than the market? It’s likely that they were in technology for part of their portfolio, and it lost up to 31%. These numbers show that the average retiree that’s probably spending out of their 401(k) or plan to do so soon has been taking more risk than the S&P 500.

A Set-It-and-Forget-It Approach Won’t Work with Your 401(k)

Since part of a worker’s paycheck is taken away and put into their 401(k) to help save for retirement, that should convince them to care about managing it. You need to be engaged with it and understand risk. Do you take a set-it-and-forget-it approach to your bank account? We’re guessing that’s not the case (or it shouldn’t be anyway). The set-it-and-forget-it approach won’t work for your 401(k) either.

Why Would a Retiree Still Have Money in a 401(k)?

We briefly touched on it, but the investment options in a 401(k) are sometimes limited. Logan’s question, though, is why would someone still have money in a 401(k) in retirement? Is it because you don’t know what to do with it? Why wouldn’t you be out of a 401(k) in retirement and into a managed IRA?

“For instance, let’s say that someone is a 50-50 (50% in stocks, 50% in bonds). Last year, that portfolio would be down in the neighborhood of 16%, 17%. But your bonds were a big portion of that. What you can do is get a managed IRA and buy things like U.S. treasuries. Up until this week, a one-year U.S. treasury was paying around 5.1%, 5.2%. That’s a guaranteed rate of return since it’s a government bond. Inside these managed accounts, we’ve separated out the stock or equity sleeve and get people in a position where they’re going to be safe for the next six to 18 months.” – Logan DeGraeve

On the bond sleeve, we don’t have the conviction to look people in the eye and say that they’re short-term inflation-protected securities will have a 5% return by the end of the year. But if your treasuries are laddered correctly, that 5% return (or at least close to it) is possible.

The questions that Logan just asked are also touched on in our Retirement Plan Checklist. It provides an age-based timeline of things to think about as you’re preparing for retirement and 30 yes-or-no questions that gauge your retirement readiness. With your 401(k) likely being your biggest asset as you near retirement, that’s obviously something we covered in great detail in our Retirement Plan Checklist. Download your copy below.

The Federal Reserve and Interest Rates

When we look at the pressure right now that’s on the market right now from the Federal Reserve raising rates, that’s measurable. It’s not going to be favorable to the market until the Fed says that inflation is under control. It’s looking like that won’t happen until sometime in the second half of this year.

But what if you did lose 23% on your 401(k) last year and you’re in retirement, and you don’t want to make drastic changes with knowing it will come back at some point? That’s why it’s so important to have a financial plan. It will give you a look at your overall risk. Maybe you have a few 401(k)s from old employers. Those 401(k)s all need to work together for your overall household’s risk to tell you what the financial plan will need to do.

“The worst thing you could do is have seven different 401(k)s and one is doing this and one is doing that. You then have no idea because it’s impossible to keep tabs on them.” – Logan DeGraeve

Being Proactive with Your Portfolio

We don’t want you to worry about what’s going to happen next. You need to be proactive within your portfolio inside your 401(k). You can mitigate a lot of the volatility that people are experiencing.

Remember, too, that last year is in the past. For the bulk of our clients that we’ve done proactive planning and dynamic allocations with, their plans are still on track. What happened last year hasn’t hindered their long-term probability of success. There’s a good chance that what happened last year didn’t impact your ability to stay retire if you’ve done a good job of saving—even if it’s to your 401(k). But if we have two or three more years like 2022, it’s a whole different story.

“These are situations where we need to make lemonade out of lemons. There are a lot of sour notes out there in the market. The crazy thing is that it’s broad based. When you break down the 11 sectors of the S&P 500, I can only think of one that is positive right now. That’s oil because it’s in demand.” – Bud Kasper

Inflation May Be Down, But …

It was just announced on March 14 that inflation cooled to 6% in February. That’s down from 9.1% in June. But you’ve probably noticed that most things at the grocery store haven’t been any cheaper the past few months. There’s a lot of things that go into CPI. So, what does inflation look like from a spending aspect on your plan?

That circles back to your retirement assets. If you planned to live on $60,000-$70,000 a year in retirement, that might need to be $65,000-$75,000 now because things are more expensive due to inflation. That’s why it’s critical to set up a spending plan for retirement.

A lot of people want guidance with their 401(k), whether they’re working or still have it in retirement. Your company provider should give you some insight into that and you should have some written information that was provided to you as well. If you have that info but don’t understand it, then reach out to a CFP® Professional. And we can’t stress enough that it needs to be a CFP® Professional and not a financial consultant or salesperson.

“All a financial consultant will look at is how old you are and try to get some level of risk associated with that. They don’t know what your dreams or goals are. It’s like if you were going to the doctor and went to a broad-range doctor that didn’t know you. That’s not what you want when you’re looking for advice about your health. You want them to know you and what you’re trying to accomplish.” – Logan DeGraeve

Risk Is Fluid

There are obviously times when you have greater risk and times you have less risk. Right now, there is a lot of risk being taken on from a global perspective. The question is whether you know the risk levels of the options within your 401(k). If you don’t, it’s time to do some homework on those options along with consulting a CFP® Professional.

“If you brought your 401(k) to me, I’m going to ask to see all your options. I’ll look at what you have and analyze the riskier side of the 401(k) compared to the safer side. I’ll do with what an understanding that there are nuances with the exposures of large-cap, mid-cap, and small-cap stocks. Are we looking at government bonds or high-yield junk bonds? Should those even be in a 401(k)? Once we have an assessment of the options, we create that and continue to funnel money into it by dollar-cost averaging.” – Bud Kasper

However, there have been a lot of people that have said that their stocks are down more than they ever thought they would be during this market downturn. Those people likely didn’t truly understand the stock or its history to see that it was too risky.

It also highlights the importance of being proactive in your portfolio and making alterations. If you’re 20-30 years from retirement, you have some time to make those alterations. But if you still have a 401k in retirement, a 23% loss in your 401(k) in one year can be difficult to recover from.

401(k) Rollovers

It’s important to know that you’re not handcuffed to your 401(k) in retirement. If you’ve retired (or separated service from your job), you can move your 401(k) to something that will give you better investing options.

“I hope there aren’t a lot of people that still have money within their 401k in retirement. Why would you limit your options from an investment perspective by staying in your 401(k)?” – Bud Kasper

Some people will stay in their 401(k) in retirement because it’s comfortable. But who is comfortable now with the market down as much as it has been? Logan points out, though, that up until 2022, much of the volatility we’d experienced in recent years was during the onset of COVID and late in 2018. Prior to last year, you could’ve sat in your target date fund and been happy with an average return of around 12% or 13%. But that obviously hasn’t still been the case for the past 12-15 months. Pain can push people out of their comfort zone.

So, What Changed in 2022?

The volatility that we’ve experienced is a result of the Federal Reserve interfering with the natural forces of the market by keeping interest rates extremely low. We’re paying the price for that now.

“We need to be realistic of what the capital markets could deliver in the next five to 10 years. What the capital markets did in the previous 10 years isn’t indicative of what they may do in the next 10 years. In the past 10 years, we’ve been in a very low interest rate environment. But what do the next 10 years look like? We’ve been so spoiled. Look at the 10-year treasury and how historically low we still are.” – Logan DeGraeve

Knowing Your 401k Balance Before You’re in Retirement

Within your 401(k), you’re going to have a balance that’s made up of three, four, five, or maybe six different funds. That’s your main allocation. But then there’s what you’re contributing to.

“I have people all the time that have it backward. They could be contributing to a bond fund, but they have equity funds within their balance. That doesn’t make any sense. If you want to dollar-cost average in, make sure you’re dollar-cost averaging into your equity funds. In times like this, you can buy lower. That’s what you want to dollar-cost average into. A lot of people dollar-cost average into a stable-value fund and it doesn’t make any sense.” – Logan DeGraeve

It’s important to know exactly what you’re invested in. If we have big drops like we did last year or during the Great Recession, or Dot-Com Bubble, how much did the portfolio that you were in drop? If that makes you uncomfortable, you need to make some changes. You’re in control.

Knowledge Is Power

Speaking of being in control, we want to help you gain control of your financial life through the knowledge that’s shared in our latest episode of The Guided Retirement Show, Understanding the SECURE Act 2.0 with Ed Slott. If you’re not familiar with the SECURE Act and SECURE 2.0, you need to be as you’re preparing for and going through retirement.

Ed is known as America’s IRA Expert, and Bud and Logan are both members of the Ed Slott Elite IRA Advisor GroupSM. Ed has helped Bud, Logan, and many other advisors nationwide understand the complexity of the tax code. We then pass that knowledge about tax planning, tax savings, and the tax code along to our clients.

401(k)s for Those Who Are Still Working

We’ve wanted the focus of this article to be on 401(k)s for people in retirement. But we do want to share and clarify a few things for those who are beginning to prepare for retirement as well.

Maybe you’re 10-15 years out from retirement and need to keep your 401(k) where it’s at. It’s still critical to have your 401(k) reviewed. You could be five years out from retirement and still be taking the risks that you were taking 25 years out from retirement. That’s a problem if you’re doing that.

“In those cases, we sit down with people and begin building a financial plan. That’s where you start. Then, how much risk should your 401(k) be taking? You probably have other assets and we need to marry that risk together with the overall plan.” – Logan DeGraeve

Many of our clients are in the 55-to 70-year-old age range, so there’s a good chunk of them who are 10 years or less from retirement or have already retired. There are so many decisions that are critical to the success of someone’s retirement during that timeframe. That includes your 401(k).

“That’s why you need to be working with a company that has CFP® Professionals and CPAs that work together. It’s the coordination from a planning perspective of people’s assets and managing them in the most tax efficient way possible.” – Bud Kasper

Quick Closing Stories from Logan and Bud

Logan recently met with a person who was in their late 30s to early 40s. He looked at what that person had and began building a plan for him. However, Logan told him that it didn’t make sense to engage in a relationship with him in terms of managing his assets. Still, there were things estate planning and insurance wise that Logan wanted to make sure that person had squared away.

“He thought that I would just want to manage his money, but that wasn’t what he needed. There’s probably not a need to charge a management fee on an account for someone who is 30 to 35 years old. But we do know that they still have other needs like planning, debt management, insurance—whatever it may be.” – Logan DeGraeve

One of the things Bud likes to do for his clients who are younger is asking them at the end of the year how much they contributed to their 401(k). They usually have blank looks on their faces. Bud wants to know that because he wants to see what their actual return was outside of the contributions themselves.

“They’re going to look at that now because they need to know what’s working and what’s not working. And then rebalance the portfolio.” – Bud Kasper

Remember, It All Starts with a Financial Plan

Hopefully, we’ve provided some insight that’s valuable to you about managing your 401k in retirement and in your working years. It’s important to understand the risk in what you own. If you have questions about your 401(k) and/or how it fits within an overall financial plan, we have a few resources for you to check out.

First, take a spin with building your financial plan with our industry-leading financial planning tool. It’s not like those online retirement calculators we mentioned earlier because it allows you to factor in your retirement goals and so much more. This is the same tool that our CFP® Professionals with our clients. You can begin building your plan below from the comfort of your own home by clicking the “Start Planning” button.

And, as Bud and Logan emphasized, working with a CFP® Professional is crucial when making decisions about your 401(k) throughout the retirement planning process. If you have questions about your 401(k) or other financial planning components, you can schedule a meeting with one of our CFP® Professionals here.

You can schedule a 20-minute “ask anything” session or complimentary consultation. The setting of the meeting is totally up to you as well. We can meet with you in person, virtually, or over the phone depending on what works best for you. We look forward to the opportunity to answer your questions.

401k in Retirement: Managing Your Biggest Asset | Watch Guide

Introduction: 00:00

Retirees Lost 23% of Their 401(k) Savings in 2022: 02:14

Understand Your Risk Exposure in Your 401(k): 07:18

Retires with 401(k)s Still, Why?: 09:18

How Do You Handle Today’s Market?: 13:20

Don’t Just Leave Your 401(k) Alone: 18:35

You’re Not Handcuffed to Your 401(k): 21:39

New Podcast with Ed Slott: 24:35

What About Working Folks Still in 401(k)s: 25:50

Conclusion: 32:10

Resources Mentioned in this Episode

Articles:

- Investment Risk in 2023 with Garrett Waters

- Optimizing Your 401(k) for Retirement with Drew Jones

- How Bonds Fit in a Financial Plan

- Understanding Sequence of Returns Risk with Bud Kasper

- What Is the Guided Retirement System?

- What Is a Monte Carlo Simulation?

- The Difference Between Good Debt and Bad Debt with Logan DeGraeve

- 7 Reasons Why Tax Planning Is So Important

- Understanding the SECURE Act 2.0 with Ed Slott

- Dot-Com Bubble History Remains Relevant

- The Great Recession’s History Remains Relevant

- Setting Up a Spending Plan for Retirement

Other Episodes

- 5 Types of Financial Plans

- 9 Items That Retirement Calculators Miss That Our Tool Doesn’t

- Inherited IRA Rules and the SECURE Act

- Staying Calm Amid Economic Uncertainty

- What Is Financial Planning?

- Reviewing Rebalancing Strategies

- What Is Tax Planning?

- Inherited IRA Rules and the SECURE Act

- 10 Ways to Fight Inflation in Retirement

Downloads:

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management, LLC, an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.